Overtime

Factors

Please note, Brown Technical Insights will be off next week for Thanksgiving.

Good morning,

This week we’re looking at the technicals for the most common equity factors. Yesterday’s Playbook looked at some divergences that favor low vol, and the size factor’s perennial underperformance remains one of the most talked about stories of 2023.

This week, we’ll review year-to-date performance and cover other factors including:

High beta

Value

Quality

Momentum

Please note, the charts we’re using today feature momentum for the factor relative to the S&P 500 because we’re most interested in what is working vs. the absolute technicals.

Performance

Quality is the only factor outperforming YTD

Of the 6 major factors we’re looking at today, only quality has outperformed the S&P 500 year to date. The rest are not just lagging, but 3 are outright negative.

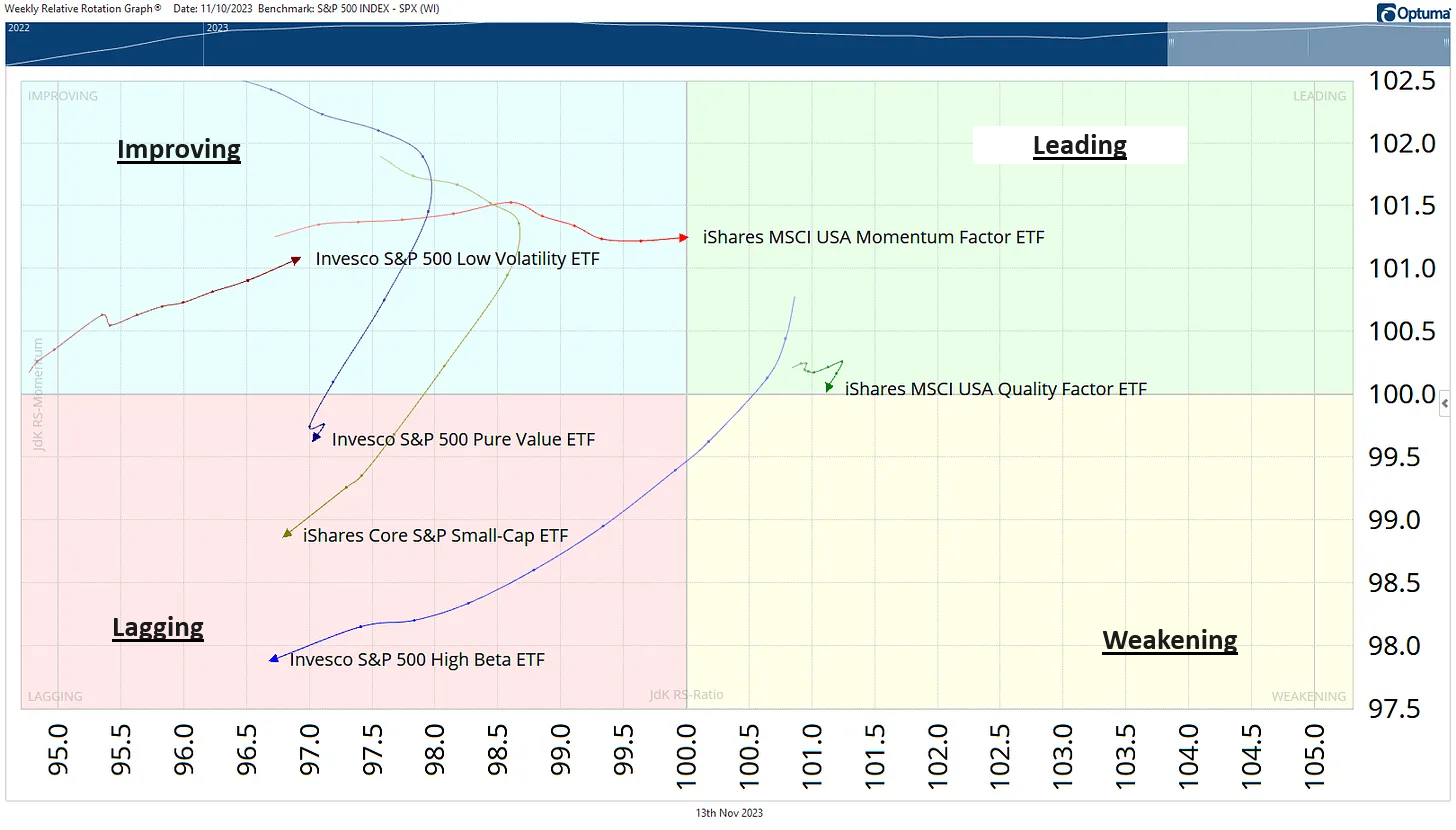

Relative Rotation Graph

The relative rotation graph is another way to view performance and confirms most of what I’m going to call out in the traditional technical charts below.

Quality is leadership, but flirting with moving towards weakening

Momentum is doing well

Low vol is showing signs of improvement

Value and small-caps are terrible

High beta has gone from leading to firmly lagging, a yellow flag amid the market’s recent rally

Quality

Quality has been worth paying up for

The quality factor isn’t all tech by any means, but its chart pattern certainly bears a strong resemblance to XLK. We’ve all heard the fundamental reason that people have flocked to the Magnificent 7 is those strong balance sheets and frankly, this supports that. The relative trend is incredibly strong but is showing a bearish divergence on its most recent new highs.