Overtime

Mailtime

Good morning and welcome to Mailtime!

It’s the last Tuesday of the month where I take your questions and chart requests and provide my view on what you’re seeing.

Thanks to everybody who participated, let’s dive in!

Questions

How does AIRR look technically and how does it compare to XLI?

AIRR is the First Trust American Renaissance ETF, which according to the website is “designed to measure the performance of small and mid cap U.S. companies in the industrial and community banking sectors”. Despite the name, it only has 10% in financials, so it is basically a small-cap industrials fund, a fantastic place to to have been over the past 3-4 years.

Looking at the technicals, the chart is messy but a breakout above $74.60 would target $82/share. Versus XLI, the ETF remains in long-term uptrend, but has underperformed since May. This is notable because since May, small caps have outperformed large, and regional banks have outperformed small-cap industrials, so I would have expected the opposite.

What’s the biggest risk to a bullish outlook between now and year-end?

I laid out my bullish view on this market on Monday and think it is important that we’ve seen the right type of leadership since the August 5 lows. However, an important caveat to the S&B 20 Cyclicals vs. Defensives chart I shared in yesterday’s MMP is that while we’ve seen a nice rally recently, the ratio is still 14% off its highs from mid-March.

It’s a similar story with our other 3 risk ratios, which remain well below their respective YTD highs while the S&P 500 sits just 2% from its.

When I go stock by stock and sector by sector, I’m starting to see some extremes in the defensives and bond proxies, especially staples. XLP currently has an RSI-14 over 75 and 3 of its leaders (Colgate-Palmolive, Coca-Cola, and Wal-Mart) are more than 2 standard deviations above their 200-day moving averages.

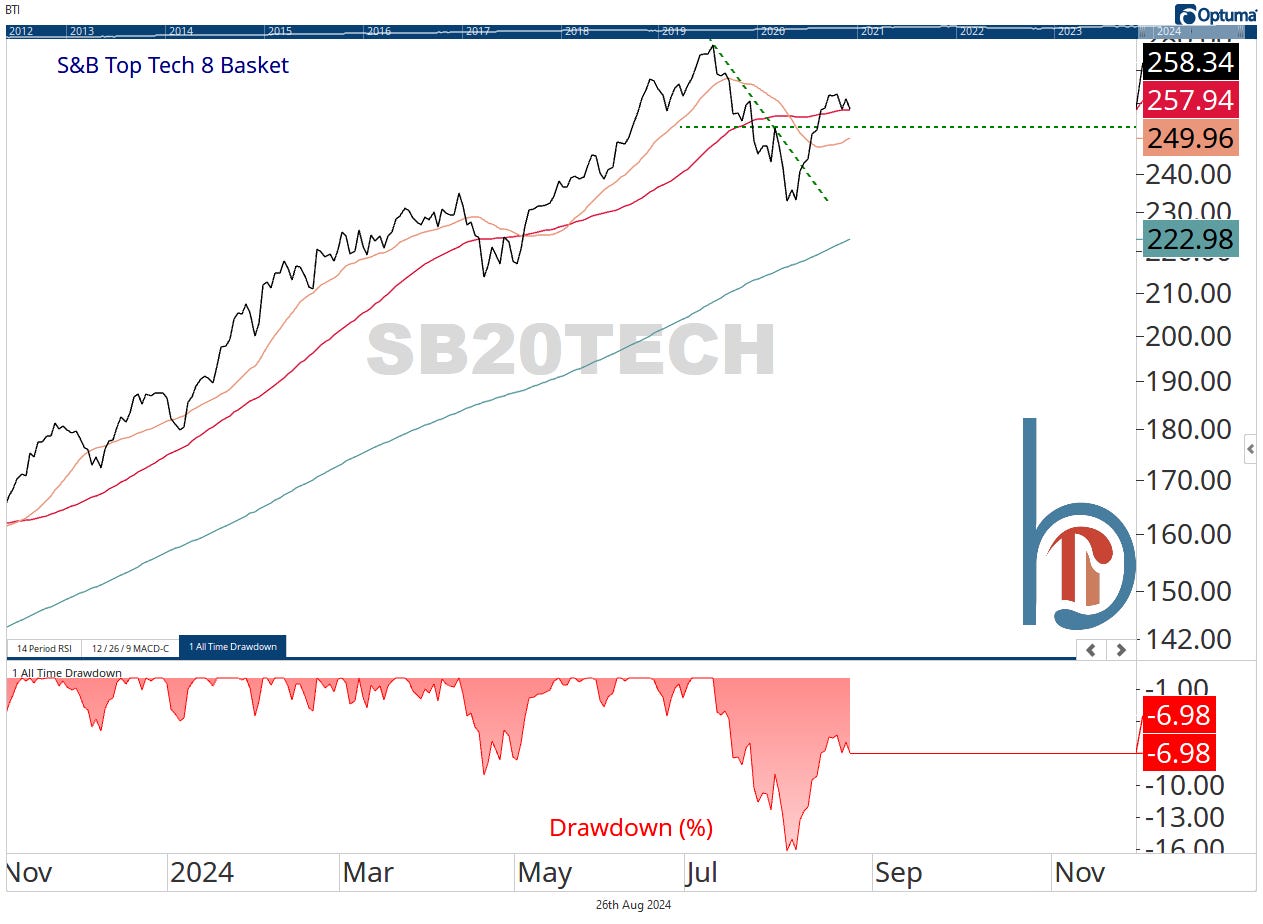

Those stocks making new highs isn’t bearish, but if they tire, it increases the need for cyclicals or mega-cap tech to perform. Mega-cap tech is what is most important to the index and that group has yet to make it back to new highs. 👇