Stock Trends

Victory laps, recent misses, top setups and a Mag 7 check-up

Good morning,

We’ve got a lot to cover today, so not much time for an intro.

Tuesday saw bad breadth as yields broke out but most stocks bounced back yesterday. It was the recent rotation stocks that got hit the most on Tuesday, and while the absolute breakouts are still intact in most of the homebuilders, it was a reminder that fighting relative trends is a tough battle, even if you’re eventually right.

The stocks that this market continues to reward the most are aggressive growth stocks, and luckily we’ve had some good calls there.

Today, we’ll review some of our biggest recent winners as well as:

3 calls that haven’t gone our way

Hot List updates

All of of the Mag 7

Timely long opportunities

and more!

Victory laps

Huge breakout for Unity Software yesterday

Bullish setup highlighted last week. A gap-fill is always a tactical risk but the big-picture target says the low-$40s are in play.

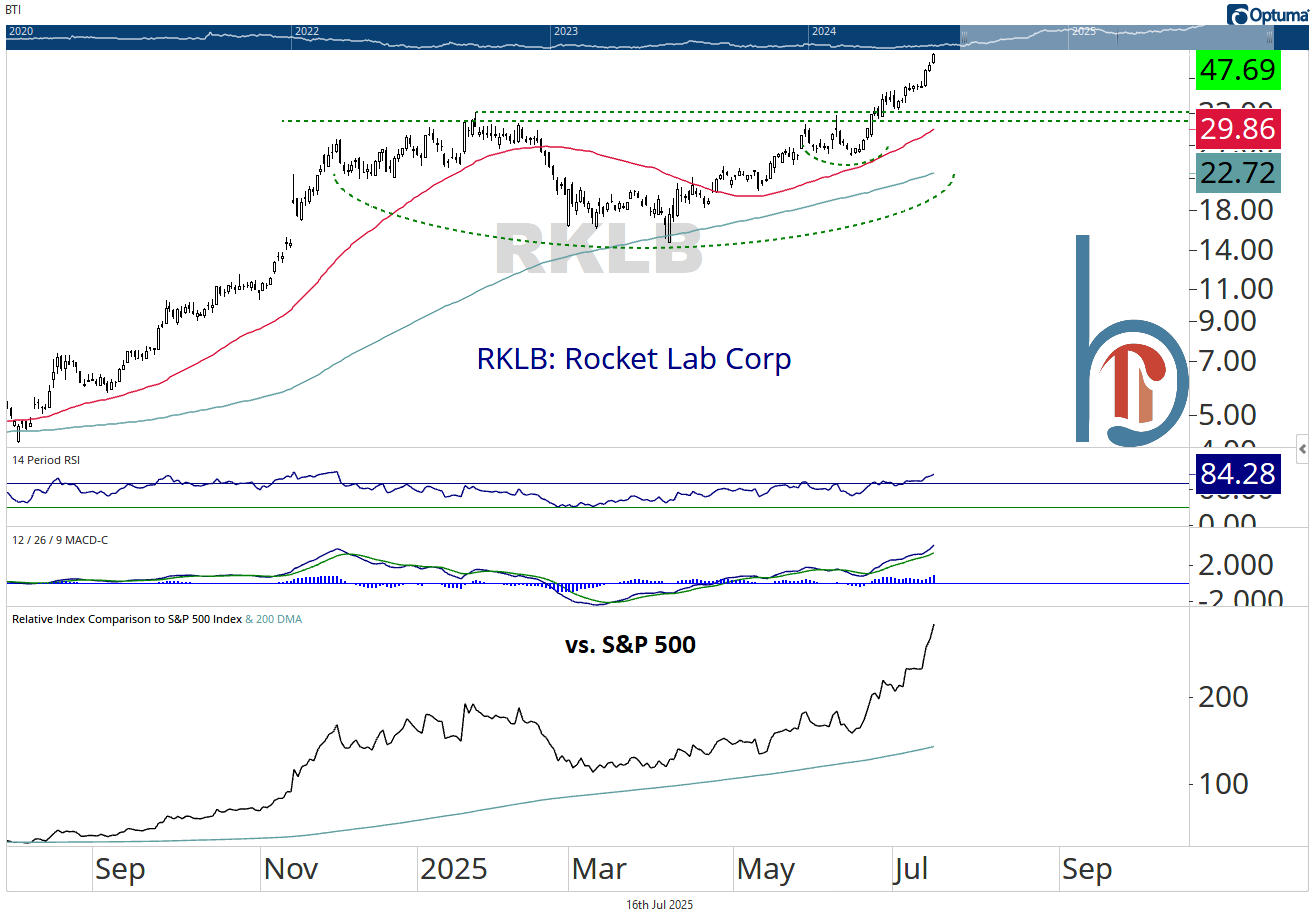

Rocket Lab now a double since our April feature

When I first featured RKLB in our late April aerospace and defense focus the stock was at $20 and I said “A breakout above $22 could easily see the stock at $26 or even $32.” Well that turned out to be too conservative because the stock is now more than a double. It’s still a bullish chart making all-time highs but investors should be aware that yesterday, Rocket Lab hits its price objective from this 6-month base, so this would be a logical place to start to see some digestion.

Archer Aviation breaks out

Another high-flyer first featured in our April 24 report, Archer Aviation gave investors another opportunity with its recent pullback to the 50-DMA. The stock broke out yesterday with a 7.3% gain and looks like it wants to make another run at $14.

Hot List pick KTOS has gone crazy

KTOS gained another 6.2% yesterday, putting our gain since it was added to the Hot List in late May at 46%. 52-week highs are hard to fade, but as I pointed out in Monday’s Playbook, we’re getting into thin air here. In addition to that extreme overbought reading, we’re closing in on a longer-term price target.

It doesn’t make it the top, but tactical investors should consider tightening stops or taking some profits.

Below is the current Blue Chip Hot List 👇