Overtime

Sector technicals

Good morning,

This week we’re checking in and providing a technical update for all 11 S&P 500 sectors. We’ll show their current trend score (0-8 based on absolute and relative moving average slopes) as well as a qualitative update on each sector SPDR ETF.

Let’s get into it!

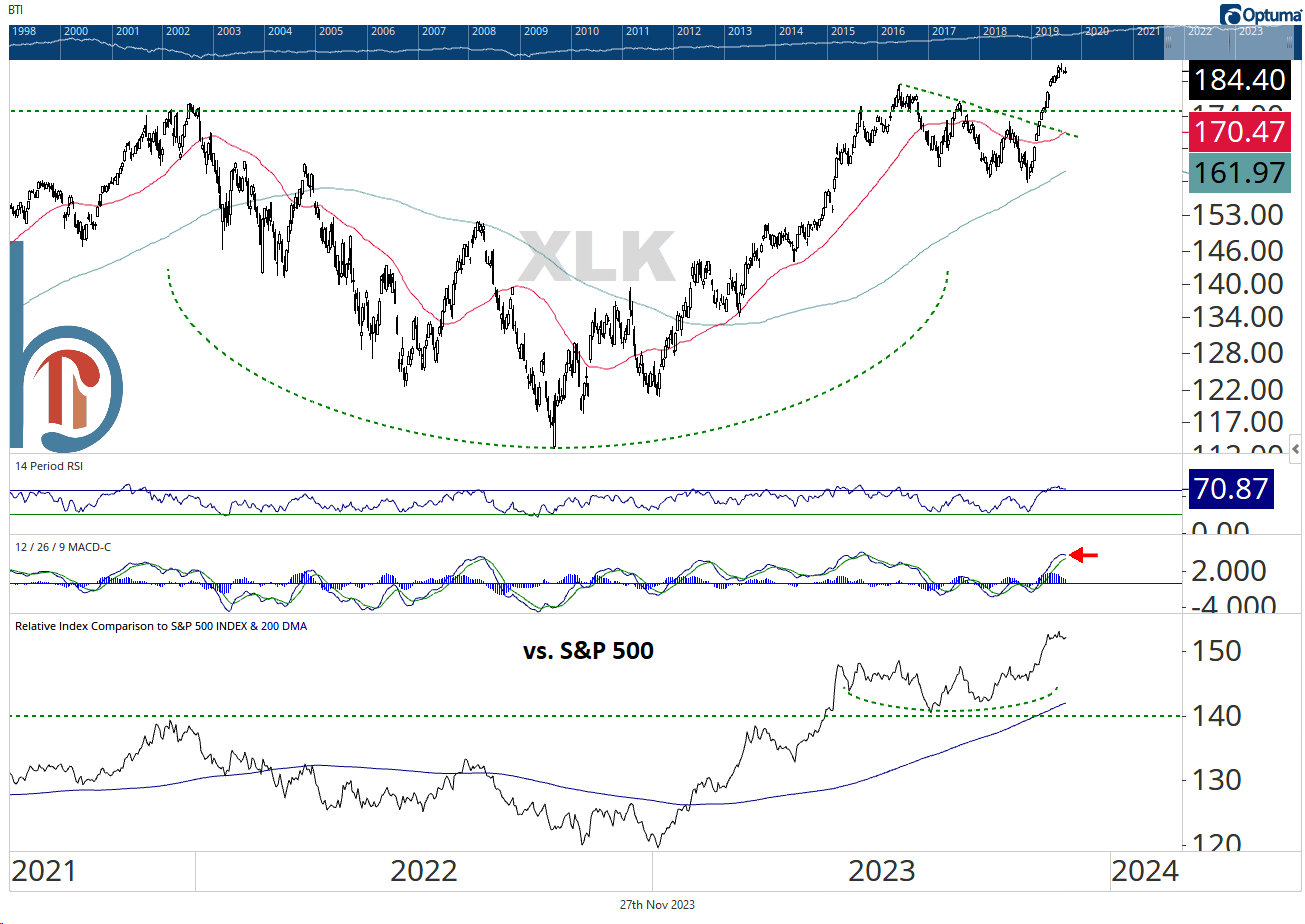

Tech (Trend Score: 8)

Percent of components above 50-DMA: 84%

Percent of components above 200-DMA: 67%

Update: Technology remains clear leadership from a trend perspective and we shouldn’t lose sight of that if your time horizon is longer than the next few weeks. However, I would note that the sector has already broken out, and like top holdings Apple and Microsoft, the daily MACD is on the verge of flipping negative. Last Wednesday’s high of $186.35 is tactical resistance, while first support is $179.

