Overtime

The State of the Markets

Good morning,

The temperature is cool and brisk, snow is beginning to fall and Christmas decorations are lighting up neighborhoods.

That can mean only one thing:

It’s outlook season.

The embarrassing time of the year where every sell-side shop, broker-dealer, and research team lazily trots out a 20 page PDF all to tell you the same thing they did last year: We expect mid-single digit returns for stocks next year.

Mid-single digit. On the histogram of annual returns it is basically the one bucket the markets never give you, but hey, it’s “average”.

Brown Technical Insights won’t be participating in this charade and I’m not going to tell you what I think will happen over the next 12 months (or worse yet what “should” happen) but I do want to give you something I think is far more valuable:

What IS happening.

I’m calling this week’s Overtime, State of the Markets and it will be heavy on charts, short on words and provide a big picture look at what “is” happening in all major asset classes and sectors as we head into the final two weeks of 2024.

Enjoy!

Major US Indexes

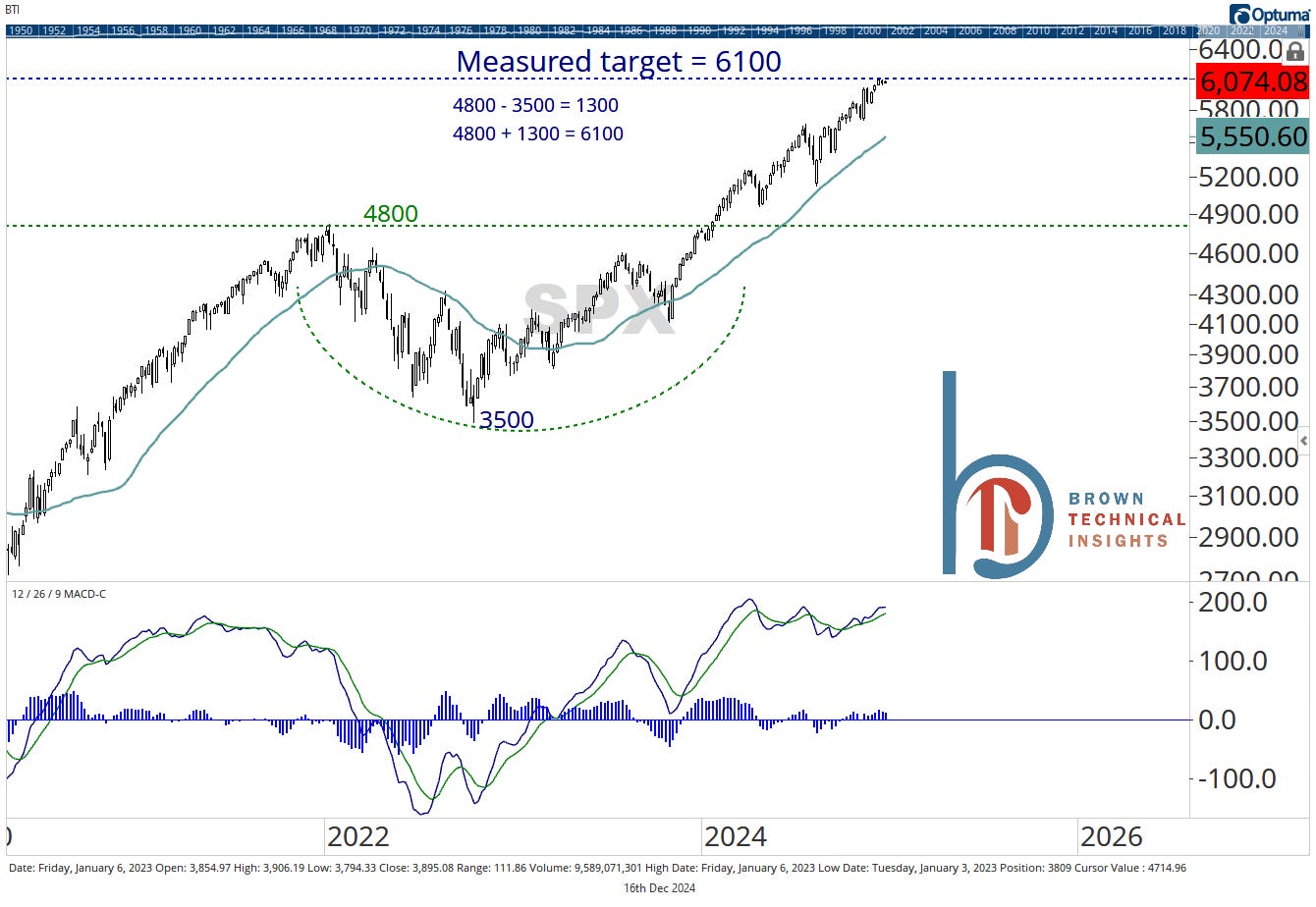

S&P 500 tracking to its second consecutive +20% yearly gain

This hasn’t happened since the late 1990s when we went 4 in a row. It should be noted that the index has now hit a significant level, the measured target off its bear market base.

