Overtime

Charts from the Twitter-verse

Good morning,

This week, we’re changing things up and bringing you some charts from outside sources, specifically Twitter.

Twitter (I guess it’s “X” now?) is one of my favorite resources and frankly, I think should be used by everybody who does active investment management. There are just so many great minds posting great charts throughout the day, and all completely for free.

So today I’m compiling some of the best charts (technical and fundamental) that I’ve seen over the past week.

As always, credit is given and all of these accounts are worth a follow.*

Let’s get into it!

*Thanks to some insanely stupid moves from Sir Elon, I can’t embed the tweets in Substack. So what you see are screenshots and the links are provided below if you want to be taken to Twitter or give the account a follow.

Stocks

The S&P 500 is testing support from its Ichimoku cloud (link)

Lower stocks and a lower VIX can be a bullish signal (link)

Another reason to think a down April could dull near-term returns (link)

2 months to recover current losses? (link)

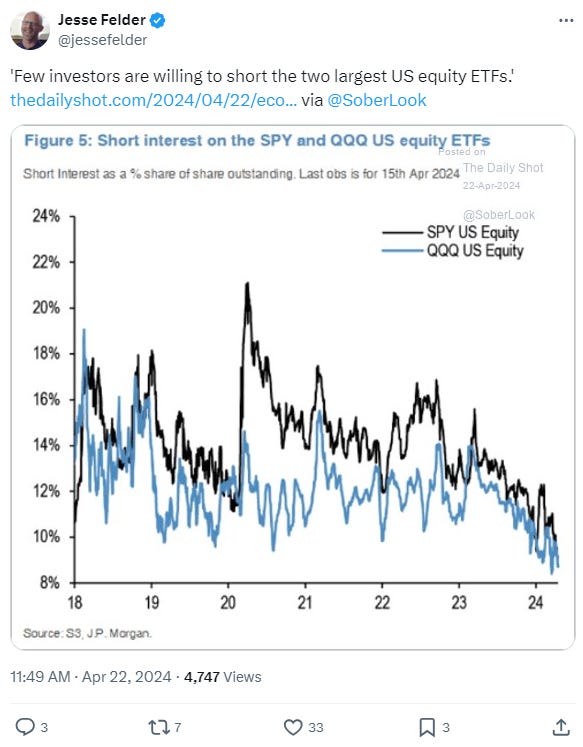

Nobody wants to short QQQ or SPY (link)

Bulls don’t want to see staples leading (link)

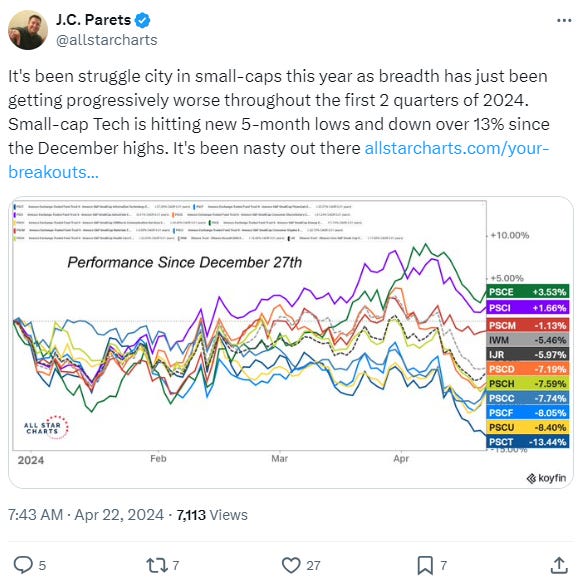

Small caps have been struggling all year (link)

Nvidia fell right to its YTD VWAP or volume-weighted average price (link)

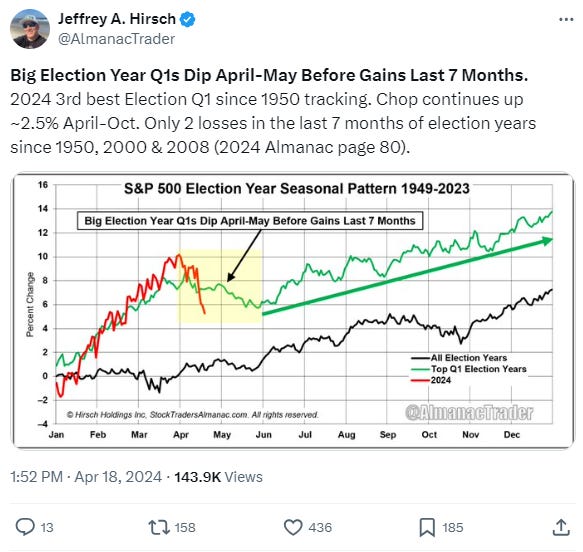

After a strong Q1 in an election year, markets tend to pause right now (link)

Most stocks were higher last Friday (link)

