Overtime

Growth ETFs

Good morning,

This week’s Monday Morning Playbook spent a lot of time on energy and inflationary assets that have performed well over the past month, so I already wanted to dedicate some space to growth stocks. And right on cue, growth roared back to start this week with Alphabet, Adobe, and Tesla all gaining more than 4% yesterday.

The longer-term trends remain strong here. But I’ve been recommending a market-weight position for most growth sectors in light of those trends, contrasted with short-term signs of exhaustion and overly optimistic sentiment.

Now that many of these growth ETFs have paused or underperformed for over a month, I think it’s timely to check in on them.

We’ll look at:

Growth and technology indexes

Major sectors

and focused ETFs

Indexes

QQQ: Nasdaq 100

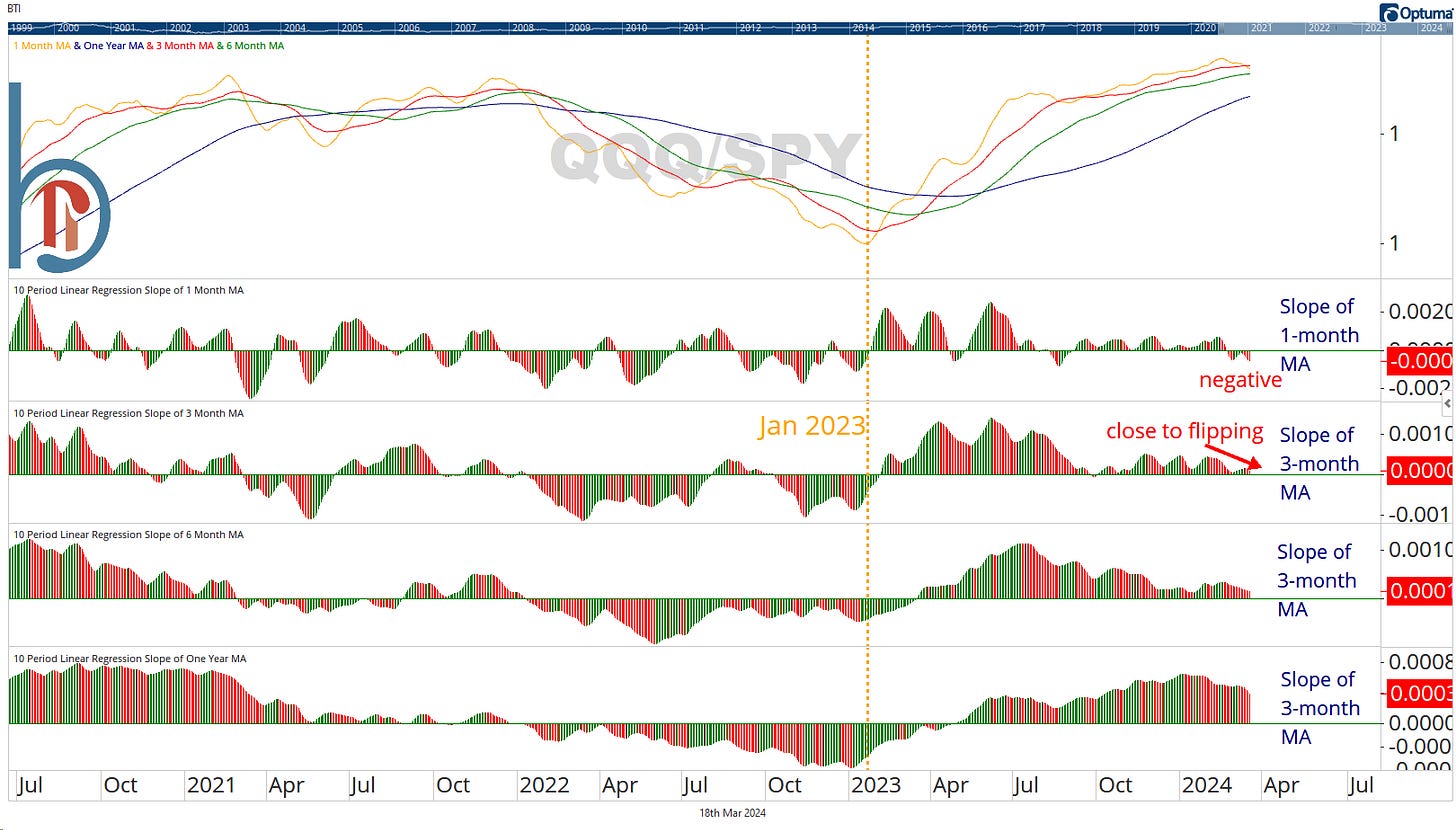

QQQ remains in a strong uptrend and the only real quibble with the absolute chart is the bearish RSI divergence that could indicate some slowing momentum. If we get a pullback, there is plenty of support between current levels and the $407 level. But, I’m most focused on the relative chart. As shown below, the slope of the 1-month MA for the QQQ:SPY ratio is negative and the 3-month is close to also falling below zero. Both of those haven’t been negative since January 2023, when the relative chart bottomed.

IWF: iShares Russell 1000 Growth ETF

Despite the recent pause, large growth is still the best-performing corner of the style box, up 9.8% YTD. And of course, the chart looks similar to QQQ with a strong uptrend but negative RSI divergence. First support here is in the $305-$312 range.

IWO: iShares Russell 2000 Growth ETF

Small-cap growth is up 3.33% YTD but it’s only beating small-cap blend and small-cap value, demonstrating that the recent rotation still hasn’t made its way down the cap scale. IWO finds itself in a bit of a no-man’s land, having broken out from an 18-month base, but stuck below resistance from 2021. I think this could be a good entry point in absolute terms, but without any relative strength, I won’t allocate our ETF portfolios to it.