Overtime

End of Year Opportunities

Good morning,

As promised yesterday, today’s report is going to highlight various trade ideas and long opportunities in ETFs and individual stocks looking out to the end of the year.

Importantly, these ideas are in addition to sector and focused ETFs held in our ETF models and the highest conviction stock ideas tracked on the Blue Chip Hot List. To see the current holdings for each, please click on the links provided.

While we won’t necessarily revisit all of these or track them like other holdings, a thesis and potential stop is provided for each.

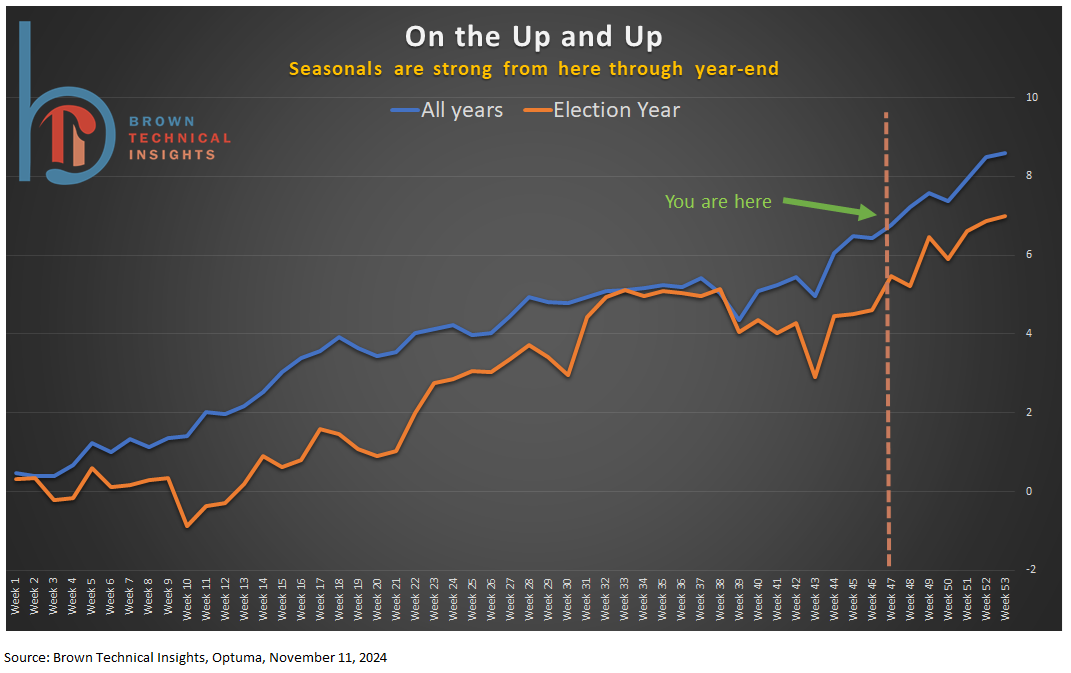

Finally, before we get into the trade ideas, a few charts on seasonality and what we typically want to look for this time of year.

