Overtime

Mailtime

Good morning,

It was a long month with five Tuesdays, so it’s been a while since our last Mailtime report.

For new subscribers, Mailtime is your chance to get your market questions and chart requests answered by me. No market questions this week, but we’ve got a bunch of timely chart requests.

Thanks to everybody who participated.

Let’s get into it!

Chart Requests

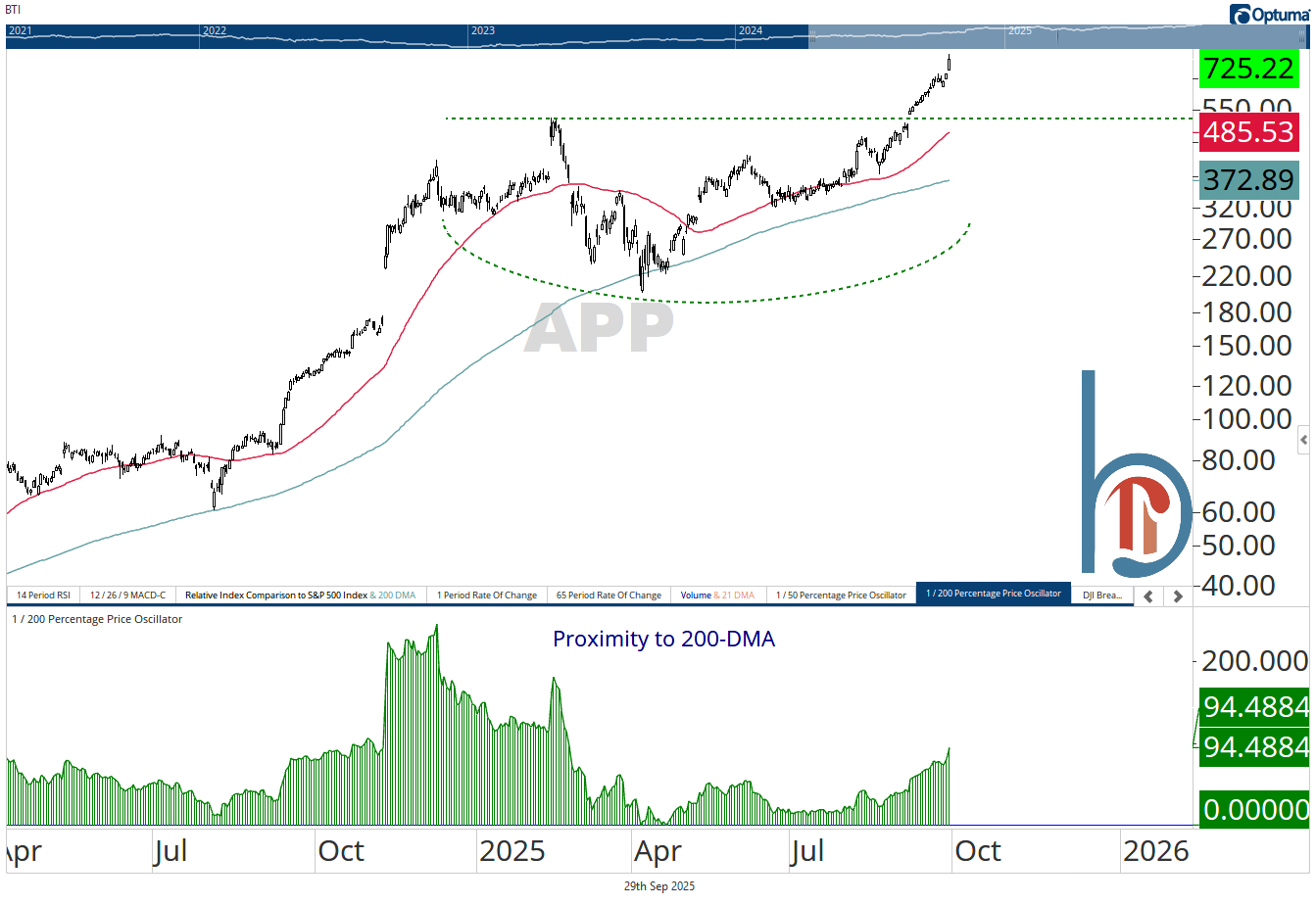

APP: AppLovin

AppLovin gapped through to a new all-time high on September 8 and has only been lower in 3 of 16 trading days since. The stock gapped up again yesterday with a huge gain and may have more runway as that base measures to $850. It is overbought on every metric, but not even close to the extremes that the stock saw last year.

