Overtime

Foreign equity investing

Good morning,

Yesterday’s Playbook took a tactical look at major indexes, sector and industry ETFs, and gold. But I left off foreign markets so we could expand on them in more detail in this week’s Overtime.

I’ll start with 3 main takeaways for investors:

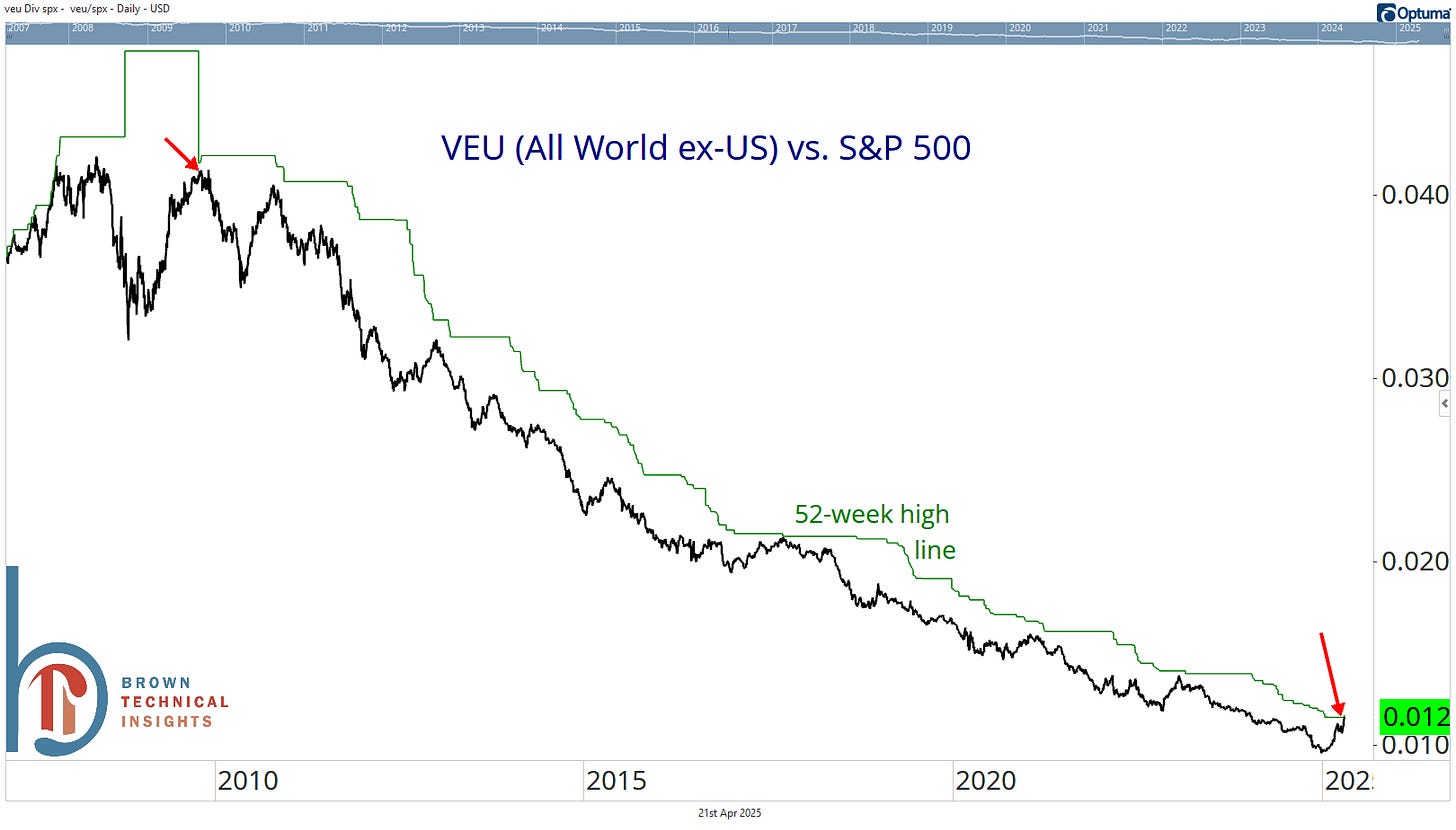

1) The relative strength we’re seeing is real and different

We all know that international markets have been outperforming YTD. The million-dollar question has been: Is this different than other brief stretches of outperformance we’ve seen over the past few years?

