Overtime

Sector Review

Good morning,

This week we’re doing a sector review and covering the 11 S&P 500 sectors from an absolute and relative perspective.

I want to keep the big picture in mind amid the recent volatility, so we’re looking at weekly candles as of this weekend (rumor has it that peeking at unfinished candles can cause you to go blind).

We’ll also cover year-to-date performance, seasonality, and short-term breadth.

YTD Returns and Seasonality

Communication services is in the lead (for ETFs that is)

Of the 11 SPDR ETFs, communication services holds the top spot with a more than 16% return year to date. Real estate is the only sector negative, though consumer discretionary is hanging in the green by a thread.

Seasonal Tendencies by Sector

After last week’s outperformance, I find it notable that healthcare has historically been the best-performing sector in June (+0.7%). Materials, energy, and financials are all entering weak stretches over the next few months, something that lines up with a strong seasonal time for bonds (lower rates).

Sector Review

Communications: 16/22 stocks above 20-DMA

Communications has been a consistent leader and the sector made a new 52-week closing high last week. The previous highs are a logical place for some consolidation but there is little reason to think XLC won’t break through.

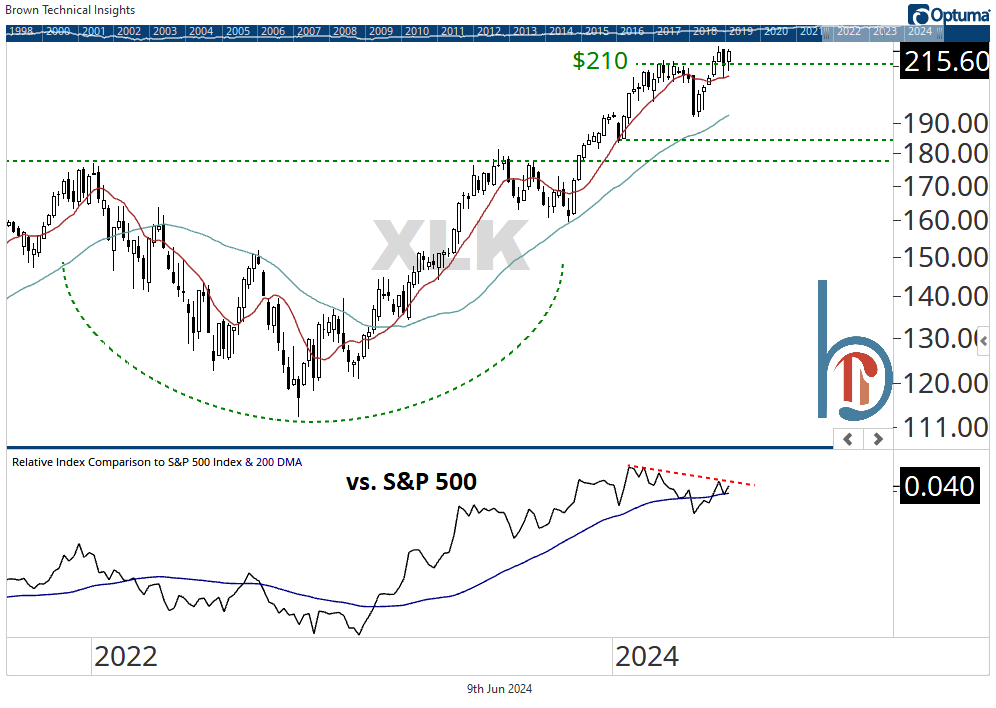

Technology: 36/77 stocks above 20-DMA

Technology is holding up above its March highs and remains in a strong uptrend. Relative leadership for this ETF peaked in January, however for the true S&P 500 sector, tech is making fresh relative highs.

*Check out last week’s edition of The Trade Report for more info on why this is.