Stock Trends

Way-too-early earnings reactions + the post office was running late

Good morning,

Nobody distrusts a pre-market move more than me, but with three of the S&P 500’s top ten holdings reporting yesterday after the bell, it would be silly not to provide an update on what they’re doing.

Today, we’ll review key levels for Meta, Microsoft, Tesla, and more as investors digest earnings.

We’ll check in on:

Continued strength in consumer staples

Late Mailtime requests

Hot List updates

and more!

Way-too-early earnings reactions

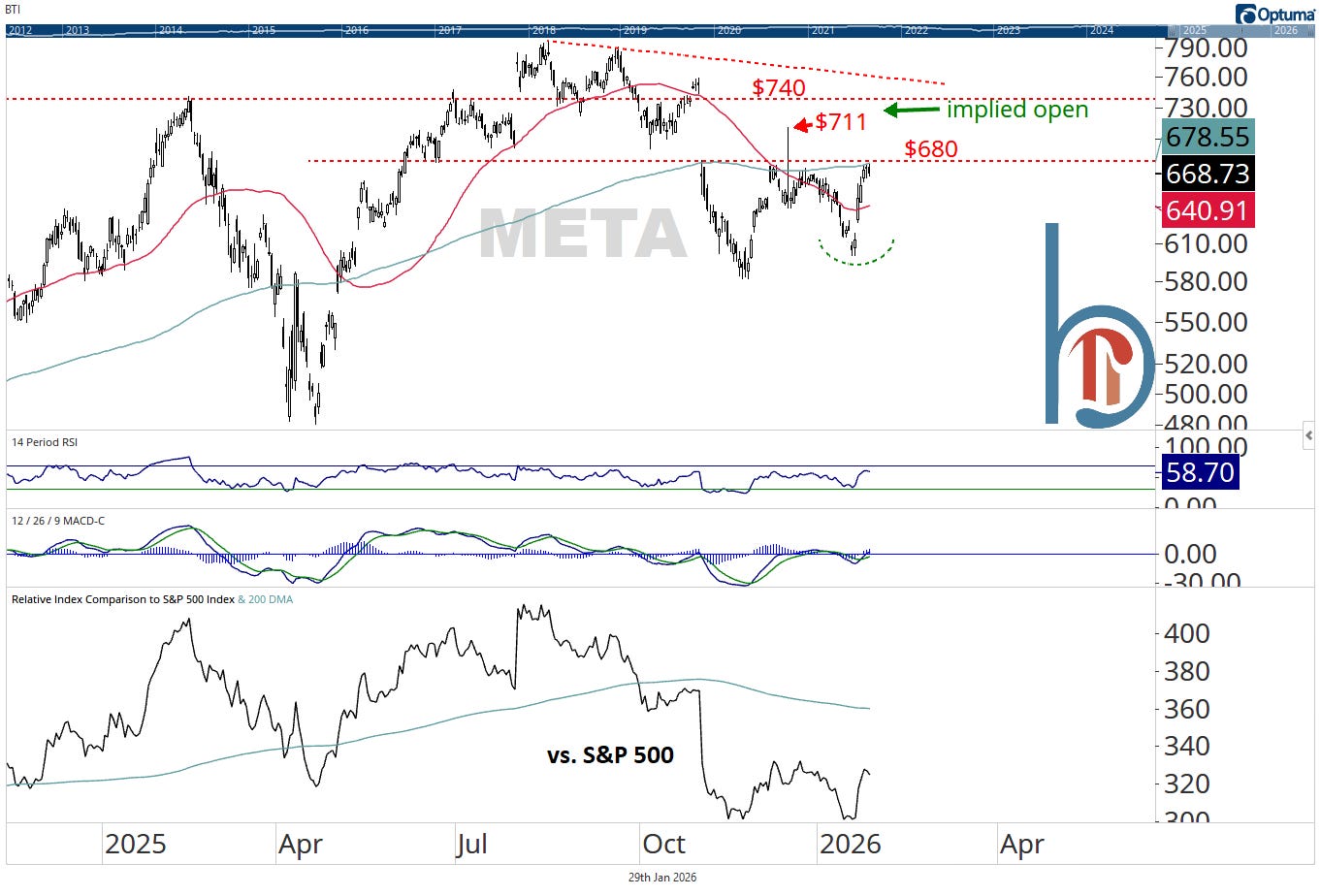

META set to clear $680, possibly complete double-bottom

META is up 8.7% pre-market, trading near $726. That’s good to easily clear resistance at $680 and put it back on the right side of the 200-DMA. Besides resistance at $740, the key level to watch today is $711, the December 12 intraday highs.

