Overtime

Commodities

Good morning,

Is gold topping? Will oil ever stop going down? Just how high (or low) could natural gas prices go?

There’s a lot going on in the world of commodities, and today I’m going to break it all down for you.

We’ll review the technical setup for:

Gold and gold miners

Other precious metals like silver and platinum

Industrial metals and miners

Energy commodities

and more!

Gold and gold miners

Tactical decision time for gold

My belief in mid-October was that gold was putting in at least an intermediate-term top, and we’ve never been higher than where we were on October 20. However, the yellow metal has been more resilient than I predicted (base case was a test of the 200-day) and we’re now coming to the apex of an important triangle. A close above $4230 is a bullish breakout that could retest the highs, but a break of $4100 sets up the late October lows ($3886/oz.) as next support.

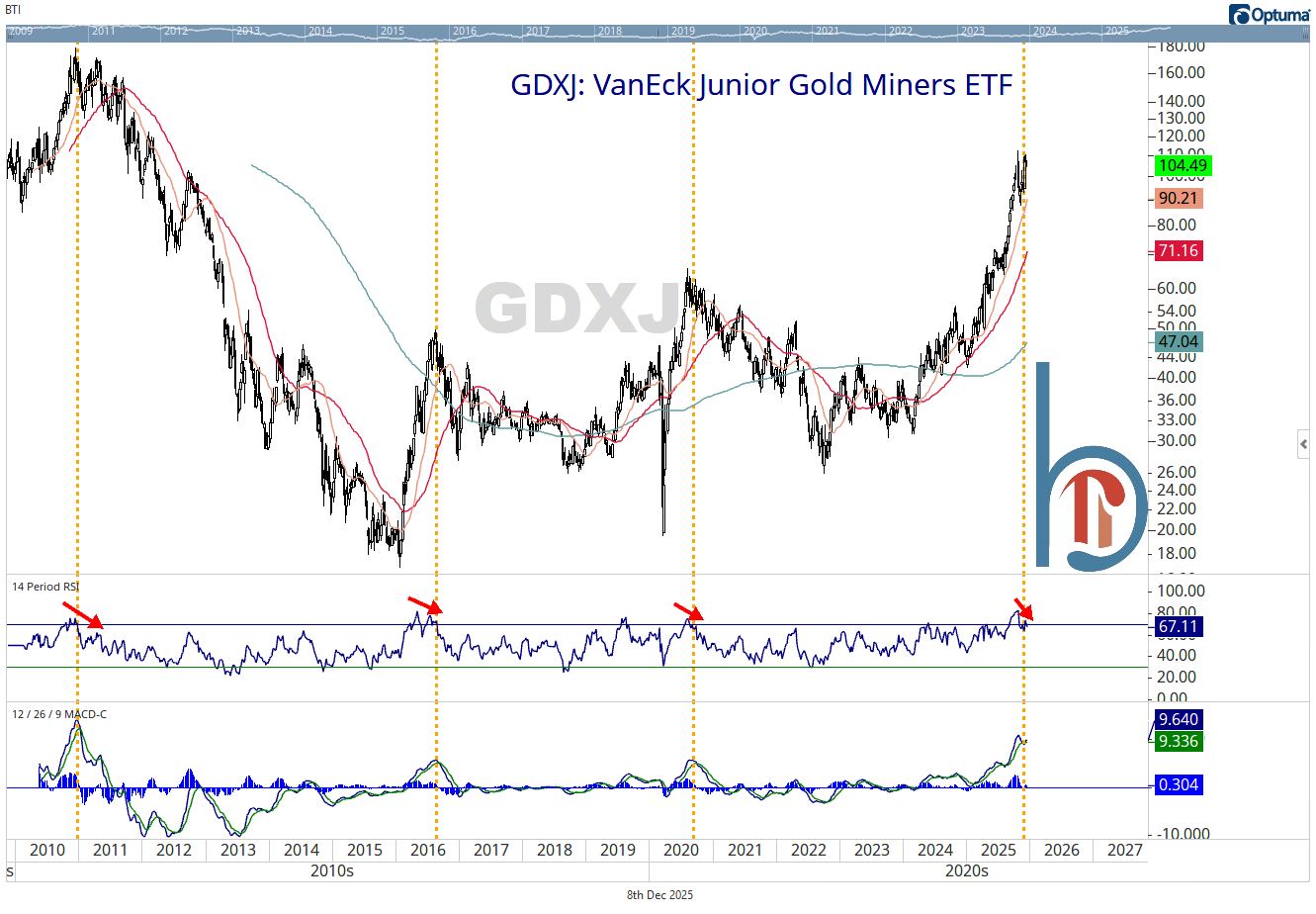

Gold miners on double-top watch

We look to gold miners to lead gold, but right now, the GDX chart is also in flux. GDX rolled over below its October highs last week, and fell 2.3% on Monday. A break of its uptrend line (close below $76) sets up risk to $68.20, and the potential for a larger double-top formation.