Stock Trends

The mouse breaks out

Good morning,

Few stocks have seen their narrative turn as hard and fast as Disney over the past few years.

After being a blue-chip darling for most of the last decade, the stock has underperformed the S&P 500 by more than 50% over the past 3 years, hurt by the streaming wars and becoming a political punching bag.

But since October, the House of Mouse has turned it around and Disney stock broke out above an absolutely huge level to start this week.

This week we’ll review

Disney and other top communication stocks

The stocks driving the PAVE infrastructure ETF higher

Bellwether semiconductors

Auto dealers outperforming

and more!

Communication services focus

Breakout for the House of Mouse

We’ve been stalking Disney for a while this year (see here, here and here) but the stock just cleared its biggest level yet. $118 wasn’t just the February 2023 high, it has been a pivotal point going back to 2015 and the stock is now on the right side of it. 👇

GOOGL hanging tough at $151

I’ve been skeptical of Alphabet’s ability to hang on here given how strong resistance has been at $151. It’s a bad entry point just below that level, but the stock is hanging right there the past two weeks, increasing the odds it can push through. If it can get above $151, that helps the case for adding to XLC in next week’s ETF portfolio trades.

All-time highs in sight for Netflix

Nextflix’s momentum is slowing but that’s only a problem for short-sighted investors. The move above $580 leaves all-time highs as the only thing to call resistance and the stock remains a relative leader.

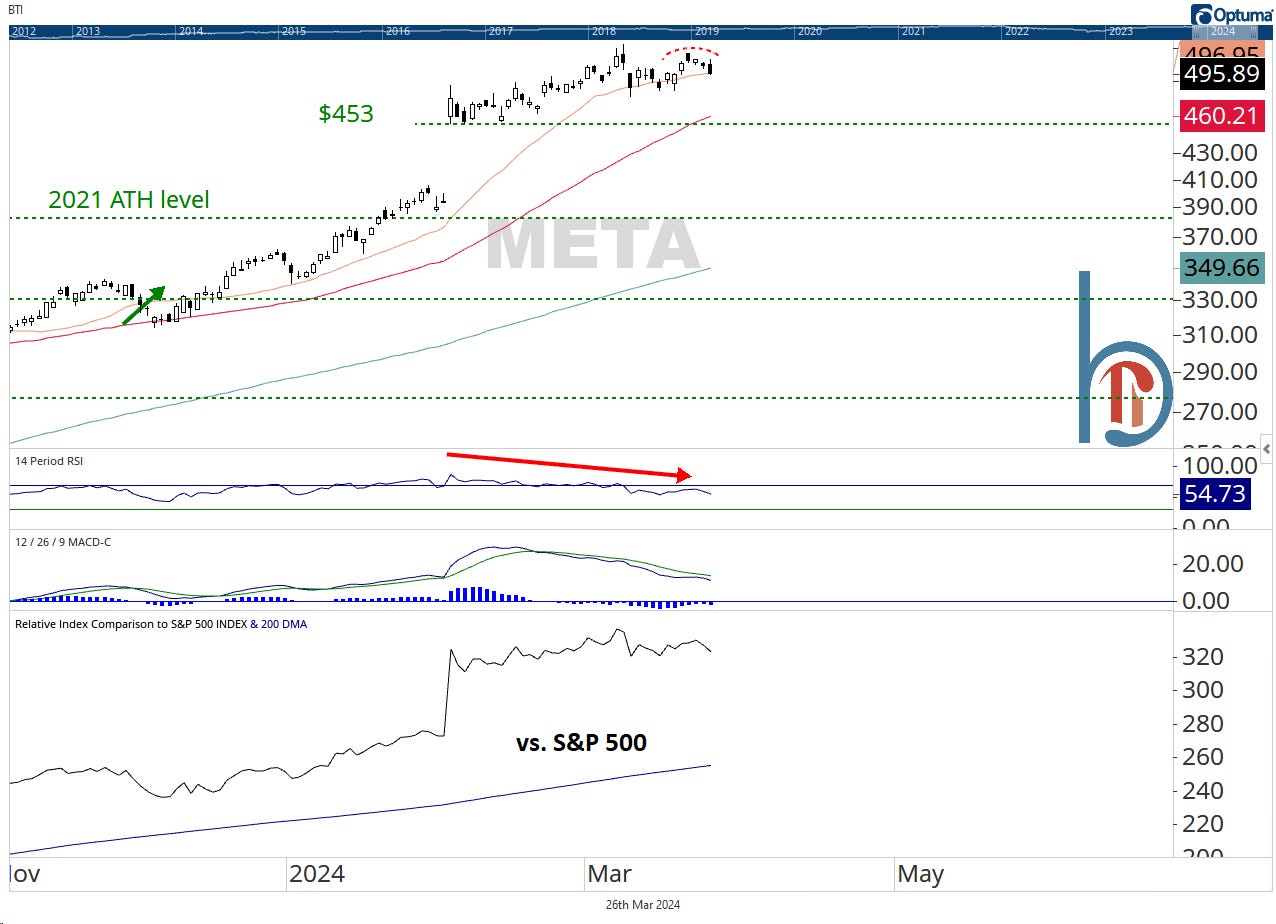

$453 is support on META

Meta Platforms is also looking a bit tired, printing a lower high over the past week and with some clear momentum divergences. Still, $453 is a good support level and potential place to add to longs.