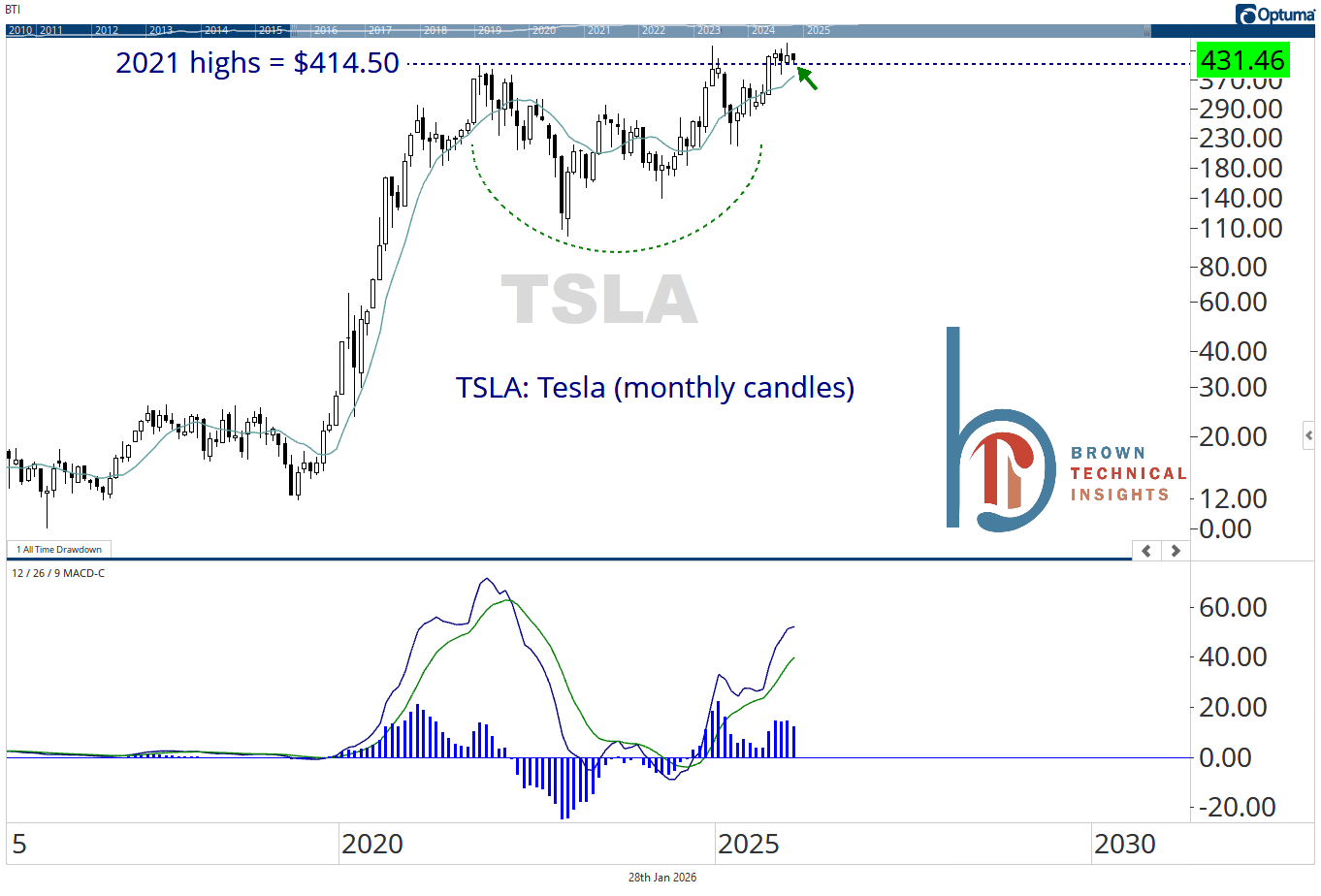

Muted action for Tesla this morning

Tesla is moving remarkably little for a stock with a history of wild earnings swings. The stock is up 2.2% to $440, which keeps the chop that it has seen over the past month going. Overhead, $490 still looms as resistance, while the good news is we’re maintaining the long-term breakout level 👇