Overtime

Healthcare

Good morning,

This week, we’re taking the healthcare sector into Overtime. While we were off for vacation, there were some major individual stock moves in the sector, including Eli Lilly completing a massive top, UnitedHealth finally rallying after a 62% drawdown, and Hot List stock Gilead Sciences hitting a 10-year high following earnings.

Despite those mixed results, 2025 has been atrocious for the healthcare sector. It’s the worst-performer year-to-date and one of only two sectors down on the year.

And that underperformance didn’t just start in January. As today’s first chart will show, the current run is now arguably the worst stretch of relative performance ever.

So, is healthcare so bad that it’s good?

Today’s report will cover:

Just how extreme the underperformance has been

Contrarian outflows

Top-down technicals

ETF sub-groups

Technicals for the sector’s top five weights

3 relative leaders

and three setups for bottom-fishers

Historic underperformance

This is arguably the worst stretch of relative performance ever

Since late December 2022, healthcare has underperformed the S&P 500 by 43%, tying the worst relative run with a period in the early 1990s. Of course, the all-time relative high was back in 2015, so you could argue the relative bear market began then. Either way, this is as bad as healthcare investors have ever had it, and that alone warrants a closer look.

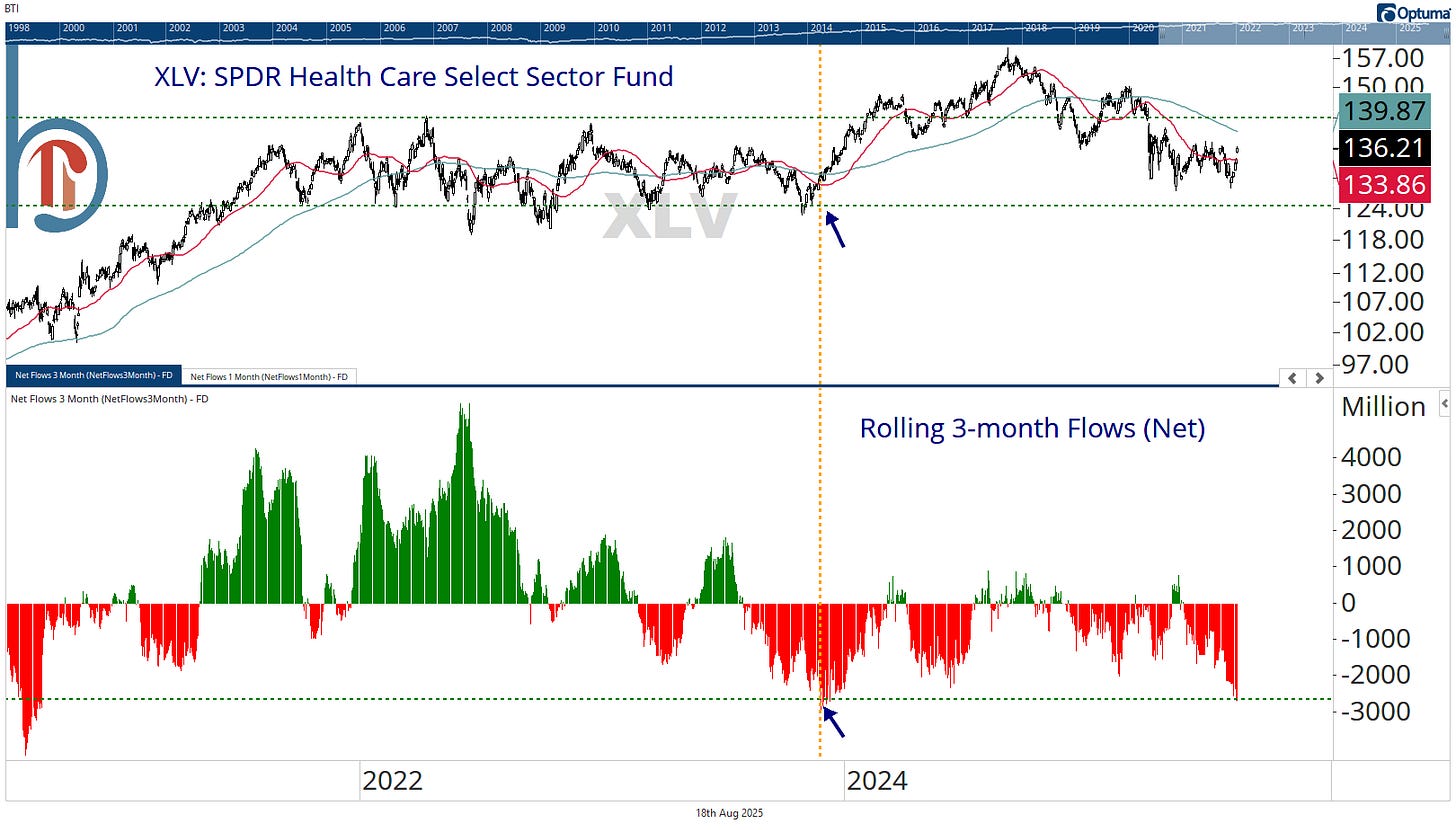

Mass exodus is highly bullish

Sentiment follows price and investors can’t get out of XLV fast enough. The SPDR Healthcare ETF currently has the most 3-month outflows since November 2023. Those extreme outflows nailed the end of a two-year trading range and started a 30% rally over the next 10 months.