Cash is Still King

Neither bonds nor gold look investable for those looking trying to preserve capital

Hey! First off, thanks for following along! This post won’t follow the format of Beat the Bench’s flagship publications, but I wanted to give everyone a chance to sign up, see the interface, and get my thoughts on an important market story.

Also, Beat the Bench has a website!!

I’ll be announcing some of the key publications on social media next week, but if you want to go on a take a peak, you can view the details for what Beat the Bench is all about on the website! I plan to post the first Monday Morning Playbook on September 19 and at a minimum the first week will be entirely free before I put up the paywall. So subscribe now and never miss a post! If you haven’t visited Substack before, I promise you are going to love it. Take a look around, let me know if you have any questions (Scott@BeatTheBench.com) and I hope you enjoy!

Cash is still king. On Tuesday, the 30-year Treasury yield closed at its highest level since 2014, reminding everyone that the risk in rates is still to the upside. Yes, bonds don’t have the comically lopsided risk/reward that they had when the 30-year was at 1% (and the 10-year at about 60 bps), but for the most conservative investors the higher starting coupon still doesn’t seem to justify the principal risk in the near-term.

There are some momentum divergences on the daily time frame, so it wouldn’t be a surprise if this one wasn’t a straight line, but the inverse head and shoulders patterns still measures to 4%, which also happens to be next resistance derived from the 2014 highs.

