Overtime

Sector Trends

Good morning,

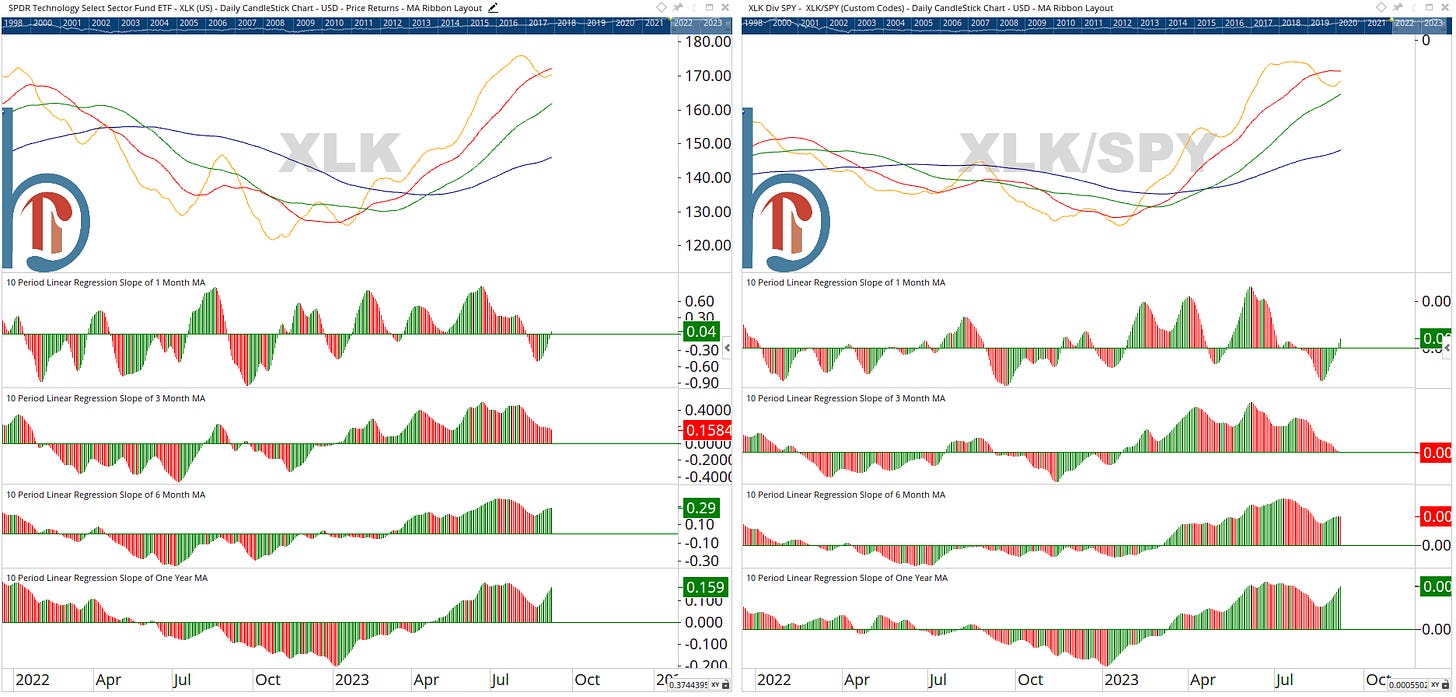

This week we’re doing a sector review with a focus on a new systematic scoring system. You’ve seen me break out these moving average charts that show the slope of the 1, 3, 6, and 12-month moving averages, and now I’m applying a simple scoring method to it to help quantify where the trends for the 11 S&P 500 sectors are.

The system is simple: For each sector, one point is awarded for each of those moving averages with a positive slope. We’ll look at the absolute and relative charts for each and total them up for a potential high score of 8. A sector with all four moving averages in decline in absolute and relative terms would, in theory, score 0.

Below those sectors are ranked, and I’ll provide some additional thoughts throughout.

Technology: 7

Tech is our leader, with only the 3-month slope of the XLK:SPY ratio currently negative. After a brief correction, the one-month slope is back to positive in absolute and relative terms and long-term trends remain bullish.