Overtime

Breadth check

Good morning,

This week, we’re checking in on market breadth.

Yesterday’s Playbook explored continued bullish price action from major indexes and risk ratios, but breadth is another key reason why we want to continue to lean into equities.

Today’s report will break down key breadth statistics, highlighting the good, the messy, and a few risks to watch.

Let’s get into it!

The good

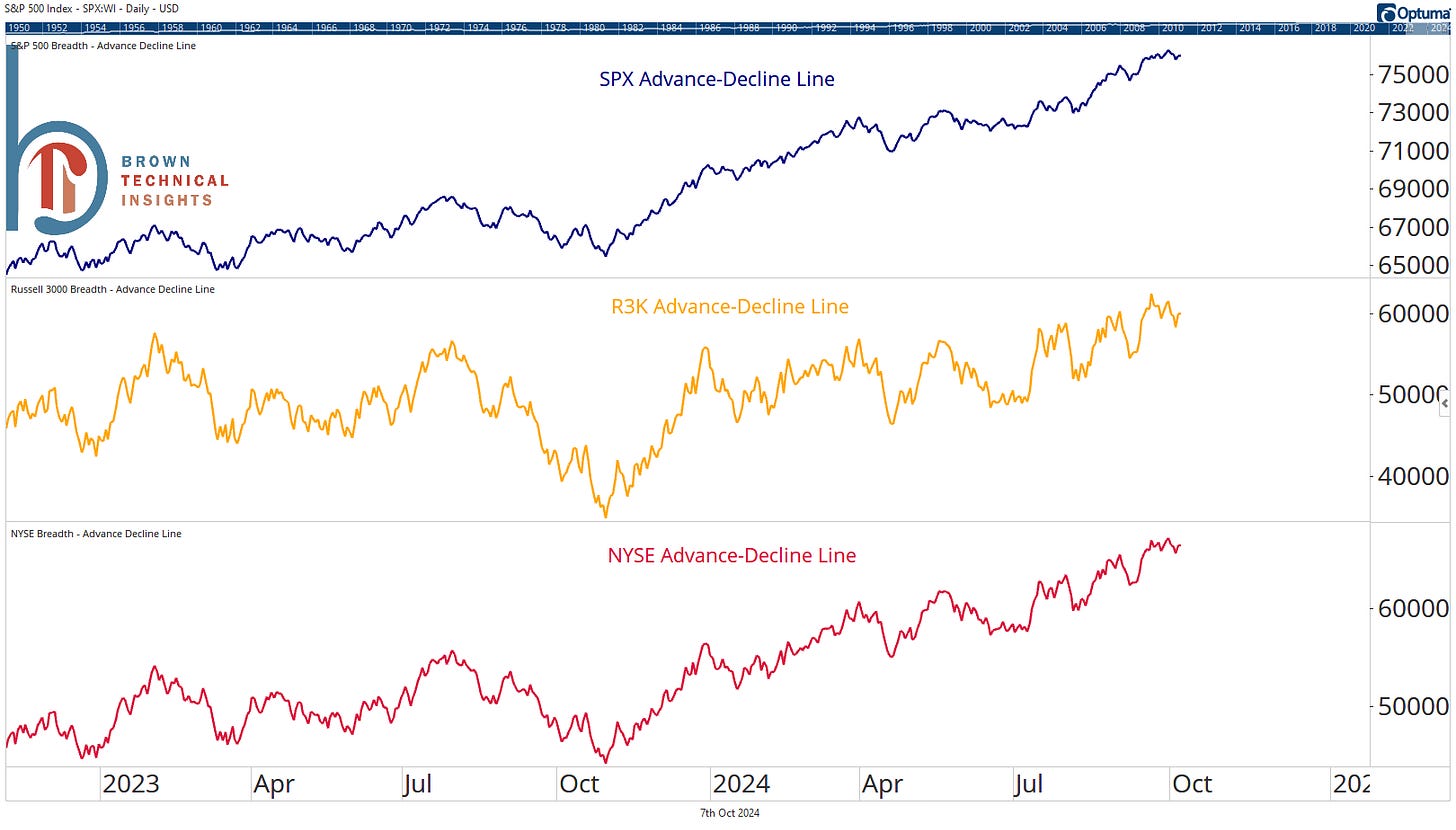

Advance-decline lines continue to trend higher

One of the simplest measures of breadth, the cumulative advance-decline line, continues to trend higher for major indexes, whether that’s the S&P 500, Russell 3000, or NYSE Composite (common stocks only). This is important because these metrics often peak well before major declines in the indexes, suggesting a bear market likely isn’t on the horizon.

Intermediate-term breadth remains healthy for the S&P 500

Another positive is that intermediate to long-term trend breadth remains bullish. Roughly 3 in 4 S&P 500 stocks are above their 50 and 200-day moving averages, and we’re just a week removed from multi-month highs in both readings.

New lows are non-existent

We’ll talk about new highs in a second, but new lows are nonexistent for S&P 500 stocks. Ahead of any major top, there are often many stocks or groups of stocks already breaking down and we simply don’t have that right now.

The messy

Keep reading with a 7-day free trial

Subscribe to Brown Technical Insights to keep reading this post and get 7 days of free access to the full post archives.