My answer is yes. One example, the “rest of the world” is making its first 52-week high vs. the S&P 500 since October 2009 and the first consecutive 52-week highs since 2007 before this ratio began its long descent.

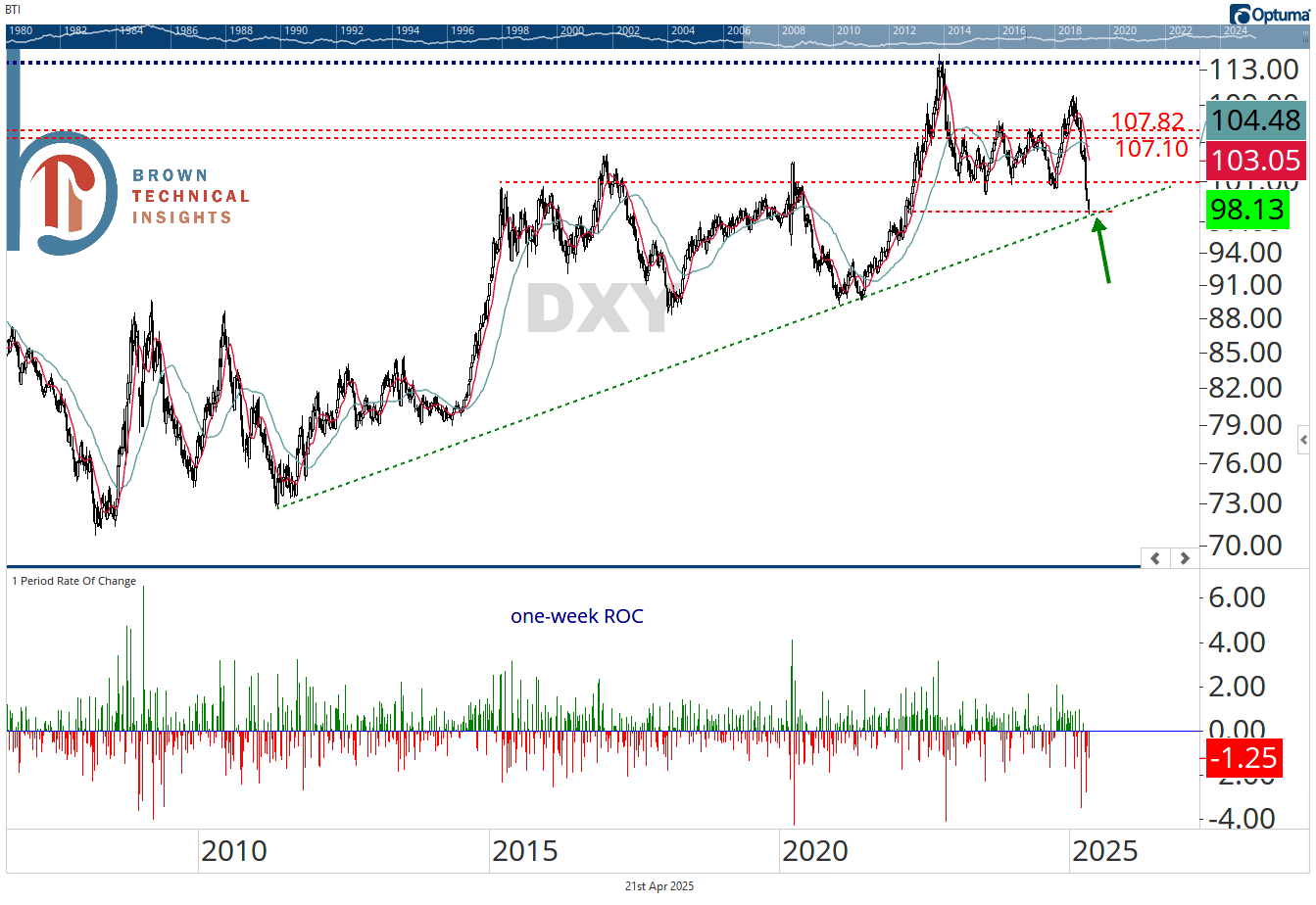

2) The dollar collapse is a big reason for the relative strength

Last Monday, I pointed out that the DXY was extremely oversold based on its 3-month rate of change. And in the five trading days since, it has gone on to lose an additional 2%, including 1.25% yesterday. We may be oversold but now that we’ve broken support at 101, the operating assumption has to be there is more risk to the downside.