First up: Seasonal Tendencies

End of year rally is base case based on trend and seasonals

But beware November momentum crashes

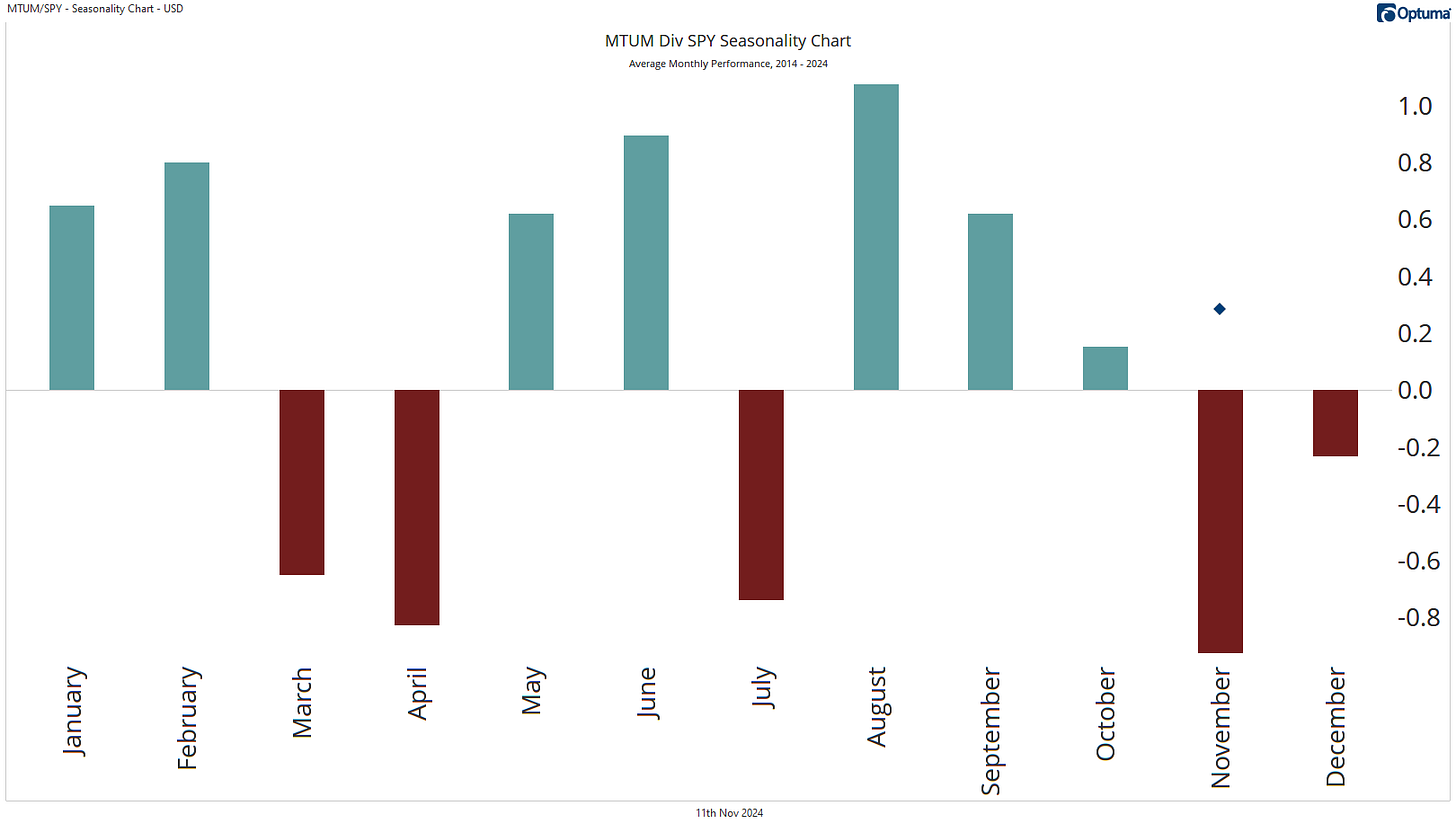

As trend followers and technicians, we always want to err on the side of momentum and relative strength. However, it is important to note that November is historically the worst month for momentum stocks on a relative basis. Meaning, stocks that have been outperforming over the trailing 6-12 months are more likely to underperform the market than in any other month.

