Let's Look at Some Stocks

Beat the Bench is still a work in progress, but if you found this congrats! Enjoy some stock analysis as I continue to refine the posts!

Thursday, August 25, 2022

The entire market remains in a holding pattern ahead of the Jackson Hole Symposium. The easy expectation with so many charts sitting at critical spots is to expect J-Pow to say something that sends stocks decisively higher or lower, and likely interest rates decisively the other way. However, it is my experience that unless he massively screws things up, or is truly intent at undoing to financial condition easing that has happened over the past few months, we are more likely to pass such a closely watched event without a resolution.

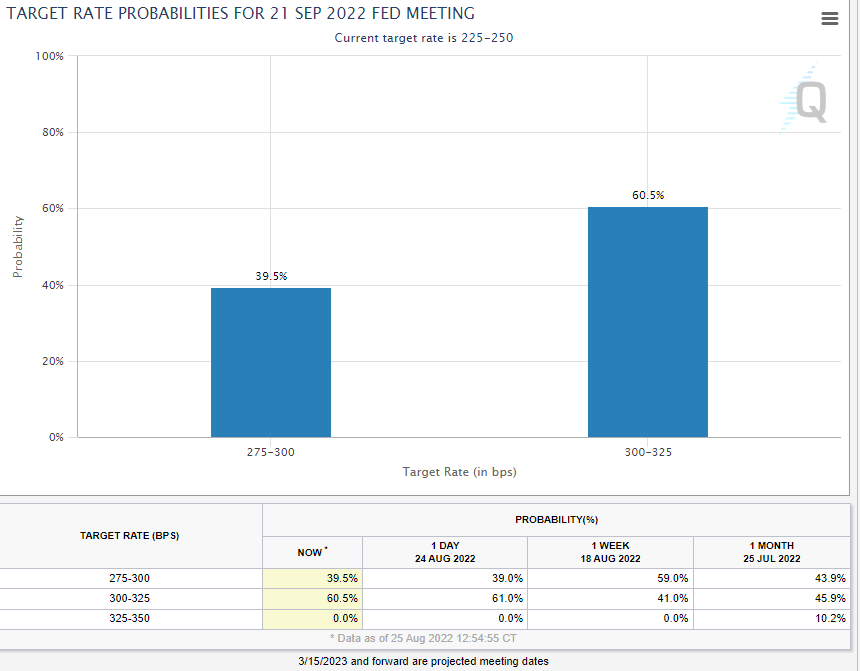

Let’s set the macro stage first. The entire market is glued to whether the Fed hikes 50 or 75 bps in September and market odds show it at still closes to a coin flip, but the odds have flipped from a 60% chance of a 50 to a 60% chance of a 75 in the past week.

And while 50 is objectively more bullish short-term, I’m skeptical that the size of the hike matters. What matters is the messaging and where the market thinks the Fed actually gets to. The market is currently pricing in a terminal rate of 3.75% around the March meeting, which essentially is challenging the Fed that if they go 75 in September, they’ve got 50 bps more and that is it. If J-Pow makes it clear that that they intend on more, expect all of the stories about overhead resistance to turn to “where is next support” over the coming months.

All the Fed speculation is fun and games, but I trust the charts and the terminal rate feeds directly into long-term Treasury yields, along with inflation expectation. As we see with the chart of the 30-year below, the risk remains to the upside and recent action looks like a pause from historically overbought conditions. However, the inverse H&S pattern that is marked targets 4% and if we reaccelerate back above YTD highs we could be there in a second. Don’t let anyone tell you fairy tails about dollar cost averaging in fixed income. If your clients need fixed income, that means that are conservative and need liquidity. Bonds are no place for those with those requirements.

We can make this simpler by just charting core bonds. Below is AGG. If this was a mid-cap software company would you own it??

Despite the fact that I occasionally get sucked into making predictions when the odds look really good, investment management and this blog is all about making bets. High risk/reward bets, where you know if you are wrong immediately. The bet on bonds here is pretty simple. We think rates go higher and bonds go lower. How will we know if we are wrong? Because AGG will go back through that major resistance level at $104, where it already failed one time. For now though, avoid bonds.

Let’s talk equities. We don’t want the entire portfolio to be one correlated bet, but the obvious place to avoid if rates are setting up for another leg higher in growth stocks. Too many advisors get suckered into making the growth vs. value bet because of the use of mutual funds and the proliferation of Morningstar style boxes. But as shown in the growth:value ratio, this trade has been a giant headache for nearly 3 years. Gun to my head, I’m taking value here, but we think there are easier bets to make.

Comm services is a growth heavy sector and remains incredibly, if not comically bad in relative terms, with every investor in XLC since its inception underperforming the SPX.

Even more remarkable, is when you look under the hood of this sector, it is top to bottom terrible, despite the fact that it includes everything from Facebook (we will never call it Meta here) to Match.com to Verizon. All have hit 52-week relative lows in recent days. Why not just underweight this sector, and stop trying to bet against Growth, which is 13% this beast? Again, I cannot be more clear. If you say you like value over growth, a tiny part of that bet is that this trend stops. So don’t make it! (Apple vs. the S&P 500 shown).

So what sector do you overweight if you are underweighting comm services? I would nominate industrials, which as shown in the bottom panel are breaking out to 52-week relative highs. Sure the absolute chart isn’t great, but we’re trying to add value here, not have a crystal ball. Avoid a sector loser, overweight a winner with strong momentum, rinse and repeat.

