Overtime

ETF Flows

Good morning,

Rotation is in the air, and as we discussed in yesterday’s intro, we want to ride that wave as far as it will take us.

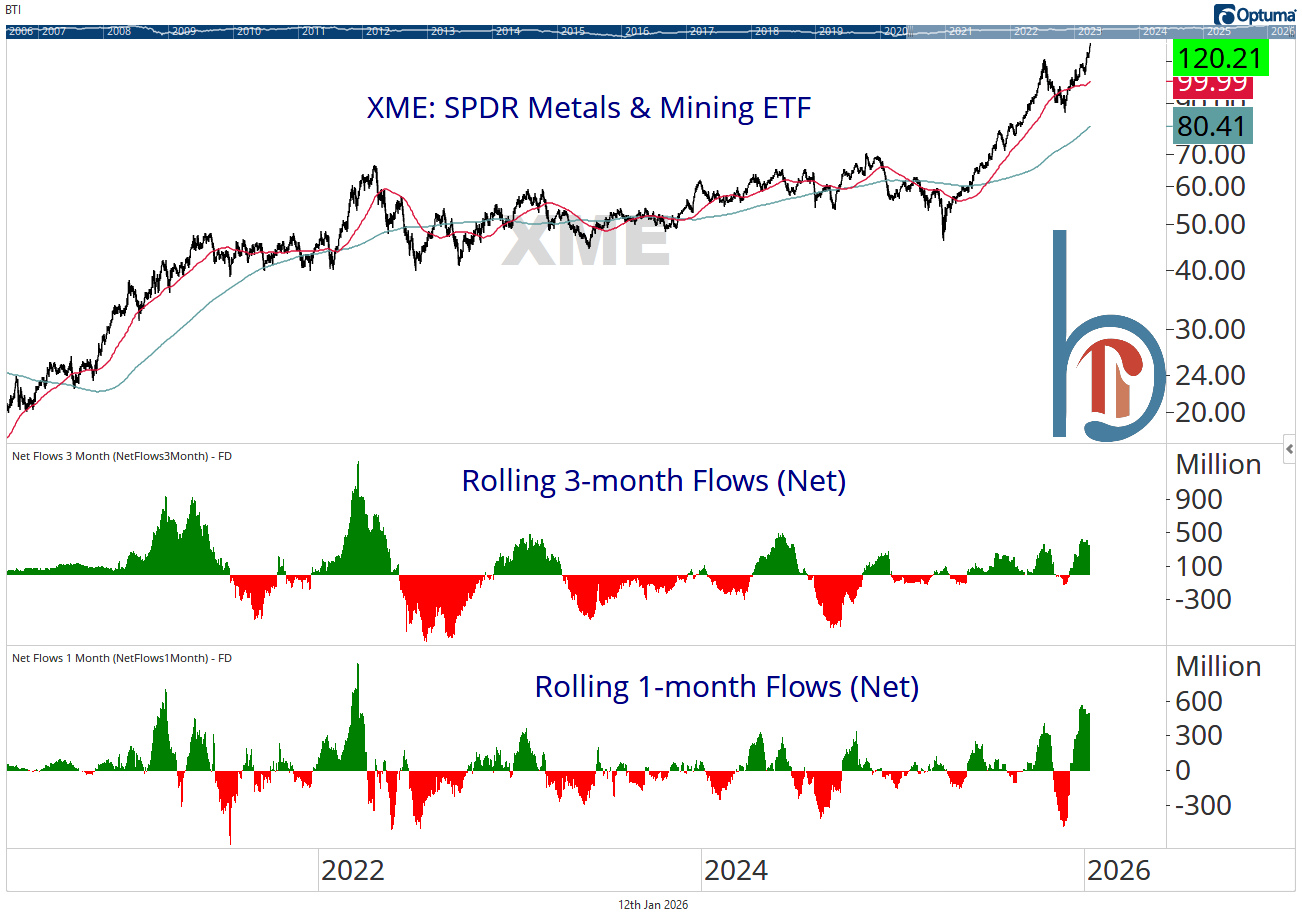

However, one thing that can be a risk to a trend is sentiment and one of my favorite sentiment tools is ETF flows. Flows are great because they show what investors are doing rather than what they are saying.

Today’s report is looking for things that are overly consensus, universally hated, or just not noticed by investors yet. Paired with classical charting and relative strength, it can be a powerful combination.

Just like our previous reports, I’ll highlight ETFs that fall into one of 3 categories:

Overly aggressive. These ETFs have seen extreme inflows. For an uptrend, I don’t believe that alone is a reason to sell but it’s a yellow flag and could indicate more downside vulnerability in a correction.

Contrarian positive. These ETFs have seen significant outflows recently and extreme readings could indicate selling is unlikely to continue to the same degree. Potential tailwind if a downtrend can stabilize and a bullish indicator for uptrends or ETFs breaking out.

Apathetic. Flows here aren’t extreme in either direction but that means there could be room to run for the underlying trend.

Let’s get into it!

Overly aggressive

Industrials

I’m surprised to see industrials here because XLI only really broke out from a six-month trading range last Monday. Nevertheless, both 1 and 3-month inflows are at multi-year highs, suggesting a tactical risk to sustaining the recent outperformance.