Overtime

Mailtime

Good morning,

It’s the last Tuesday of the month when Overtime becomes Mailtime.

Today, I take your market questions and chart requests and tell you what I’m seeing in what you’re watching.

Thanks to everybody who participated, let’s get into it.

Questions

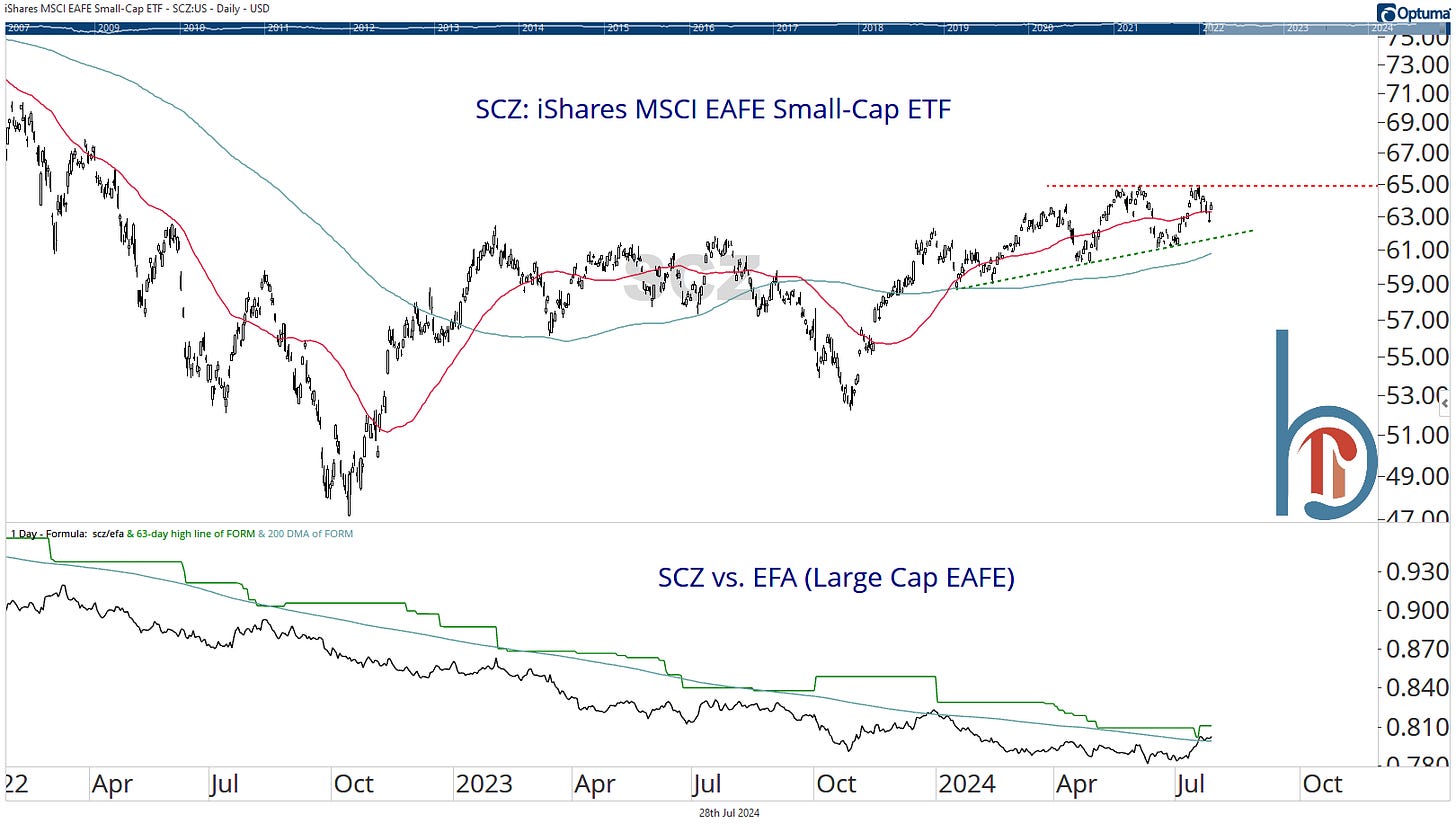

Is the small cap phenomenon is happening internationally? I’m curious what you see looking at individual stocks, country/region specific, or even small-mid developed vs emerging.

Looking at the two charts above, my answer is: Not really.

Now both small cap EAFE (foreign developed markets) and small cap EM are in uptrends, above rising 200-DMAs and with a steady series of higher lows. But we haven’t seen near the relative surge that we have in the U.S. and I think the reason is two-fold.

One, our small-caps are surging because of expectations for a Fed cutting cycle starting in September. That just isn’t a dominant factor for the returns of small cap stocks in other countries.

Second, the relative change vs. large is also a function of the Mag 7/semiconductor sell-off. There are a few notable international semiconductors (TSM, ARM, ASML) but other countries don’t have the extreme technology exposure and concentration risk that our domestic indexes do.