Overtime

Commodities

Good morning,

Gold hit a 3-month high last week, while oil prices remain volatile following the attacks on Israel and elevated tensions in the Middle East.

So after a big focus on stocks and interest rates in yesterday’s Playbook, we’re taking commodities into Overtime to make sure you are up to date on the forgotten asset class.

This week we’ll cover the technicals for

Gold and precious metals

Copper

Energy commodities

and more!

Precious metals

3-month high for gold

Gold has now suffered two sharp reversals at $2000 over the past two trading days, making it very tough to be tactically long if we’re below that level. Intermediate-term trends remain challenging, but the yellow metal has broken out of a small base vs. the S&P 500.

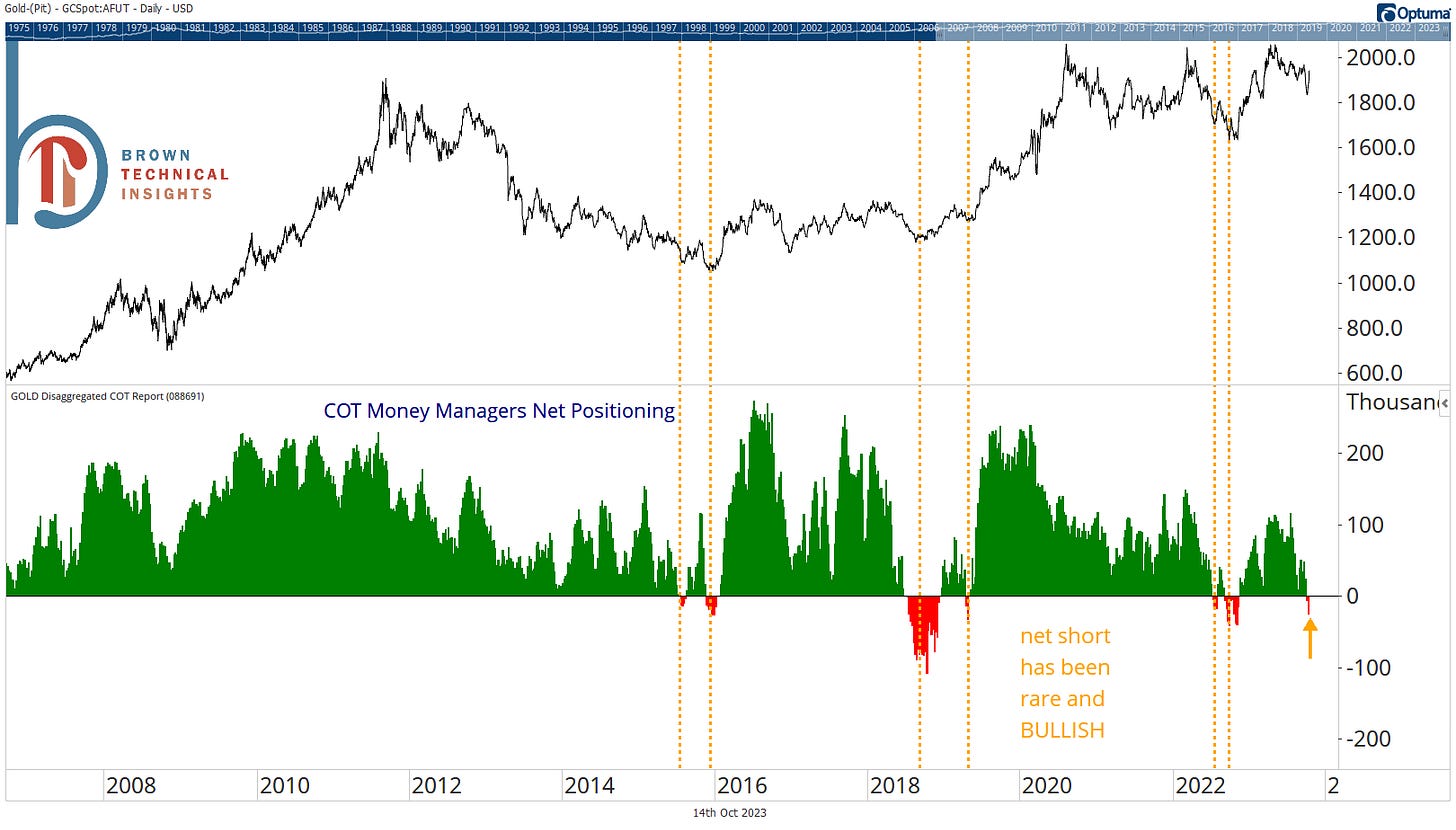

Speculators net short gold has been very bullish recently

COT money managers’ positioning moved back to net long (barely) last week but the message remains the same. Despite some subtle momentum over the past week, sentiment towards gold remains apathetic at best, a positive from a contrarian standpoint.

Long-term base remains enticing

This is the chart that has technicians drooling. Gold looks to be a huge base two and a half years in the making and the measured target on a breakout would be about $2400/oz. The key word I would use here is optionality. Tactically, the case for gold is still challenging, as are the intermediate-term trends. But if you’re okay with waiting or potentially underperforming, I don’t hate the idea of a slice of the portfolio sitting in gold to be there when (if) this eventually breaks out.