Good morning,

Below are the latest 3 From The MMP. The Monday Morning Playbook (MMP) is the flagship publication of Beat the Bench and now includes 2 ETF models, in addition to more charts, analysis, and actionable takeaways.

Upgrade to a paid subscription using the link above, and get not only the full edition of The Monday Morning Playbook each week, but access to the Tuesday Deep Dive, my individual equity report Stocks: The Good, The Bad, and The Ugly and the Beat the Bench Concentrated Equity Buy List.

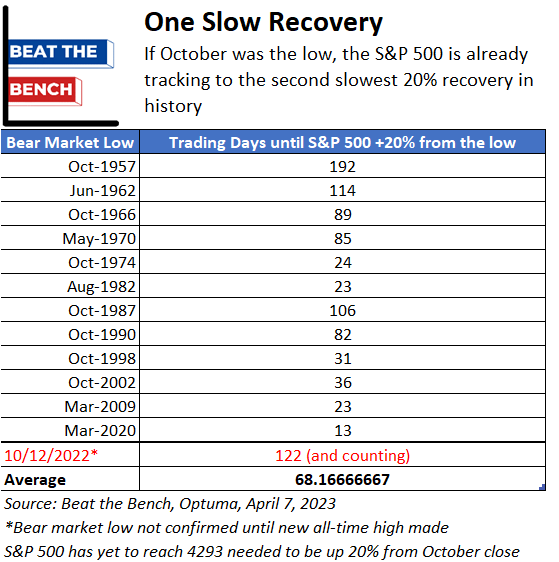

122 days and counting

As discussed in last week’s Deep Dive, if October was the low, the S&P 500 is already on track to the second slowest 20% gain from a bear market low on record. While nothing in markets has to happen, historically we see strong gains off the initial low and that makes it at least more likely that a retest or new low could occur this cycle.

The trend is there is no trend

I think the above visualization does a good job illustrating why I don’t want to be too married to any particular view of this market. Above are 6 different simple moving averages (ranging from one month to one year) with the actual price of the index removed. In uptrends like 2021, they are all rising, with the shorter-term ones consistently staying above the longer-term ones. By the summer of 2022, the trend was clearly down. But now all are clustered within a 2.3% range and going sideways. The trend is there is no trend.

Credit spreads not buying the equity bounce

Finally, one key concern for the market is that as the S&P 500 has nearly erased its February drop, HY spreads are still 80 bps wider than they were at the start of February. Sure, they’ve come in a bit, they seem to be saying things aren’t as strong as they were two months ago.

That’s it for this week, thanks for reading! If you like my work, please consider upgrading to a paid membership and tell your friends about 3 From The MMP.

Scott

Scott Brown, CMT

Founder and Chief Investment Strategist, Beat The Bench LLC