Overtime

Monday midday check-in

Happy St. Patrick’s Day!

This week, we’re doing things a little different.

I’m sending our normal Tuesday report today to update you in real-time about follow-through, intraday breadth, and the status of this week’s level to watch.

We’re also going to do a weekly candlestick review for all 11 sectors and key international markets and rank them by how well they’ve held up during the current correction.

Let’s get into it!

Major indexes

This week’s level to watch: 5642 on the S&P 500

It’s early but as of 11:15 am ET, the S&P 500 has broken out above this week’s level to watch, 5642. This makes the first higher high for the index on the intraday chart since the correction began and also its highest overbought reading, a bullish sign. Next steps, holding 5642, and ideally hitting its short-term measured target which is 5780.

Midday breadth check

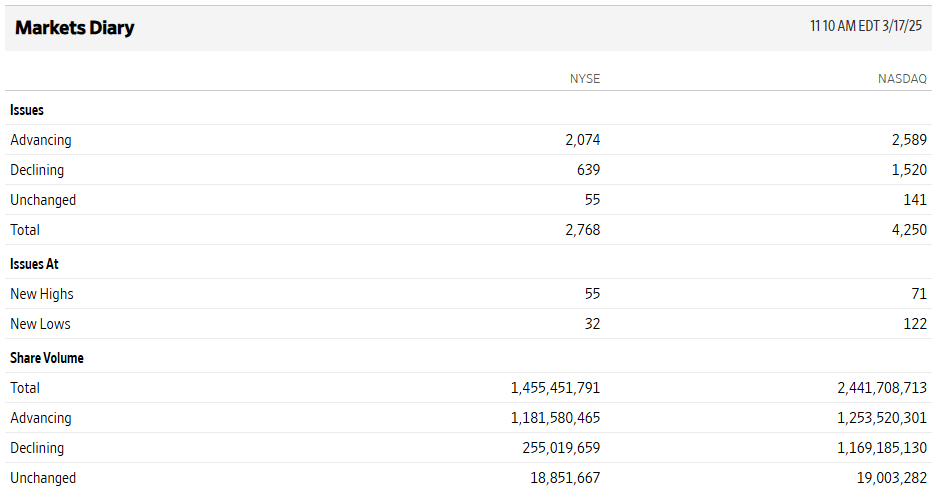

Two hours into trading, advancing stocks outnumber declining stocks by 3:1 on the NYSE but less than 2:1 on the Nasdaq. Small caps (+0.9%) are leading while the Nasdaq (-0.2%) is slightly lower, highlighting the disparity in breadth improvement noted in today’s Playbook.

Overall, today’s start is a modest positive but suggests we’ll need to see the reaction to the Fed on Wednesday before we have an idea of weekly confirmation or the possibility of additional daily breadth thrusts.

Sectors and international markets

*Drawdowns are from 52-week highs and as of this weekend

EAFE: -2.0% from 52-week high

Foreign developed markets are higher to start this week and knocking on the door of a breakout from a 6-month consolidation. $84.56 is the magic level for EFA.

China: -4.6% from 52-week high

China is leading this morning, up more than 1.2%. We’re back through the breakout range and the only thing left to call resistance is the October highpoint of $59.79. I think it gets there and like it long.