Overtime

ETF Flows

Good morning,

Markets got crushed yesterday, once again failing to deliver confirmation of a Friday reversal pattern or any sign of investor demand for stocks.

Under the surface, breadth wasn’t as bad as the headline index declines but at this stage of the market correction that may be more of a negative than a positive. At least if everything was falling it would get us closer to a total washout.

We’ll continue to follow our correction checklist but ultimately, bottoms are formed on sentiment. That makes today’s look at ETF flows especially timely.

Just like our previous reports, I’ll highlight ETFs that fall into one of 3 categories:

Overly aggressive. These ETFs have seen extreme inflows. For an uptrend, I don’t believe that alone is a reason to sell but it’s a yellow flag and could indicate more downside vulnerability in a correction.

Contrarian positive. These ETFs have seen significant outflows recently and extreme readings could indicate selling is unlikely to continue to the same degree. Potential tailwind if a downtrend can stabilize and a bullish indicator for uptrends or ETFs breaking out.

Apathetic. Flows here aren’t extreme in either direction but that means there could be room to run for the underlying trend.

Let’s get into it!

Overly aggressive

Communication services

Despite the growth-led selloff, XLC is making 52-week relative highs. But inflows are extreme and just starting to correct with price.

Banks

Investors nailed the top in banks. 3-month inflows in KBWB hit their highest level ever on February 7 and the ETF is down 15% since. We’re seeing the reading start to come in but sentiment is still too aggressive.

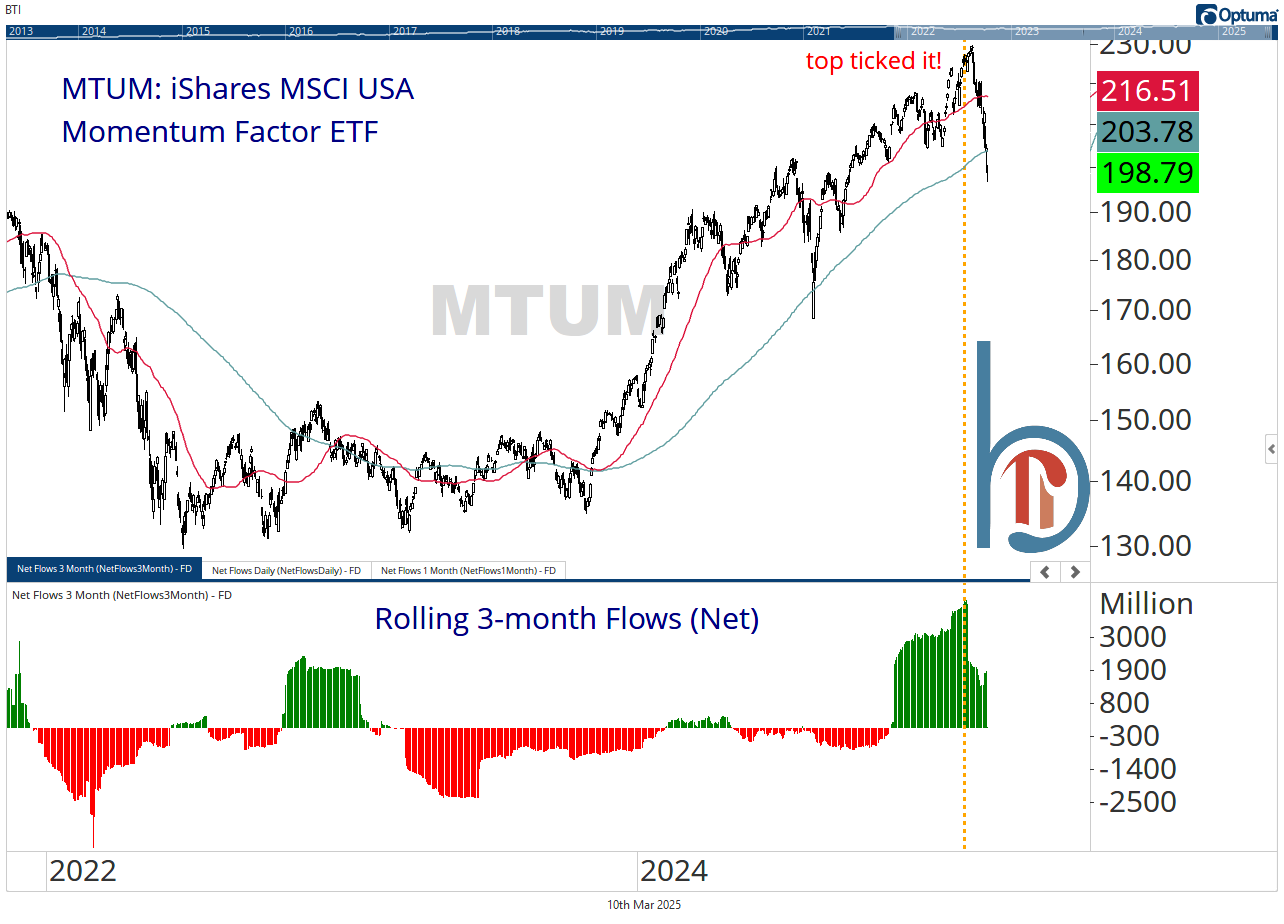

Momentum

Investors nailed the top in the momentum factor too. MTUM’s rolling 3-month inflows were setting records coming into this year and gained ground until February 11. The trade peaked a week later and MTUM is down more than 14%. We’ll likely need to see this turn negative before the bottom is in.