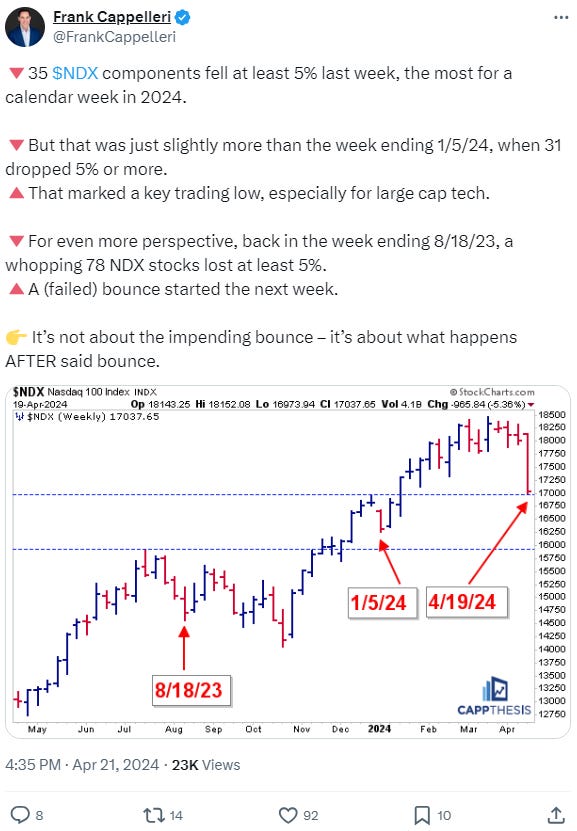

Rough last week for large-cap growth stocks (link)

People can’t get out of Tesla fast enough (link)

Bonds

Bond ETF yields are in a new era (link)

Especially compared to the dividend yield from stocks (link)

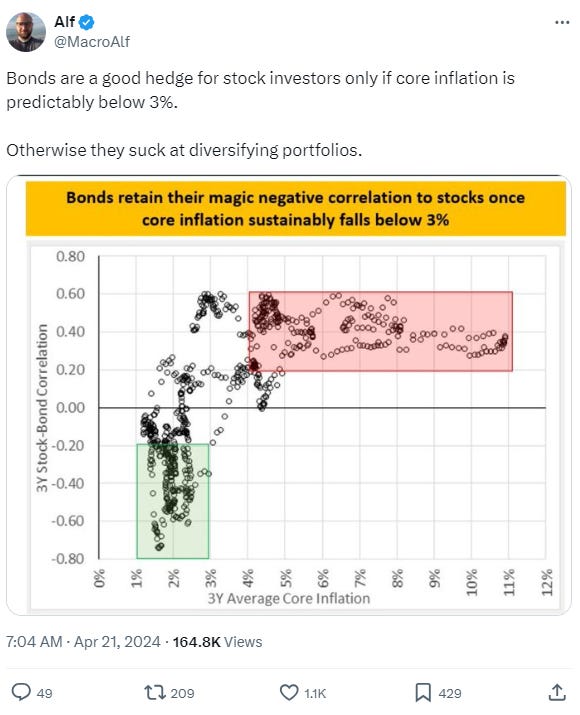

Bonds aren’t a hedge when inflation is above 3% (link)

Are real yields to blame for recent equity weakness? (link)

Other

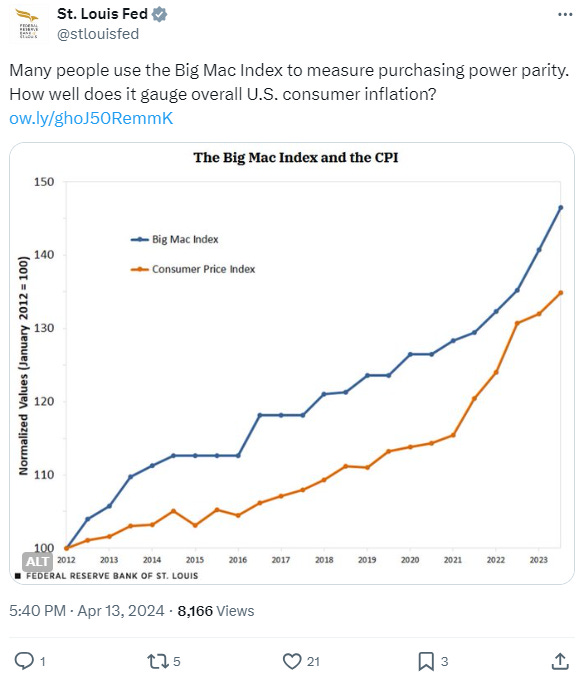

Big Mac prices are increasing faster than CPI (link)

