Overtime

The Bear Case

Good morning,

This week, we’re making the bear case for equities.

To be clear, Brown Technical Insights has been bullish and overweight stocks over bonds in the Balanced portfolio and fully allocated to stocks in our Ultra-Growth portfolio all year and portfolios remain that way right now.

However, I think there are legitimate reasons to be more cautious as we turn the corner into 2025 and I wanted to use today’s report to outline the most concerning things I’m seeing.

Let’s get into it!

Animal spirits and aggressive sentiment

I love Walter Deemer’s quote, “If you need an indicator to tell you sentiment is extreme, it isn’t”. That said, here are 5 examples of animal spirits that suggest overly optimistic sentiment could be a headwind to equities in 2025.

Crypto mania

Take your pick, from Bitcoin to Alt-coins to the Hawk Tuah and Enron tokens, the internet speculation and mania that embodied the 2020-2021 bubble is definitely back in some form or fashion. We can’t sell stocks just because idiots are making money (or losing it all) but we want to be aware of the speculative froth.

Bubble-like action in a multitude of stocks

It’s not just digital coins, plenty of large stocks are exhibiting bubble-like behavior. Palantir, Microstrategy, AppLovin, and Reddit are just a few examples of very real companies (all greater than $30B market cap) that are more than 100% above their 200-DMA and have more than doubled in the past 3 months.

*3 of these 4 lost more than 5% yesterday, with AppLovin (-14.7%) the biggest loser.

Highest ever reading for consumer confidence in future stock prices (h/t @Bespokeinvest)

Despite stocks rising over the next year 75% of the time, it is rare for more than 50% of consumers to expect higher stock prices over the next year. Main Street appears to have noticed the big gains on Wall Street in the past few years. More on that later.

Aggressive ETF inflows

Investors don’t just think stock prices are going higher, they’re putting their money where their mouth is. Inflows into the equal-weight S&P 500 ETF (RSP) have reached the highest level in 18 months, while investors have poured money into software stocks. Both of these were completely ignored by investors as they were breaking out (RSP highlighted in our July flows report and IGV when I was pounding the table in early November) but now flows suggest risk is more skewed to the downside.

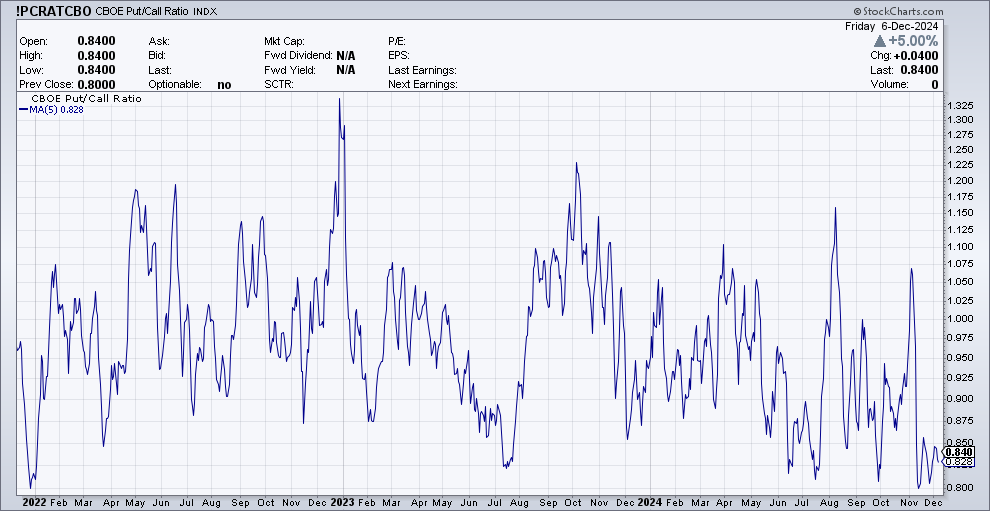

Put/calls near the lowest level in years

Finally, for a hard data example: Put/call ratios. Put/calls measure how much interest investors have in protection (puts) relative to upside (calls). The 5-DMA of the CBOE put/call ratio is hovering just above 0.8, one of the lowest levels of the past few years.

2 years makes a believer out of everybody

Back-to-back +20% return years are rare

The S&P 500 is currently up 27% YTD, on track for back-to-back annual gains of more than 20%. Above are the only two times since 1950 we have seen that. A just 2.6% gain followed 1955, while the late 90s actually saw the S&P 500 go 4 in a row before succumbing to a 3-year bear market.

Below are returns following a lower threshold of consecutive +15% annual gains, where we did see a double-digit decline in 3 of 8 instances.