Overtime

ETF Flows

*Today’s report was originally scheduled for Tuesday but I’m traveling this week and needed to complete it early and saw no reason to hold back its release. Enjoy!

Good morning,

It’s election week, which means we can all look forward to our call and text spam falling back to normal levels soon.

As today’s editorial in the Monday Morning Playbook discusses, this is not a week to be trading or making a lot of moves. But as the election takes everybody’s focus away from what actually matters, what better time to focus on something that always matters:

Market sentiment.

We’ve taken to highlighting ETF flows about every 3 months, in what has become one of the most popular reports. And I think with good reason.

In our July report, both the Mag 7 ETF (MAGS) and QQQ were less than a week removed from all-time highs, but flows were flagged as overly aggressive. Since then, mega-cap growth has gone dormant and both ETFs are lower while the equal-weight S&P 500 is up more than 5%.

Just like our previous reports, I’ll highlight ETFs that fall into one of 3 categories:

Overly aggressive. These ETFs have seen extreme inflows. For an uptrend, I don’t believe that alone is a reason to sell but it’s a yellow flag and could indicate more downside vulnerability in a correction.

Contrarian positive. These ETFs have seen significant outflows recently and extreme readings could indicate selling is unlikely to continue to the same degree. Potential tailwind if a downtrend can stabilize and a bullish indicator for uptrends or ETFs breaking out.

Apathetic. Flows here aren’t extreme in either direction but that means there could be room to run for the underlying trend.

Let’s get into it!

