Overtime

Foreign equity review

Good morning,

Global bull markets aren’t new to investors, but an environment where international stocks are outperforming US ones? Well, that’s something we just haven’t seen very often over the past 18 years.

However, the evidence continues to mount that this could be something that continues, and US investors are increasingly paying an opportunity cost for sticking within their home country borders.

Today’s report includes a comprehensive view of major foreign equity markets, with a special focus on emerging markets. Our ETF portfolios have exposure to China currently, but it is far from the only emerging market with a strong chart and recent history of outperformance.

Foreign developed markets

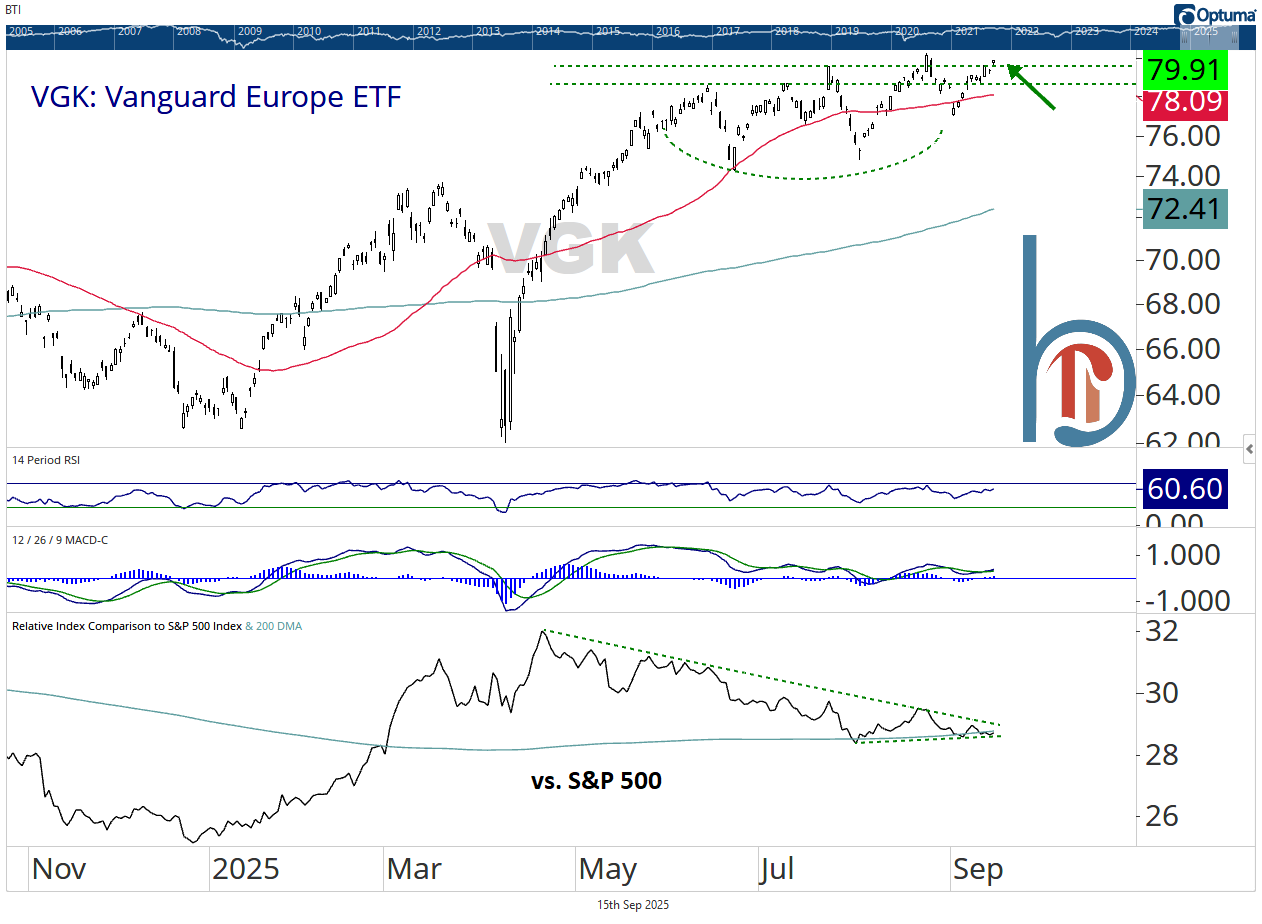

Europe is breaking out of a two-month base

The near-term target for VGK is $85. However, the relative strength for Europe has deteriorated since mid-April. Trying to find support at the 200-DMA vs. the S&P 500.

EUR/USD is an additional tailwind to Europe

EUR/USD isn’t above the July highs yet but this looks like a breakout, and as long as it is trending higher, is an additional tailwind for US investors in European stocks.