I’ve seen some people point out this long-term uptrend line, unfortunately, I wouldn’t get too excited about it. The DXY’s largest component (the euro) has already taken out its 17-year downtrend line 👇

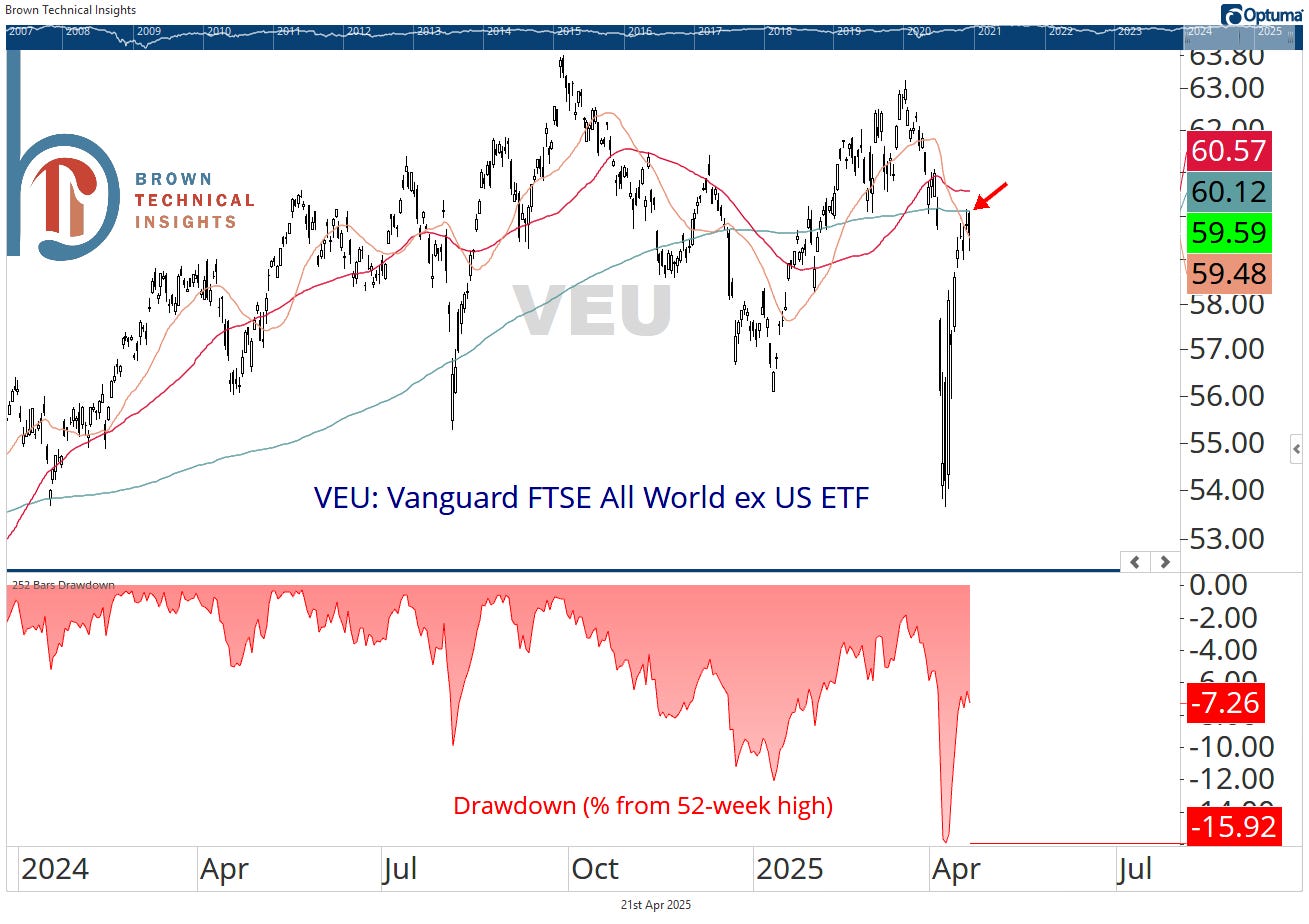

3) Don’t confuse relative strength with the potential for absolute gains

Foreign markets may be outperforming but that doesn’t mean they’re going up. As today’s report will highlight, many foreign equity indices and ETFs are in double-digit drawdowns and below their 200-day moving averages. Expect absolute gains to be hard to come by until we see stabilization in the US market.

In the rest of today’s report, I’ll break down the technicals for:

The high-level international “asset classes”

Major countries and regions

and 4 focused ETFs with the strongest setups