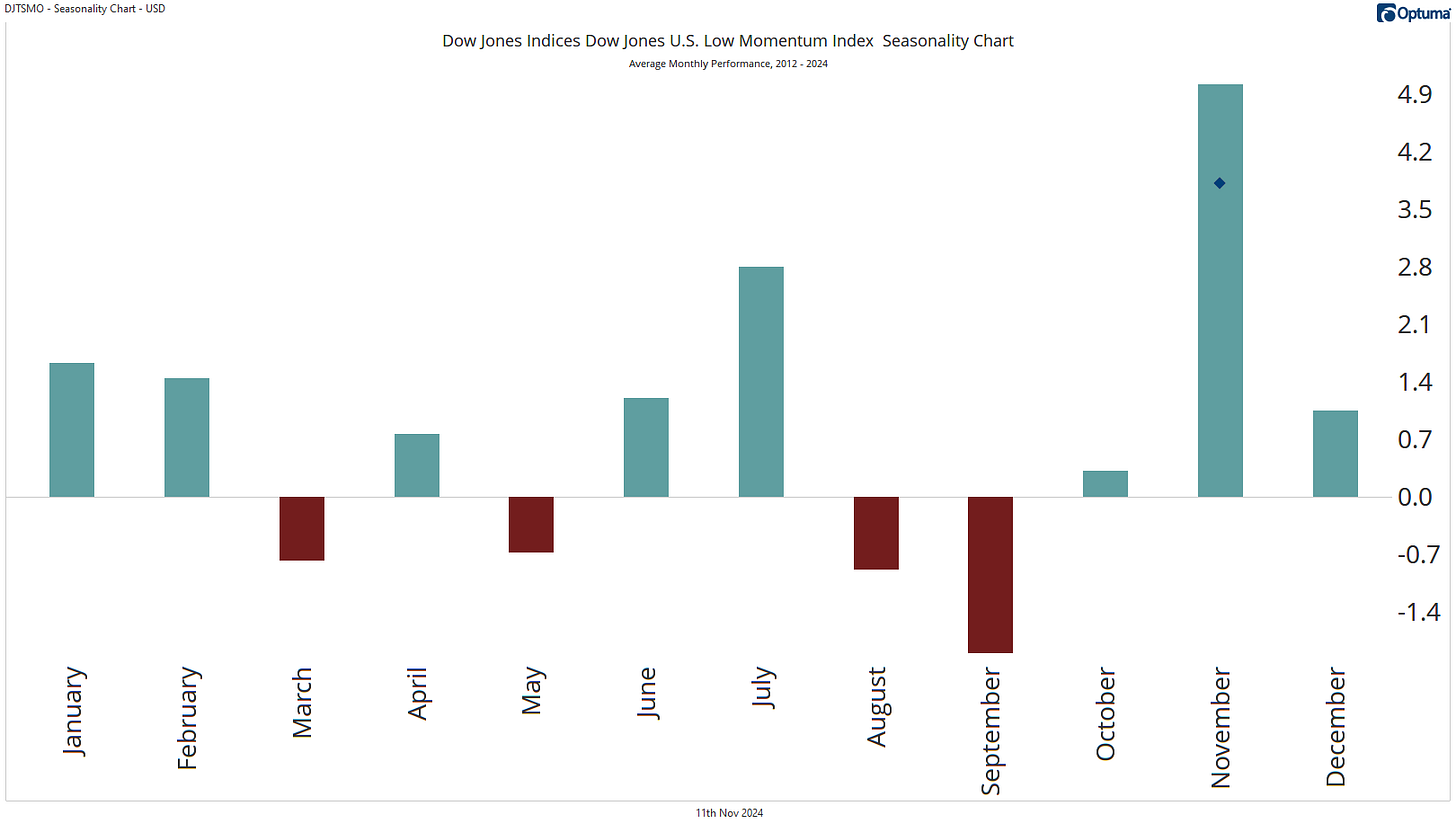

It is also the best month of the year for stocks with low momentum. 👇

This is at least in part due to weak seasonals in August and September and underperformers bouncing back from deeper corrections, but whatever the reason, it is supportive of continued momentum from areas that have lagged for most of the year but are just now breaking out.

Trade Ideas: ETFs

HACK: Amplify Cyber Security ETF

So this one is kind of cheating because we already own IGV (software) in the ETF models, but I’ve been pretty vocal about liking HACK as well. For investors that want to double-up, a stop could be placed at $67 where support has already been retested.

IBIT: iShares Bitcoin Trust ETF

It sure took a while but Bitcoin has decisively broken out from a range that held it captive for most of the year. When Bitcoin runs it really runs and now investors can take advantage in traditional brokerage accounts. $38 (just below the breakout point) is where I would place a stop on IBIT.

