Stock Trends

The weak remain weak

Good morning,

A big theme in this week’s Monday Morning Playbook was how dominant momentum has been and how the market continues to reward relative strength at the individual stock level.

In today’s Stock Trends report, we’re looking at the other side of that coin, and calling out some stocks and patterns that continue to punish bottom-fishers.

We’ll also review:

Stock that just missed the cut for last week’s Hot List

Updates to current Blue Chip Hot List holdings

2 key semiconductors

and more!

The weak remain weak

D.R. Horton breaks to 52-week lows

Sometimes a head and shoulders pattern does signal a major reversal. It sure did with DHI which is down 36% from its September highs. The stock is hitting its first 52-week low since June 2022.

Ford slides to 4-year low

Probably easy to tie in the interest rate story here too. Ford is hitting its lowest level since January 2021 and while we’re at the bottom of a downtrend channel, I can assure you it is not worth the headache.

Walgreens: The trend never lies

Sometimes when the Dow committee throws out a stock, it’s a contrarian indicator. Sometimes it’s because the stock is a future zero. WBA had a nice base and breakout but that rarely matters when the 200-DMA is downward-sloping. That’s why we wait for the trend to turn.

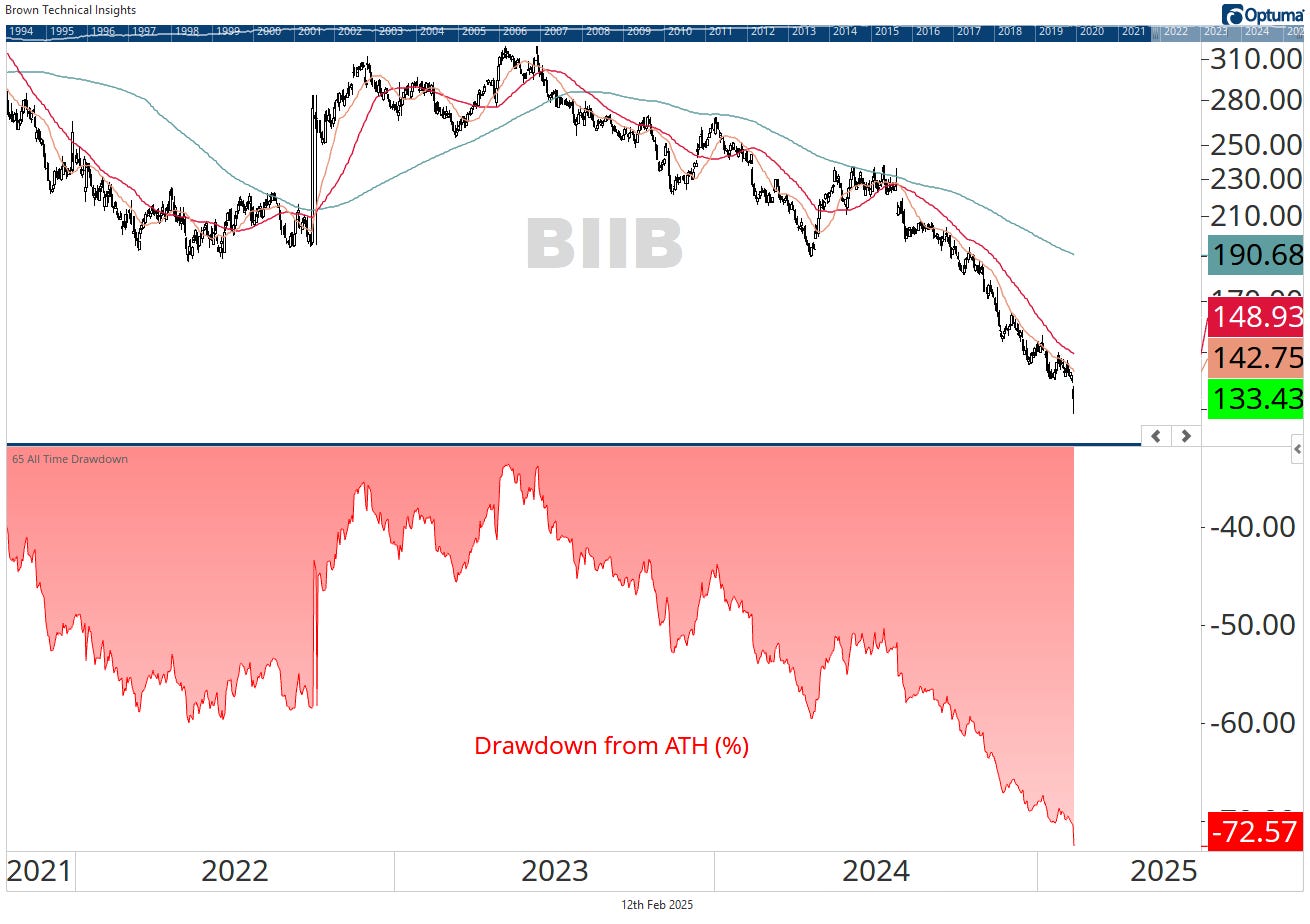

Biogen now down 73% from 2021 highs

BIIB was once one of the world’s largest biotech companies but its precipitous decline continues. The stock made another 10-year low yesterday after reporting earnings.

AMD keeps not bottoming

Everybody (including me) keeps looking for AMD to bottom and it keeps not happening. There’s some support just above $100/share but as long as the 50-day looks like this, just forget the stock exists. More on semiconductors later.