Overly aggressive

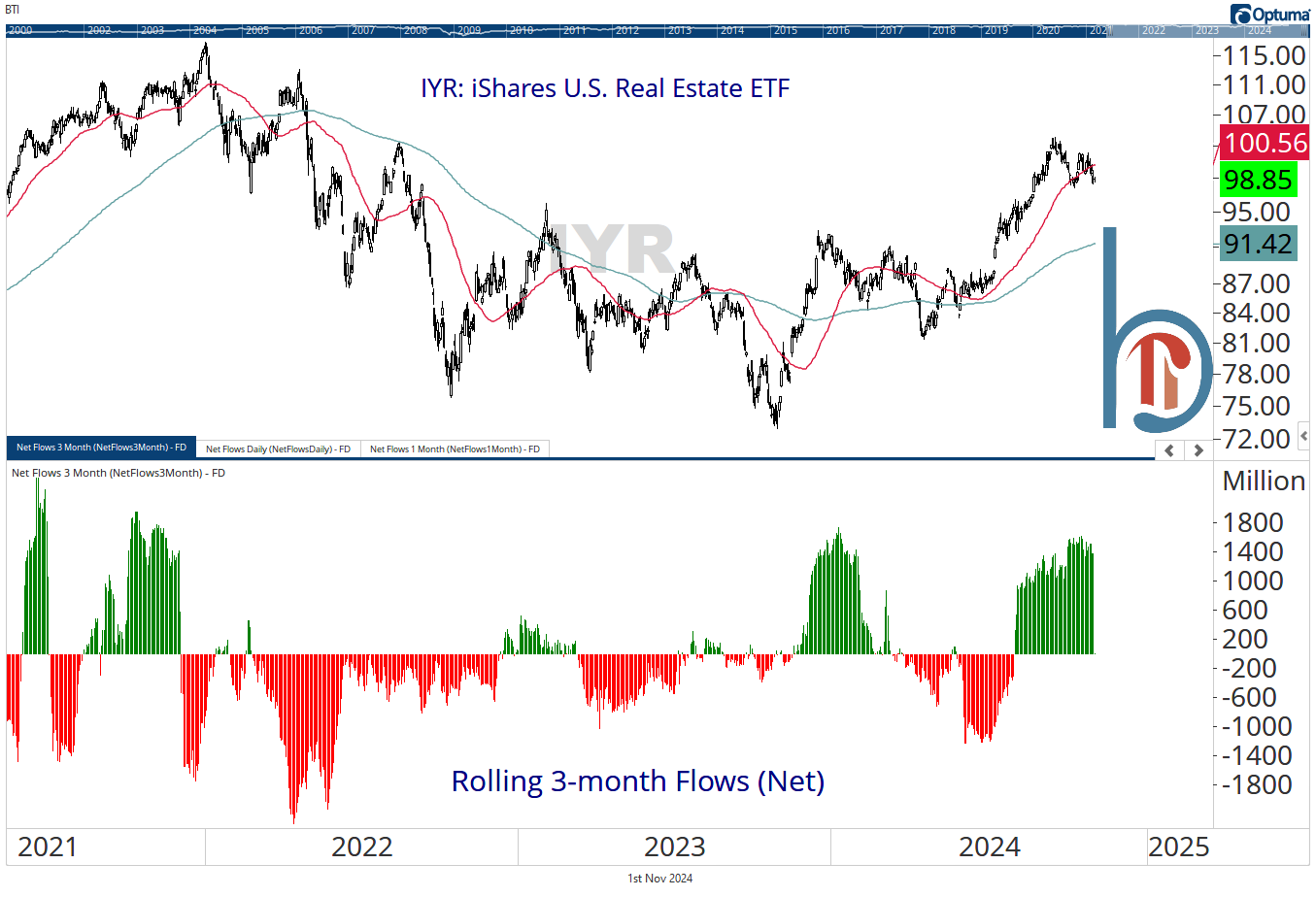

Real estate flows near top of 3-year range

Despite a 5% pullback that started in mid-September, rolling 3-month inflows into IYR (and XLRE) remain near the top of readings seen over the past 3 years. This is a risk to the group and may also suggest consensus is too bullish on bonds.

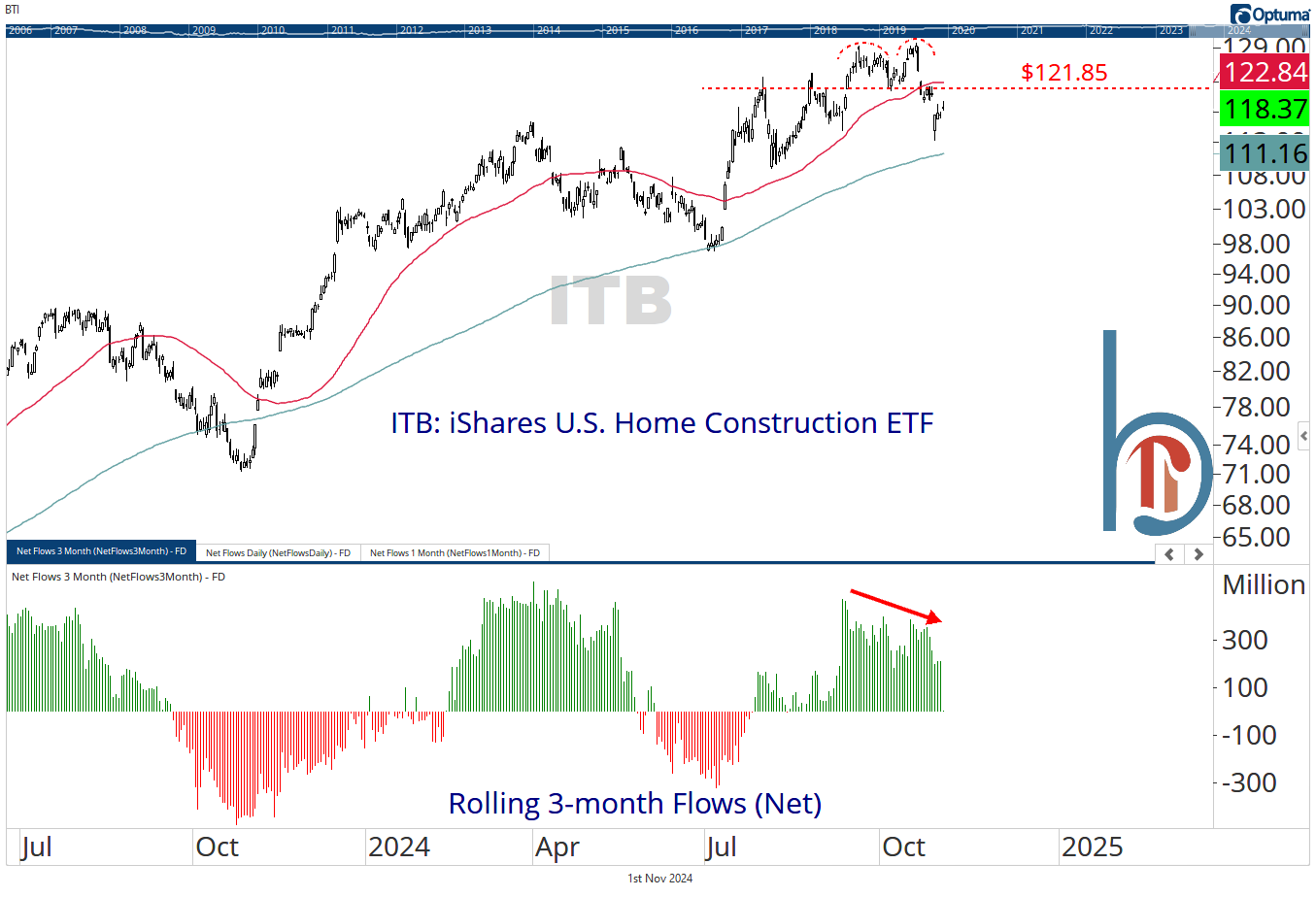

Homebuilders may have more risk to the downside

Another data point for the bond bears is that even as homebuilders have started to break down, inflows into ITB remain aggressive. They’re starting to come in, but we’ve seen this metric go negative before the last 2 corrections found a bottom.

