Stock Trends

Healthcare leaders, software names holding support and (of course) Nvidia

Good morning,

It’s starting to feel like a quarterly tradition, where Nvidia reports its earnings on Wednesday evening and we get to cover the key levels to watch in this report.

As of 7:00 am ET this morning, Nvidia is up around 14% in the pre-market.

But after its earnings call last night, it was closer to 9%.

Both are bullish reactions, but the difference is that 14% is good enough for a new all-time high, while a 9% gain would only erase the losses from the past two days.

I believe that’s important, as I’ll break down below. We’ll also look at:

Disappointing earnings reactions from recent high-flyers

Software names above support

Some of our 2024 big bases

Healthcare leaders

and more!

Key levels on Nvidia and other semiconductors

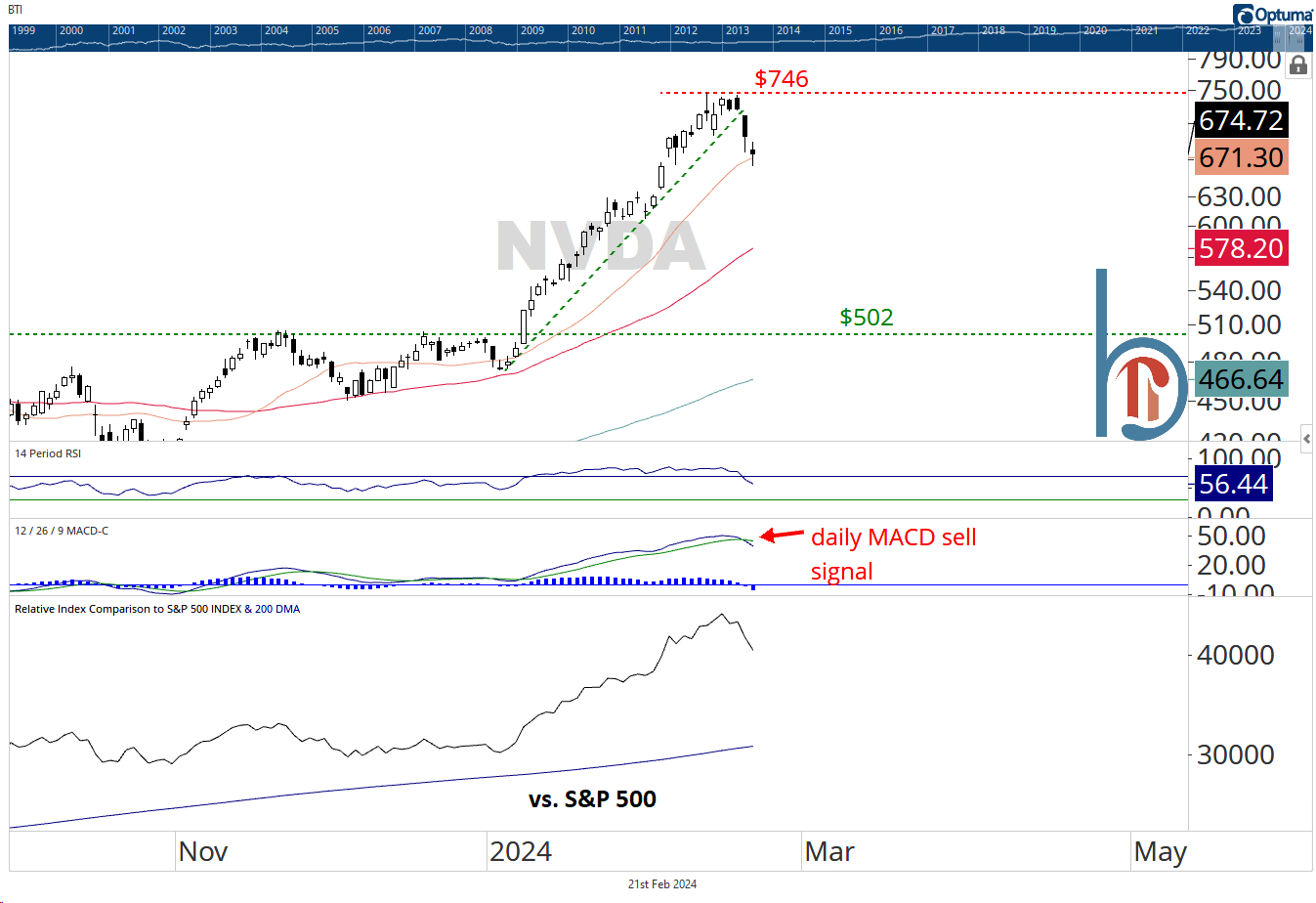

Watch $746 on Nvidia today

Nvidia sold off about 7% in the two days ahead of this report as investors understandably took some gains off the table. That action broke the YTD uptrend channel and registered a MACD sell signal. The stock is going to successfully hold its 21-DMA (orange line), so the overhead level to watch is $746. A solid close above that level and there is nothing to quibble with. But a single-digit percent gain like we saw most of Wednesday evening in the after-hours isn’t enough for a new all-time high. Combined with the other measures of slowing momentum, it could suggest we’re at the beginning of a consolidation, either through time or price.

Nvidia boost may keep AMD breakout intact

AMD was featured in our 2024 Base Finder report and the move in sympathy with Nvidia looks like it will keep the $162 breakout point intact. The stock is still working off some overbought conditions, but a month-long pause and hold of support help the case that the next big move will be higher.

Earnings disappointments

Palo Alto gives up 24% YTD gain in one day

Top cybersecurity stock Palo Alto Networks fell 28% on Wednesday after giving disappointing earnings guidance. It was good for the worst-ever day in the stock’s history and wiped out a 24% YTD gain. The stock found support at its 200-DMA and November breakout point, a reasonable place to potentially bottom but after a day like this, we’ll need to see the dust settle.