Overtime

Emerging markets focus

Good morning,

This week, we’re taking emerging markets into Overtime.

As yesterday’s Playbook showed, in contrast to foreign developed markets, EM has managed to keep up with returns in the US over the past few months, and is holding above a key historic resistance line.

More importantly, the largest country by weight, China, at nearly 30%, looks technically attractive and ready to breakout.

Today’s report will review:

The top-down technicals for EM and EM ex-China

Major country ETFs

And eight equity long ideas

Top-down technicals

EEM is making 52-week highs

EEM is making 52-week highs and above the 200-day vs. the S&P 500, so it should automatically be on our radar. However, we are approaching the top of the multi-year uptrend channel, so a pullback shouldn’t come as a surprise. For that reason, I would prefer to focus on some of the country-specific ETFs and individual stocks highlighted later in today’s report.

Could a major relative bottom be in the works?

Zooming in on the relative chart, EEM is holding up above its 200-day moving average vs. the S&P 500. While it remains below the April highs, the tight consolidation suggests a move is coming. With US markets due for a pullback and China just starting to break out, I like this ratio’s next move to be higher. And if we take out the 2024 highs, we’re suddenly talking about the potential for a major bottom in favor of continued EM outperformance.

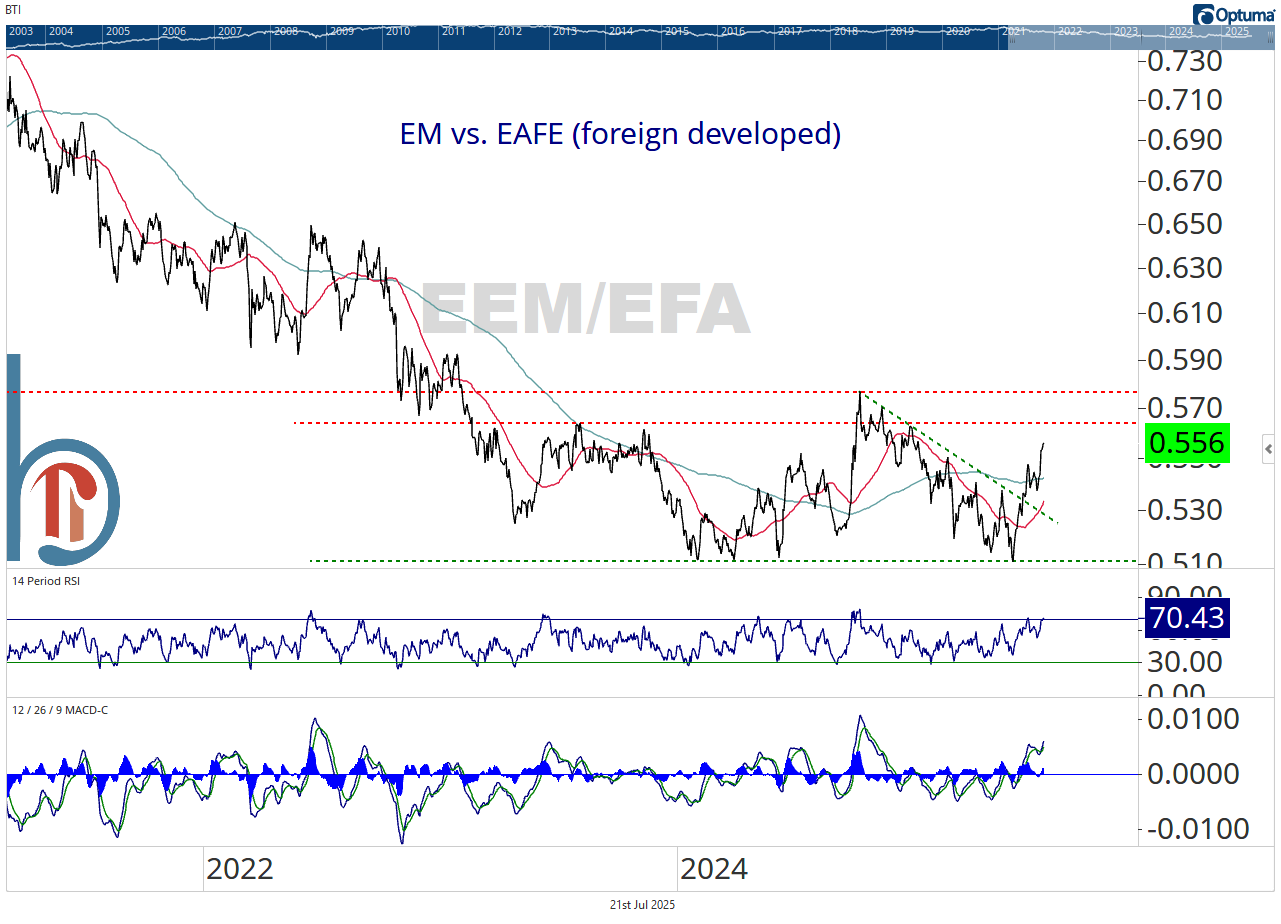

A better place for your money than Europe or Japan?

Europe and Japan are great trends, but could EM be even better? The EM vs. EAFE ratio is working on a 2-year base. We need to see a breakout above last year’s highs to complete the bottom, but short-term momentum is on EM’s side with a recently broken downtrend line and the price above all key moving averages.