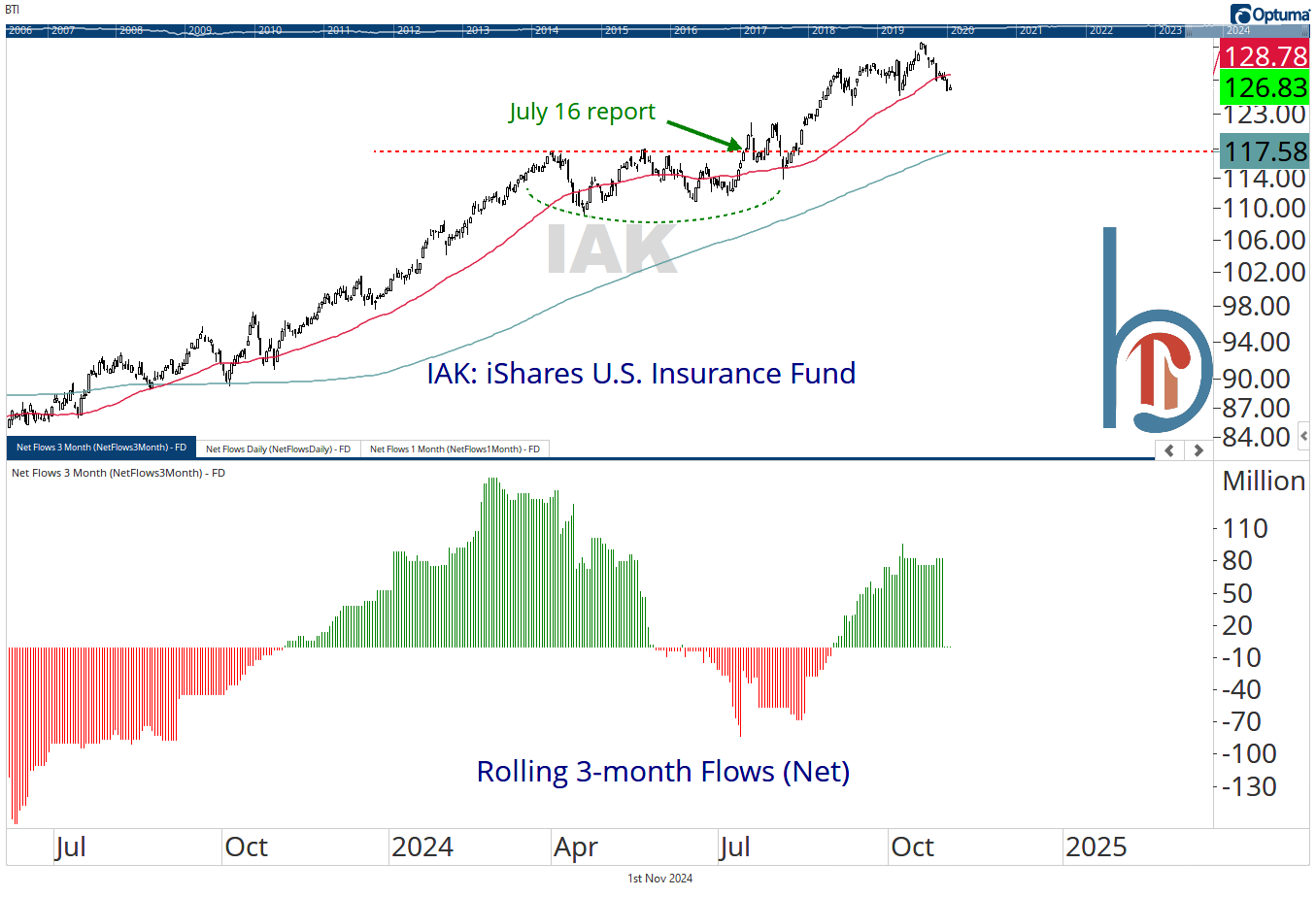

Investors are back on the insurance train

This ETF was highlighted as a contrarian positive opportunity in the July report, as 3-month flows were negative while it was pushing to the top of that nice base. IAK proceeded to break out the next day and is up about 8% since then. However, sentiment has followed price and this is no longer a contrarian long idea.