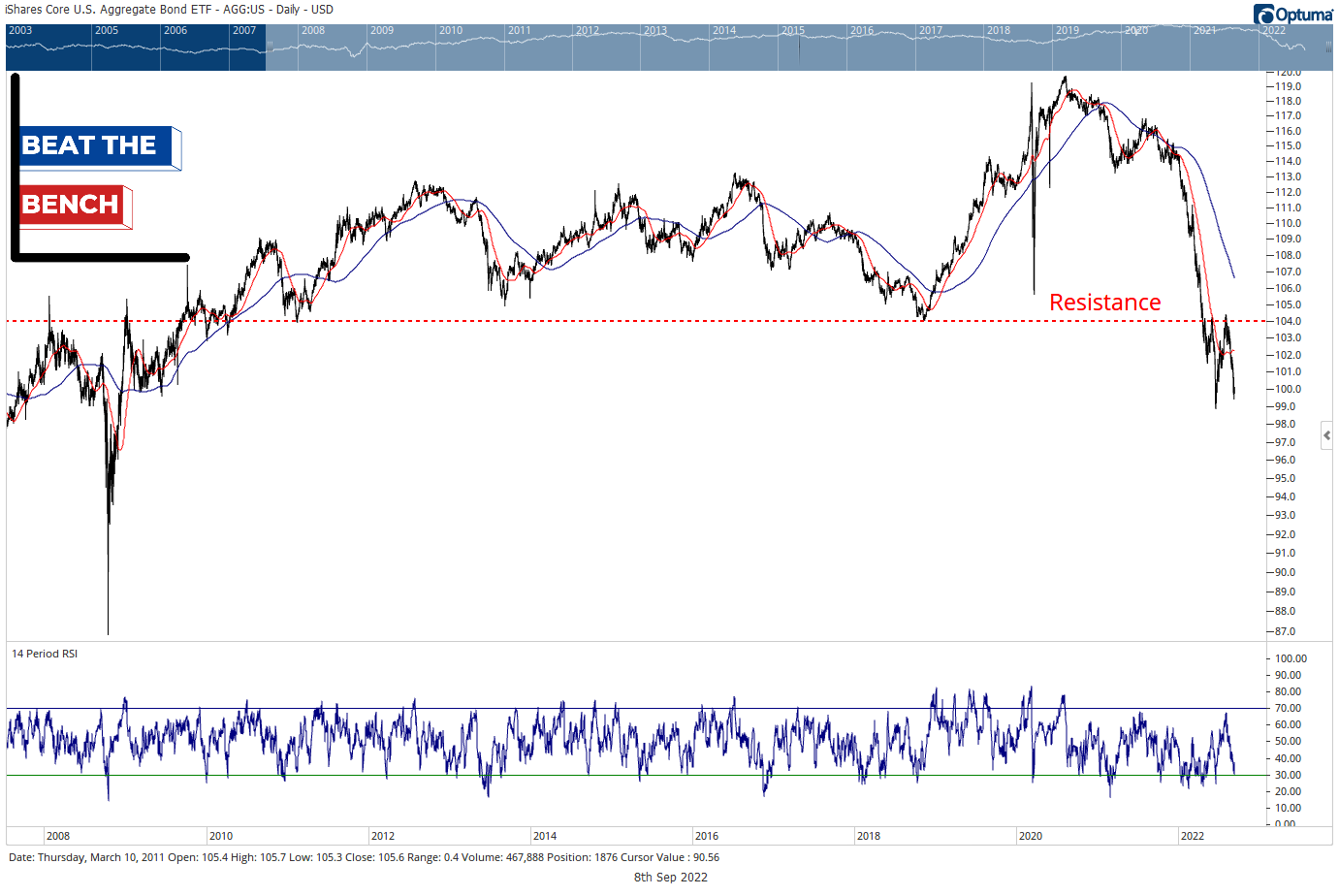

Now (hopefully) nobody owns 30-year Treasuries, but you almost certainly have AGG-like exposure in your portfolio. But should you? Again, mathematically core bonds are more attractive now than in mid-2020, but that isn’t saying much. Below is AGG (iShares Core US Aggregate Bond ETF). The play here is real simple: If AGG is below 104 (decade-long support now turned resistance) the risk to bond prices is still to the downside. If this the chart of a mid-cap software stock, would you really need to be told not to own it?

Active funds won’t save you either. Most core and core-plus managers are simply punting on a directional call for interest rates (seems like that could have been important this year…) and simply take on more credit risk than the AGG, so that over the long-term they outperform just by taking the risk premium. Buuutt, that isn’t so helpful when credit spreads are rising. Mirroring how AGG was rejected at resistance, HY spreads bounced off key support at 415 bps in mid-August, unable to tighten further and showing their correlation with equities.

Nobody goes to them for capital preservation, but it should be noted that the riskiest corners of the HY market are feeling the pain of Fed tightening, with CCC spreads back to within 30 bps of their July highs. The longer the Fed stays tight, the more likely we see credit stress creep up the quality scale in coming months.

So bonds are out for the conservative investor, or my opinion at least should be given a substantial underweight relative to your baseline asset allocation.

But what about commodities?

Unfortunately, not good news there either. DBC, one of the most popular diversified commodity vehicles on the market, closed below its 200-day moving average for the first time since October 2020 yesterday.

And while much of that was due to the technical breakdown in oil prices (63% of DBC is in energy commodities), my overall assessment of the broad commodities landscape is that good times are over.

Lastly, gold may be the traditional place to look for safety, but it has managed to be the absolute worst commodity to own to own over the past two years.

Big picture, this looks like a giant double-top, so not a great place to put capital for a conservative investor. However, there does appear to be a tactical mean reversion trade if you are into that type of thing.

Here’s the play: If gold is sitting down here above key support at $1677/oz., you can take a stab at it and use that as your stop loss trigger. There’s a bullish momentum divergence and maybe if other commodities are topping, gold will get a short stay in the sun. I don’t think it is unreasonable to see gold run to the low $1800s where the August highs and 200-day moving average wait. Much more than that seems like a stretch though, and if gold breaks support, the topping pattern measures to around $1400/oz.

So where to look? Well for true safety, I still believe that cash is king. Yes, real returns are what matters over the long-term, but in the short-run it is all about nominal returns. Would you rather have a flat portfolio over the past year, and know that you had lost 8.5% of purchasing power, or own the AGG down 11.7% and have lost 20% of purchasing power? Seems simple to me.

Scott

Scott Brown, CMT

Founder and Chief Investment Strategist, Beat the Bench LLC