Overtime

Mailtime

Good morning,

It’s not just the last Tuesday of the month (which means Mailtime), it’s the last report of 2024.

Thank you all for another great year. It’s an honor and a privilege to be able to share my thoughts here and I greatly appreciate the support of each and every one of you.

Now let’s see what questions and chart requests you and your fellow readers had before we close out the year!

Questions

Will there be another “Base Finder” Stock Trends report this year?

Absolutely! The Base Finder has become one of my favorite traditions and the 2025 Base Finder report will be released on Thursday, January 9. I’ll have combed through the entire S&P 500 and Nasdaq 100 to find the most enticing stocks with large bases and high-upside potential in 2025. Stay tuned!

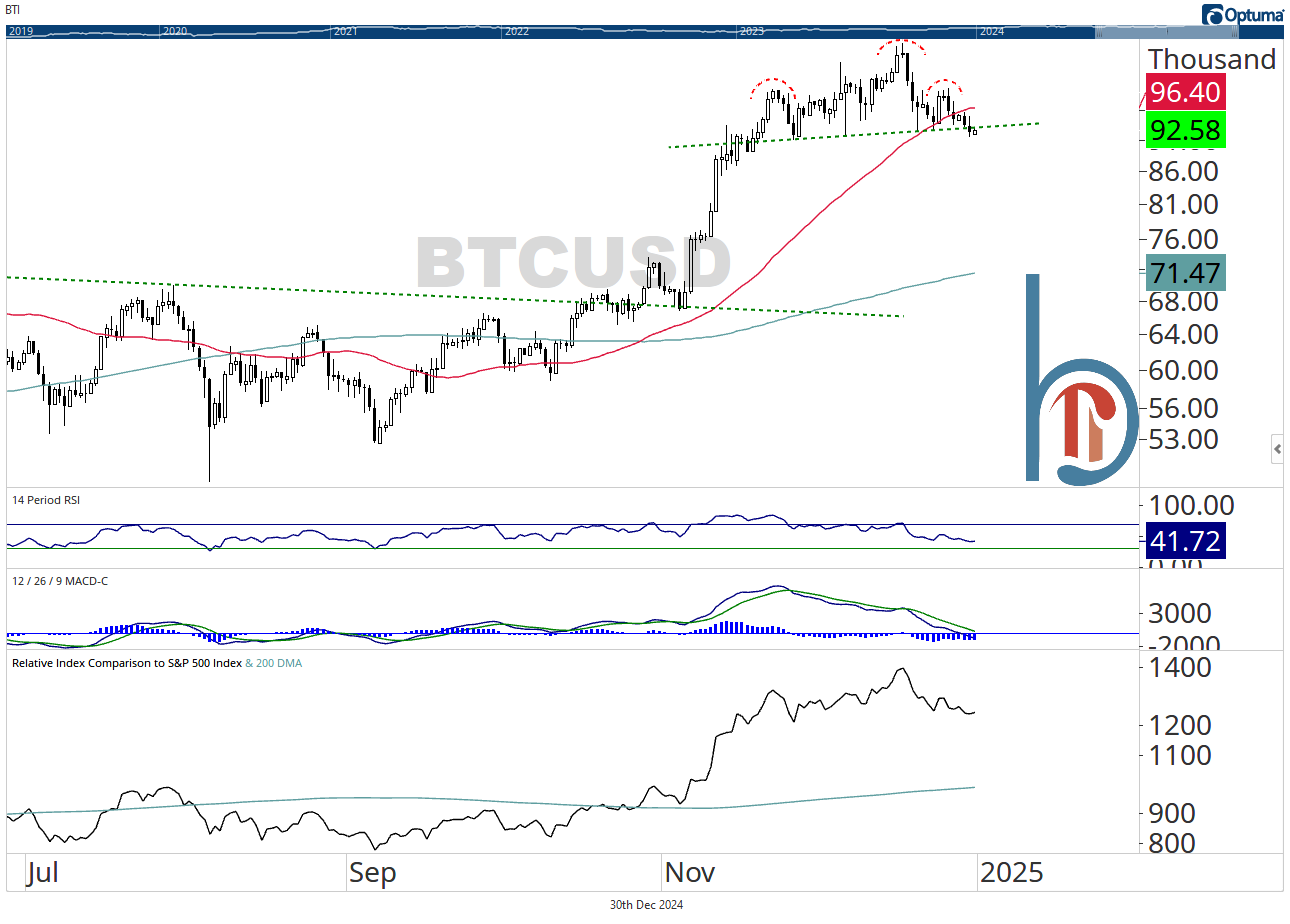

Can you provide a technical update on Bitcoin, and would you ever consider adding a small allocation to the ETF portfolios?

I called out a potential head and shoulders top in Bitcoin in yesterday’s Playbook and we arguably broke the neckline with a 1.2% decline yesterday. I’m always a little skeptical of widely-watched head and shoulders patterns, but if we’re below $92,226, we have to be cognizant of downside risk. At best, I would view it as a hold and note the current consolidation is occurring right at a key Fibonacci extension, a logical place for a pause. 👇

As for whether or not to include it in the portfolios, I’d love to hear from you!

Because so many of my subscribers are financial advisors (many of whom have restrictions on the products they can use), I’ve traditionally kept things straight down the line (non-leveraged, rarely commodities) and avoided things like K-1s that I know from personal experience can cause headaches at tax time. But maybe that’s not what you all want.

Please take the poll below and let me know!