So what individual equities look strong in the industrials sector? Well first if it has the word “airlines” in the name, forget it exists.

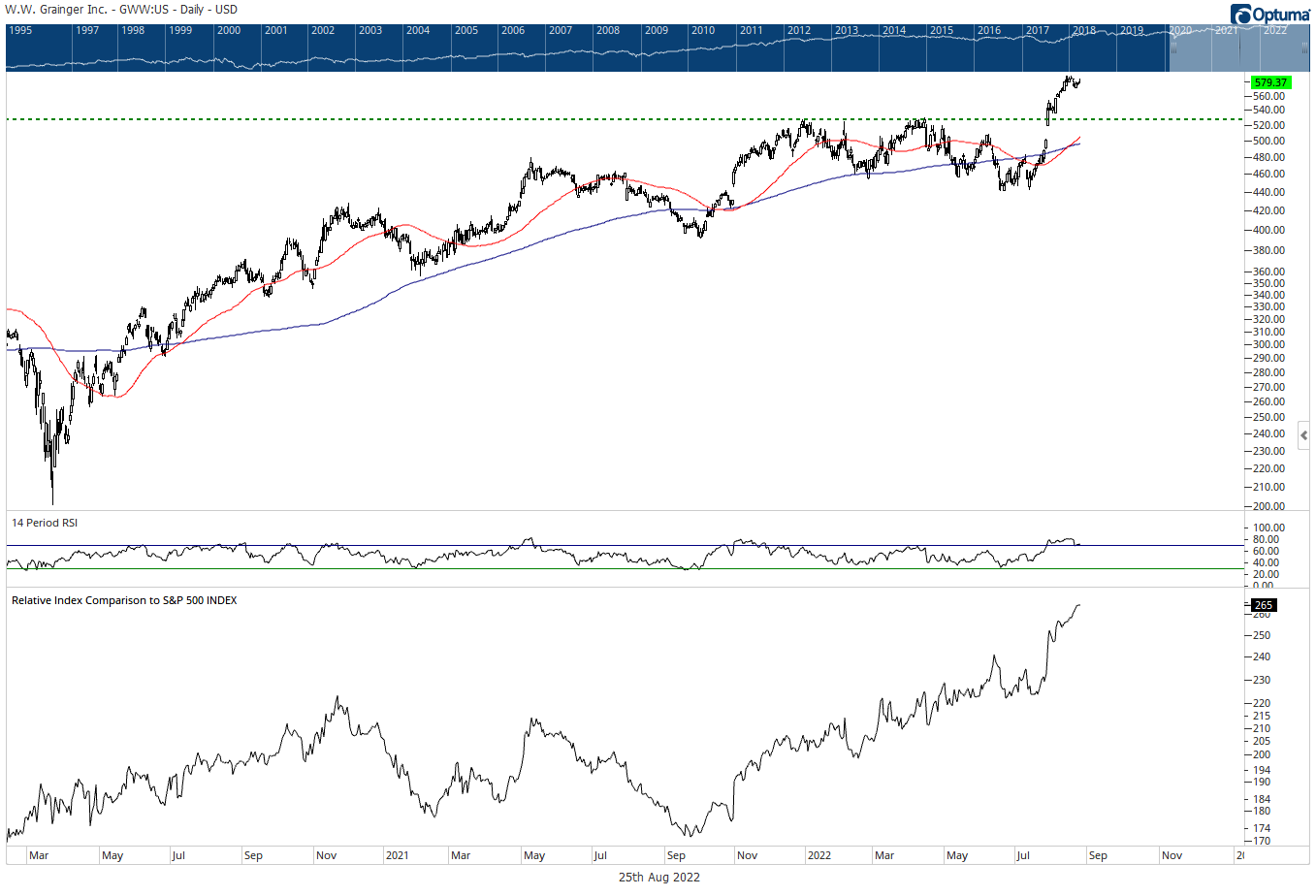

W.W. Grainger (ticker: GWW) is the kind of name we like, sitting right at 52-week absolute and relative highs after a major breakout in late-July. Sure it could pause, but if we’re above $530 the only bet on this one is higher.

CH Robinson also checks the 52-week absolute and relative highs box. We wouldn’t be dissuaded by today’s candle, simply use $112 as a stop for this transport leader.

Lastly, Howmet Aerospace (HWM) appears to be worth a look. Holding the breakout point would make managing risk easier, but it already appears to be bouncing back. Use the August intraday lows at $36.28 as a stop.

The last major story we want to watch is one that historically has been important for industrials, but right now is critically important for the entire market. The dollar is pushing up towards its July highs, but on weaker momentum than before. The industrials relative breakout may be arguing that this is the end of the line for the dollar, and while we don’t fight trends that look like this, you can save yourself listening to Powell’s speech and just watch the dollar. If it pushes up through 109, he said something the market didn’t like and expect risk assets to sell-off. However, currency markets may be expecting something more dovish and any relief in the dollar rally would be welcome news for the bulls.

Thanks for reading, and happy trading!

Scott

Chief Investment Strategist

Beat the Bench LLC

The above post, and all “Beat the Bench” posts are purely the opinion of the author and are for educational and informational purposes only. Beat The Bench is not a registered broker-dealer or investment advisor with the SEC or any state securities regulatory agency. This post is not an offer to buy or sell securities and is not a paid endorsement of any security. The author may or may not hold securities mentioned in these posts and opinions represent the current thinking at time of publication and may change at any points without notice. If you have questions, please contact your investment advisor.