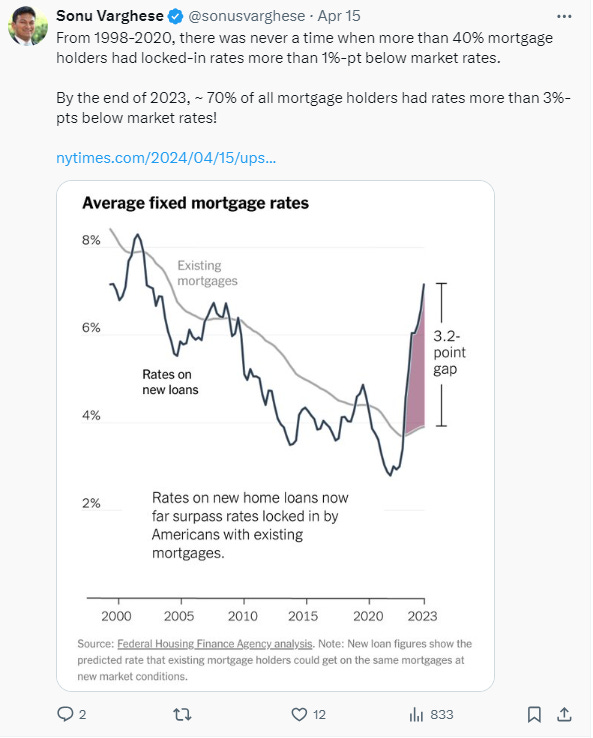

No wonder nobody is selling their house (link)

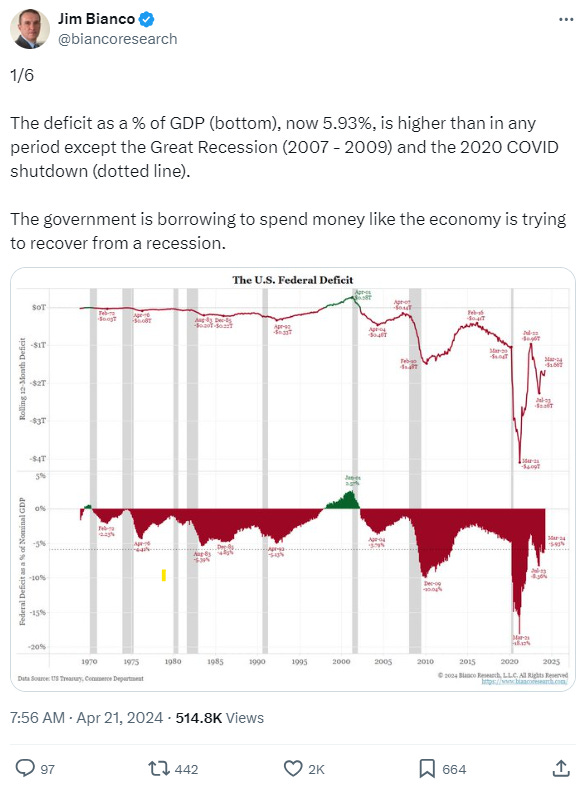

The deficit is out of control (link)

Rocks vs. Paper (link)

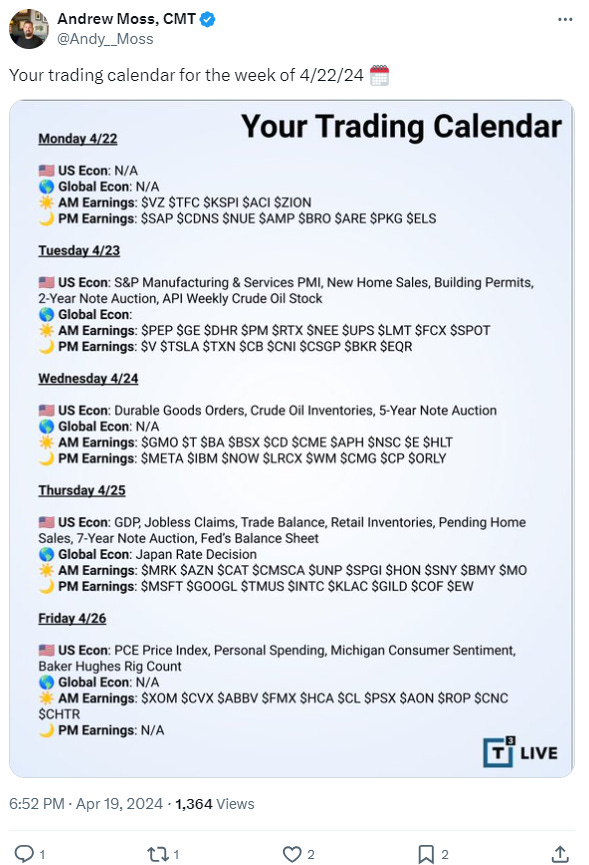

This week’s trading calendar from Andy Moss (link)

This seems problematic (link)

I hope you all enjoyed seeing some different perspectives! I’ll be back with mine on Thursday morning with Stock Trends.

Scott

Scott Brown, CMT

Founder, Brown Technical Insights

Essential insights into market trends, technicals, and opportunities