Overtime

Mailtime + thoughts on the DeepSeek sell-off

A technical analyst and a fundamental analyst are chatting about the markets in the kitchen.

One of them accidentally knocks a knife off the table and it lands right in the fundamental analyst’s foot.

The fundamental analyst yells at the technician and asks him why he didn’t catch the falling knife.

“You know technicians don’t catch falling knives!”, the technician responded. “Why didn’t you move your foot out of the way?”

The fundamental analyst responds, “ I didn’t think it could go that low”.

Good morning,

Obviously, most of the questions I received for today’s report were related to DeepSeek and yesterday’s sharp sell-off in some of the market.

Rather than try and answer each one individually, today’s report will look more like a traditional Overtime report with a dedicated focus.

I’ll break down:

What happened yesterday

My 3 most important thoughts and future investment implications

But before we do that. Let me remind you.

I am a technician.

I don’t know how many phones Apple sold last quarter, how many boots Boot Barn has in inventory, or how many subscribers Spotify has.

And I don’t care.

I am not going to sit here and pretend I’m an expert on quantum computing chips, large language models, or the future of energy demand in the US.

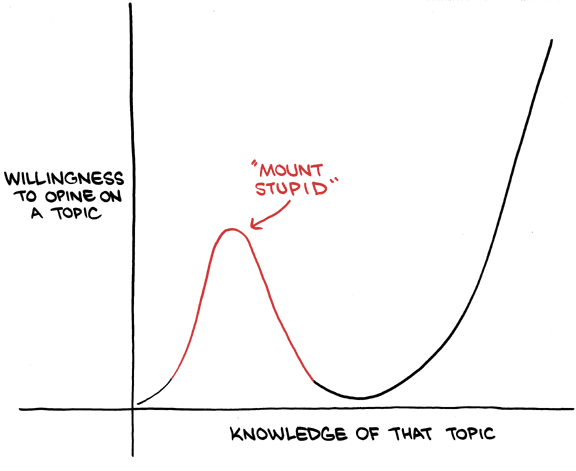

If anyone is familiar with the Dunning-Kruger Effect, I can assure you that every DeepSeek take you’ve seen in the past 72 hours on Twitter, LinkedIn, CNBC, or elsewhere is speaking to you directly from the peak of “Mount Stupid”.

There’s nothing more embarrassing than somebody who couldn’t connect their phone to a Bluetooth speaker pretending that they understand this stuff, much less the investment implications.

Only price pays.

That’s what we’ll be focused on.

But wait, I do want to know something about the fundamentals!

Okay fine. Here are a few links:

Basic, easy to read, Bloomberg article.

Complex, in-depth FAQ from someone who knows what they’re talking about.

What happened

Tech sector’s bearish reversal confirmed

Yesterday’s Monday Morning Playbook called out Friday’s bearish engulfing candle for XLK, and that was no doubt confirmed by Monday’s 4.9% decline. XLK did see a bounce off its January lows ($224.45) and the zone between there and the 200-DMA ($222.51) now becomes critical support.

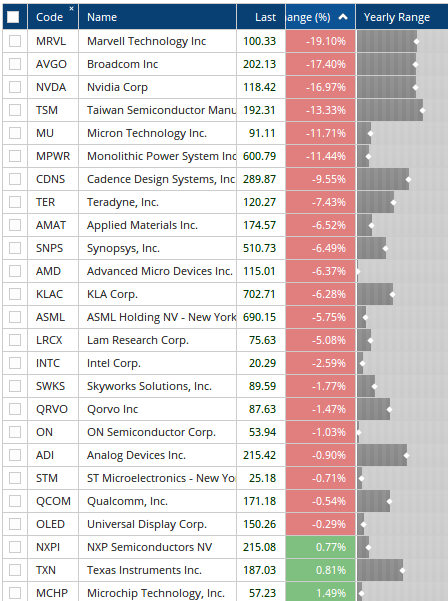

Semiconductors (SMH) falls 9.8%, worst day since March 2020

Of all the focused ETFs I track, only nuclear/uranium stocks were worse than semiconductors which suffered their worst day since the Covid crash. SMH went from breaking out and showing some relative improvement to below its 200-DMA and 52-week relative lows. After losing the 200-DMA (held 4-5 tests over the past year) SMH has to hold $235. A break of this level would suggest a risk to $200.