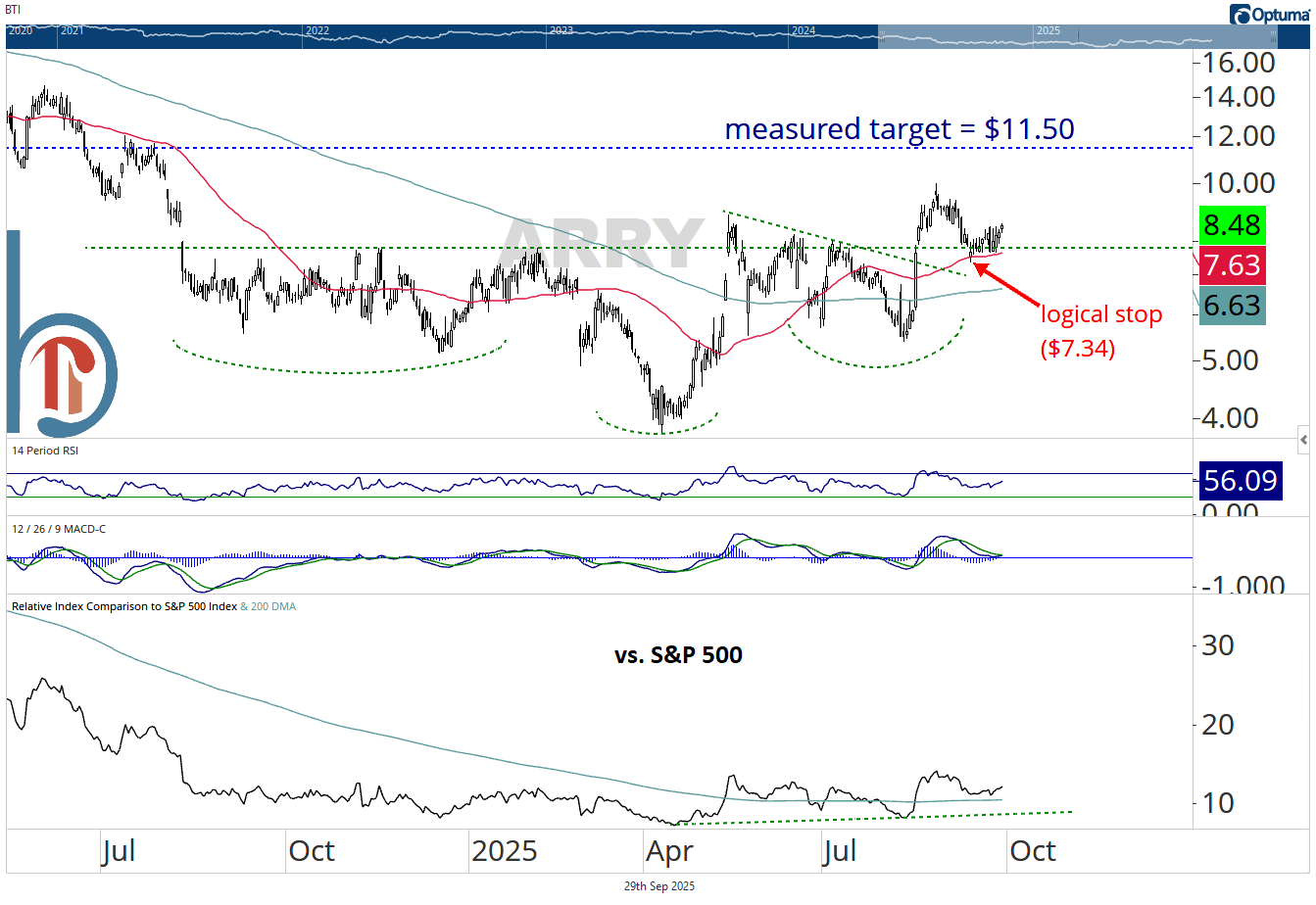

ARRY: Array Technologies

ARRY has broken out of a crude inverse head and shoulders pattern that measures to $11.50. The September low ($7.34) and successful test of the 50-DMA give investors a clear level to manage risk against.

Bitcoin

We showed Bitcoin a good bit in yesterday’s Playbook, calling out the importance of $107k and the upcoming bullish seasonality. Both are off to a good start with Bitcoin gaining nearly 3% yesterday. The next step for bulls is a strong close above the 50-DMA, which has been a key support/resistance marker in 2025.