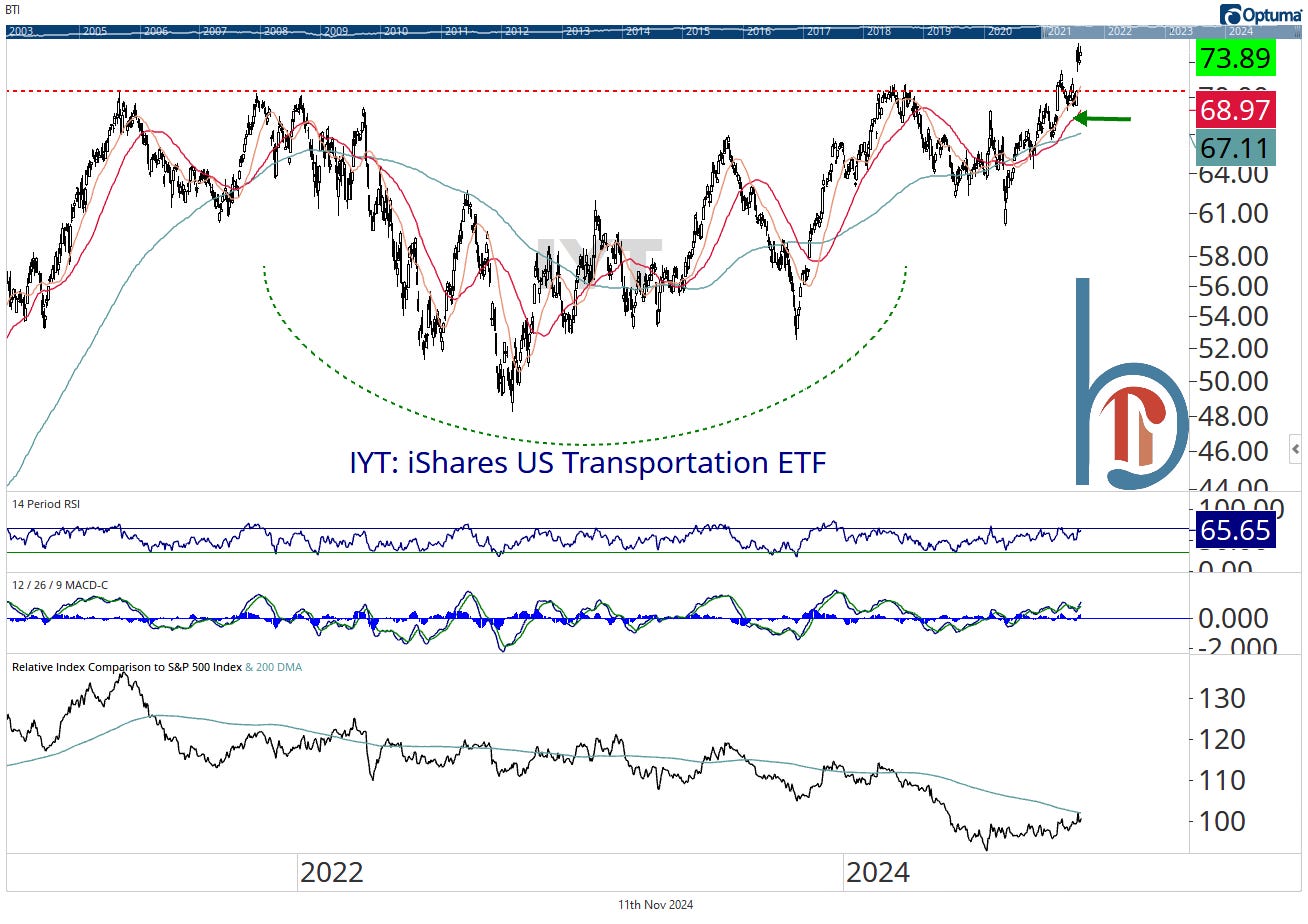

IYT: iShares U.S. Transportation ETF

Yep, we’re going back to the well here but the Transportation breakout I’ve highlighted in the last 2 MMPs is a big deal. With IYT trading just below $74, placing a stop at $68 risks just 8% of capital.

VXF: Vanguard Extended Market ETF

Remember, the momentum seasonality we looked at is about what has worked best over the trailing 6-12 months, not the past 2 weeks. The S&P 500 has been tops all year while the Dow, Russell and everything else sat on the sidelines. So why not invest in literally “everything else”? VXF holds all the U.S. listed stocks NOT in the S&P 500 and it just hit a new all-time high for the first time in 3 years. It has good short-term momentum but a longer term base that implies it could be a buy well into 2025.