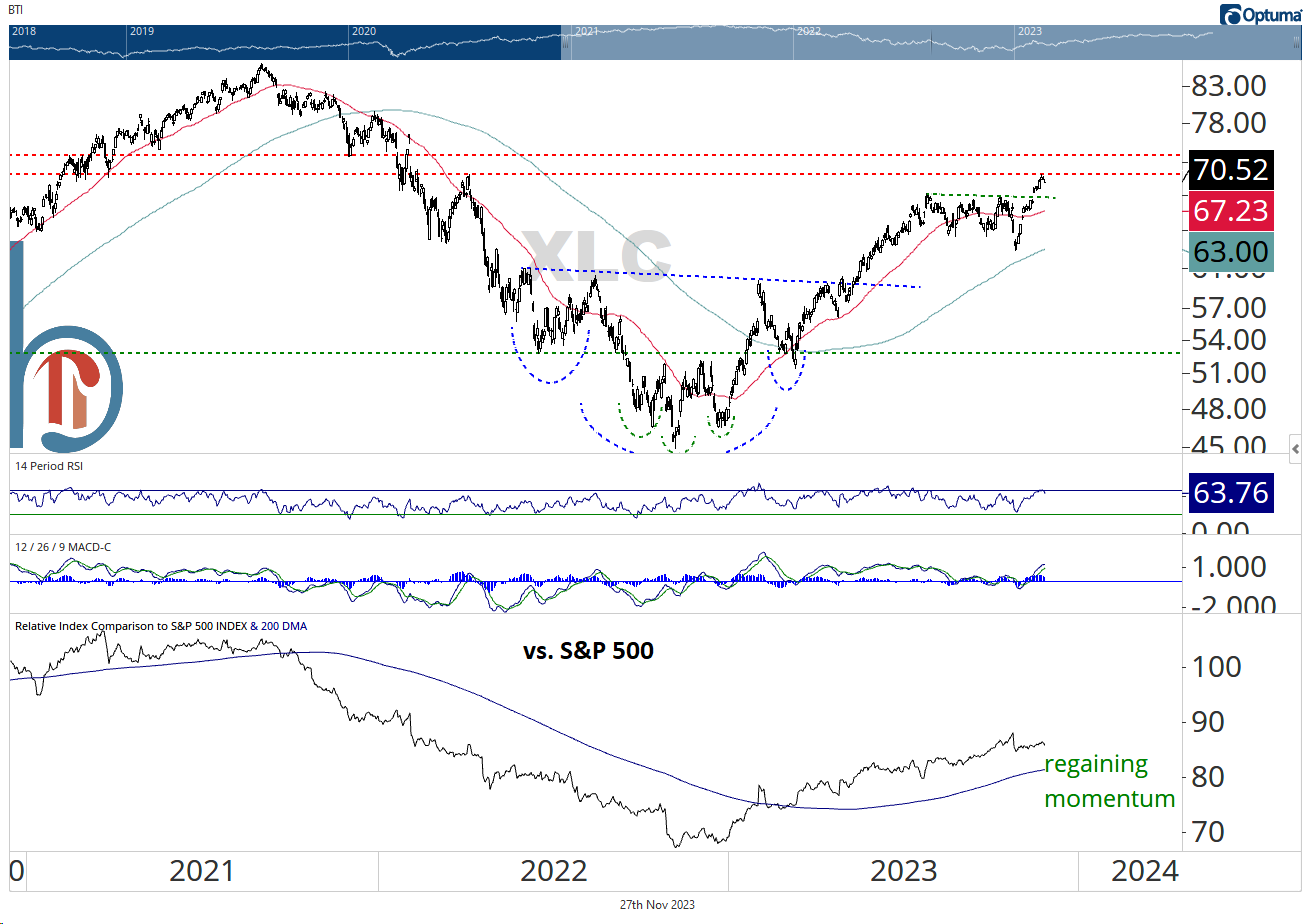

Communication Services (Trend Score: 7)

Percent of components above 50-DMA: 77%

Percent of components above 200-DMA: 68%

Update: Communications has broken out to new YTD highs, but remains a long way from all-time highs. Leadership is coming back but XLC may struggle in the range from $71-$74/share, where it really broke down from last year.

Consumer Discretionary (Trend Score: 7)

Percent of components above 50-DMA: 70%

Percent of components above 200-DMA: 51%

Update: The cap-weighted discretionary sector continues to be jostled around by Tesla, but overall is more positive than negative. In fact, you could make the case for an ugly inverse head and shoulders pattern playing out over the past 18 months. Still needs to overcome the downtrend line from the July highs. Market-weight this sector.

Financials (Trend Score: 4)

Percent of components above 50-DMA: 94%

Percent of components above 200-DMA: 74%