Overtime

Mailtime

Good morning,

This month’s mailbag was especially light, so I’ve supplemented today’s report with some additional noteworthy charts at the back end.

As always, I’ll have even more single stock charts in Thursday’s edition of Stock Trends.

But now, let’s see what chart requests your fellow readers had!

Chart Requests

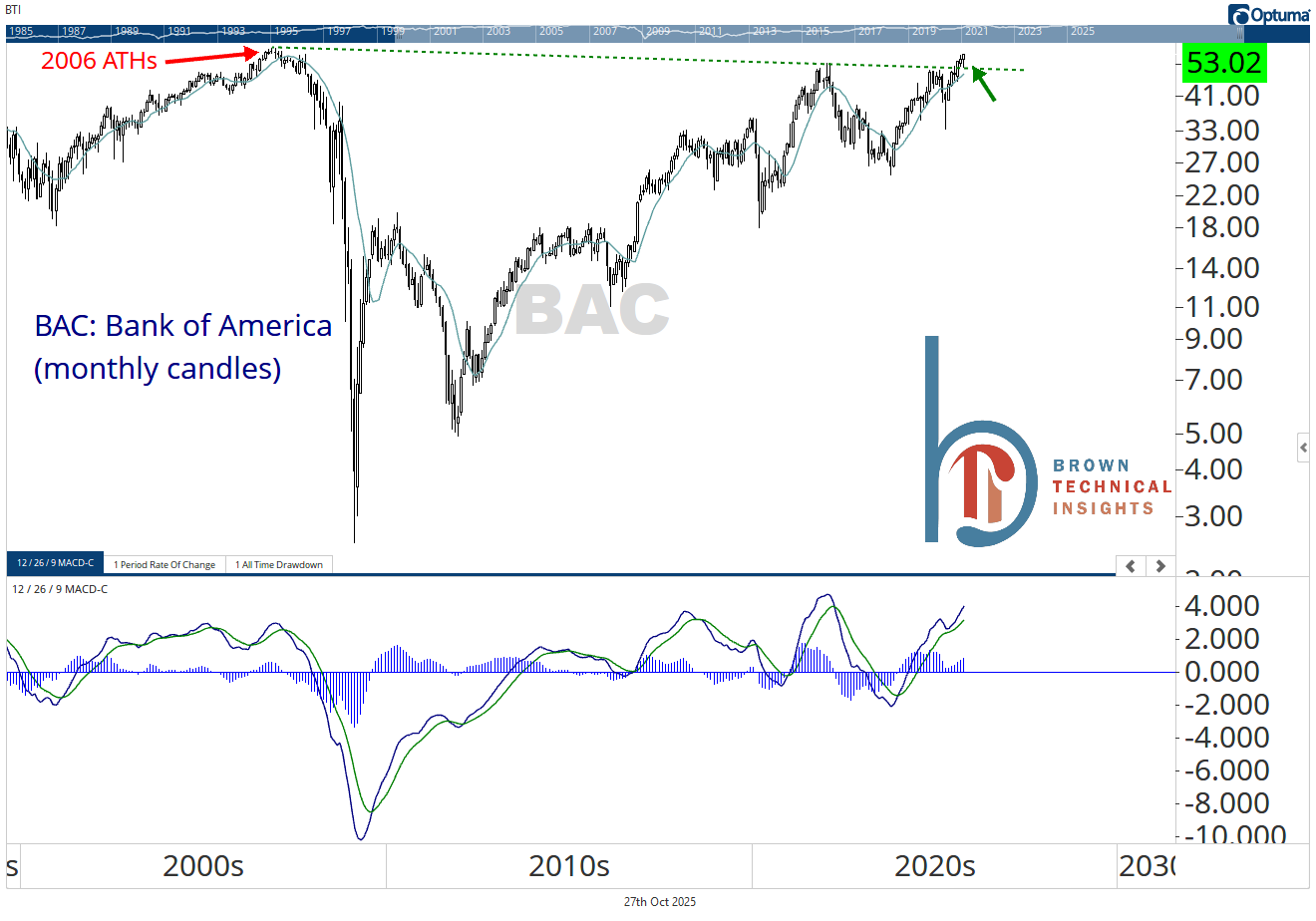

BAC: Bank of America

Bank of America broke out to a 52-week high yesterday, completing a nice little base-on-base pattern. The relative strength is pretty neutral, but in a vacuum, the stock is a tactical buy with 8% measured upside from the recent base. Perhaps more importantly, this month’s action has retested, and successfully held, a breakout that stretches back to the GFC highs 👇

DOCS: Doximity

DOCS tried and failed to break out yesterday, at one point up more than 6% but ultimately closing back below the downtrend line and both the 21 and 50-day moving averages. This doesn’t mean the stock is dead, but it’s not a tactical buy until that red line is taken out, and recent lows at $65.58 have to hold.

FN: Fabrinet

Fabrinet was a featured long idea from Overtime: Small Caps and is up 9% in the two months since. It remains a strong chart, right at all-time highs and pushing to the top of a two-week base. A close above $432 is a short-term breakout.