Overtime

Rates and the Fed

Good morning,

This week’s Overtime is telling you everything you need to know about interest rates and the Fed, ahead of next week’s Fed meeting.

While growth and tech stocks have been working for a while, “everything else” broke out last week and it isn’t a coincidence that bond yields were breaking down simultaneously. You’ve likely heard that the Fed is done, but it wouldn’t be the first time in 2023 that has been said.

So, is this time for real?

Let’s take rates and the Fed into Overtime and explore:

Technicals for short and long-term Treasury yields

Fed fund futures current outlook for the Fed

What has historically happened after the final hike of a cycle

and more!

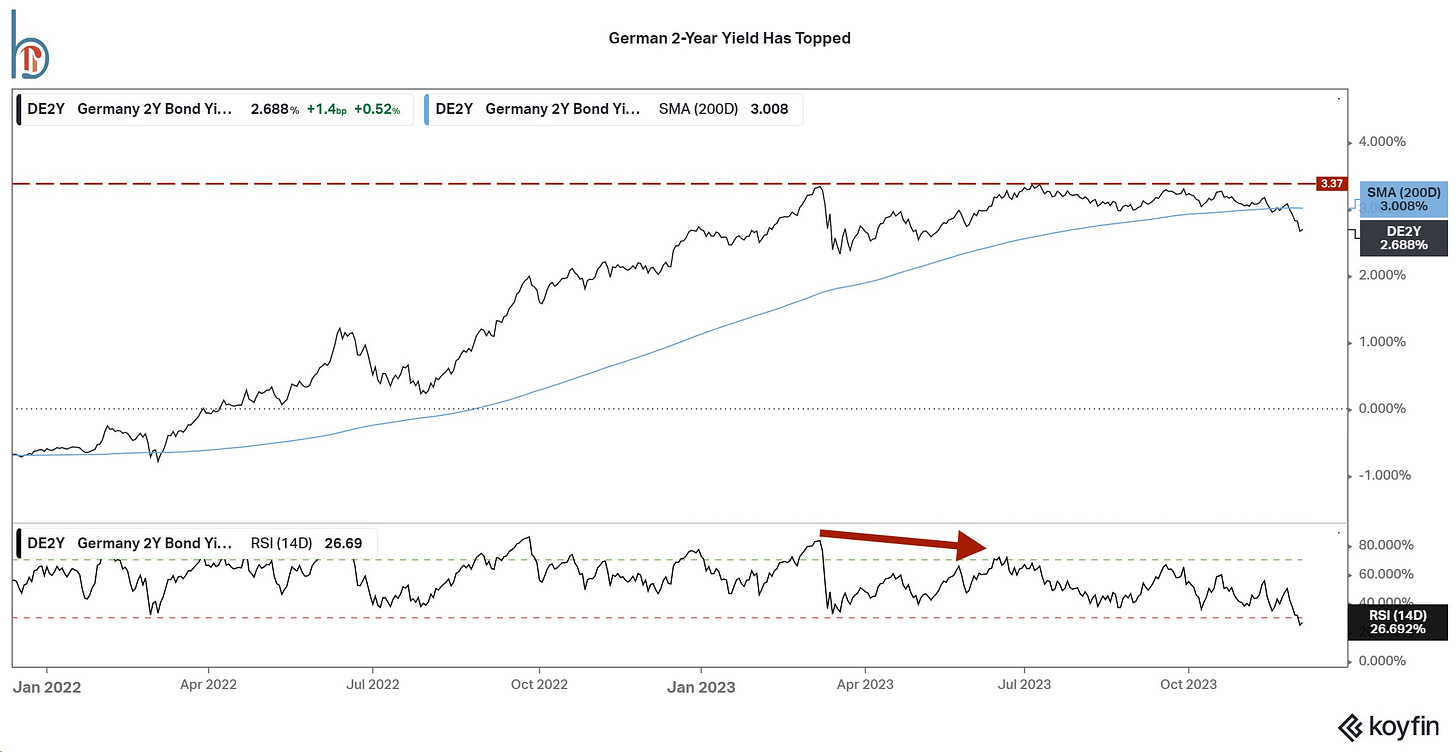

The short end says the Fed is done

2s look to have topped

After briefly breaking above 5%, the US 2-year Treasury yield has fallen more than 60 basis points in the past six weeks and looks to have decisively topped. Moving averages are rolling over, all support levels going back to June have broken and the yield is now oversold for the first time since the rally began.

Fed fund futures pricing in 5 cuts next year

Why have 2s topped? Because not only are bond investors pricing in that the Fed is done hiking rates, but they are aggressively pricing in a cutting cycle beginning next year. CME Group’s FedWatch Tool shows a 56% chance that cuts begin as early as March and the potential for 5 in total in 2024.