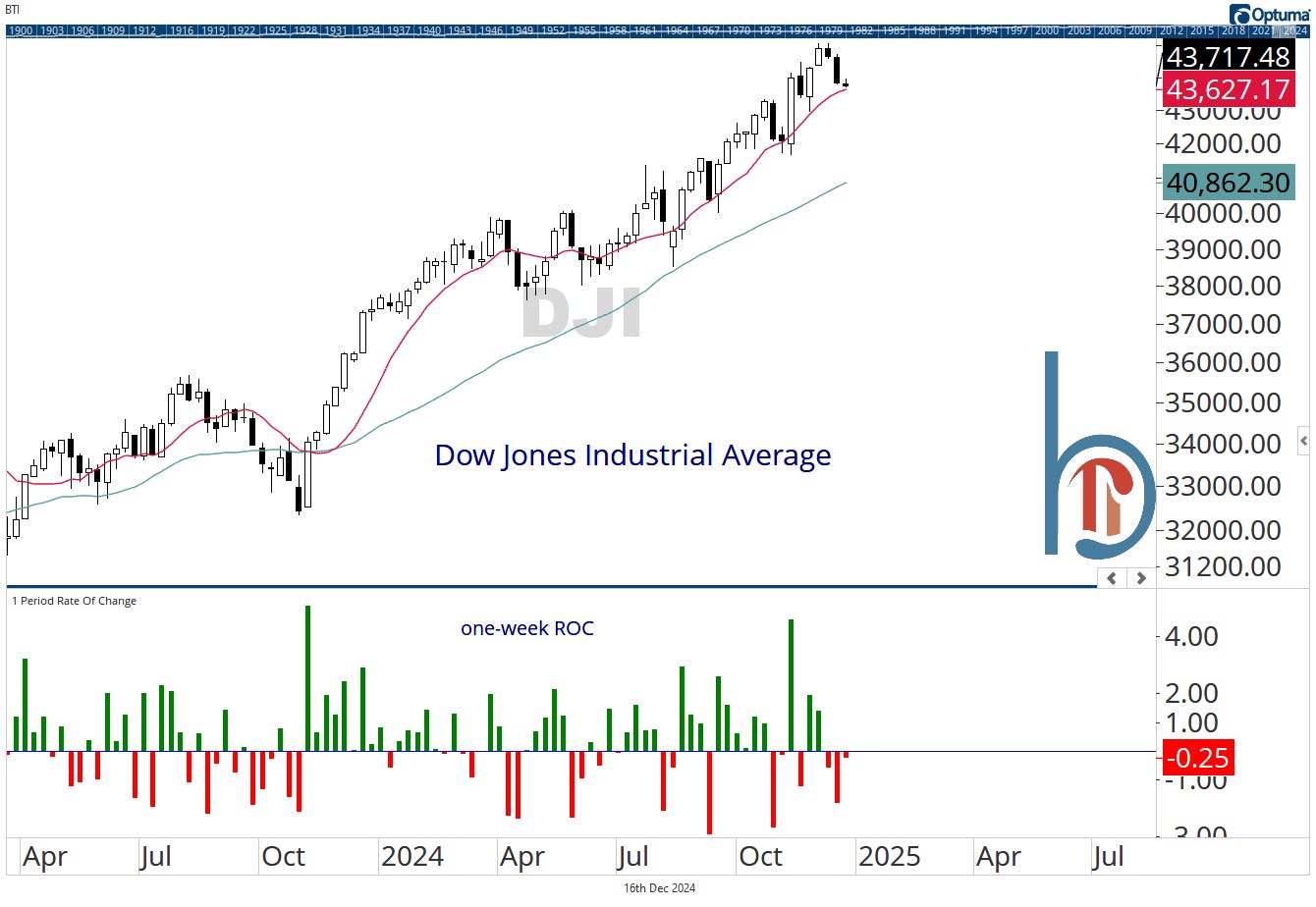

The Dow isn’t leading but it’s been nearly straight up since last October

+15% YTD.

After a summer slumber, the Nasdaq 100 is back in the driver’s seat

QQQ has soared on the back of the Mag 7 in December. Sitting at new all-time highs and multi-month relative highs vs. the S&P 500.

Will small-caps ever do the damn thing?

The Russell 2000 is down 2 weeks in a row since hitting a new all-time high in late November. Fun fact, it only did so on an intraday basis, so the ETF still hasn’t made a new “closing” high since November 8, 2021.

US Equity Sectors

*Ordered by proximity to 52-week highs

Consumer Discretionary has broken out of a 3-year base

And its two biggest components (AMZN and TSLA) just hit new all-time highs after being dead money for years.