Stock Trends

Earnings reactions, levels to watch after the bell and REITs!!

Good morning,

It’s the heart of earnings season and I’m showing you the market reactions and set-ups to all the most important stocks.

Today’s report will look at:

Earnings misses

Earnings pops that were good but not good enough

Key levels to watch after today’s bell

Healthcare stocks

Apartment REITs breaking out

and more!

Bad earnings reactions

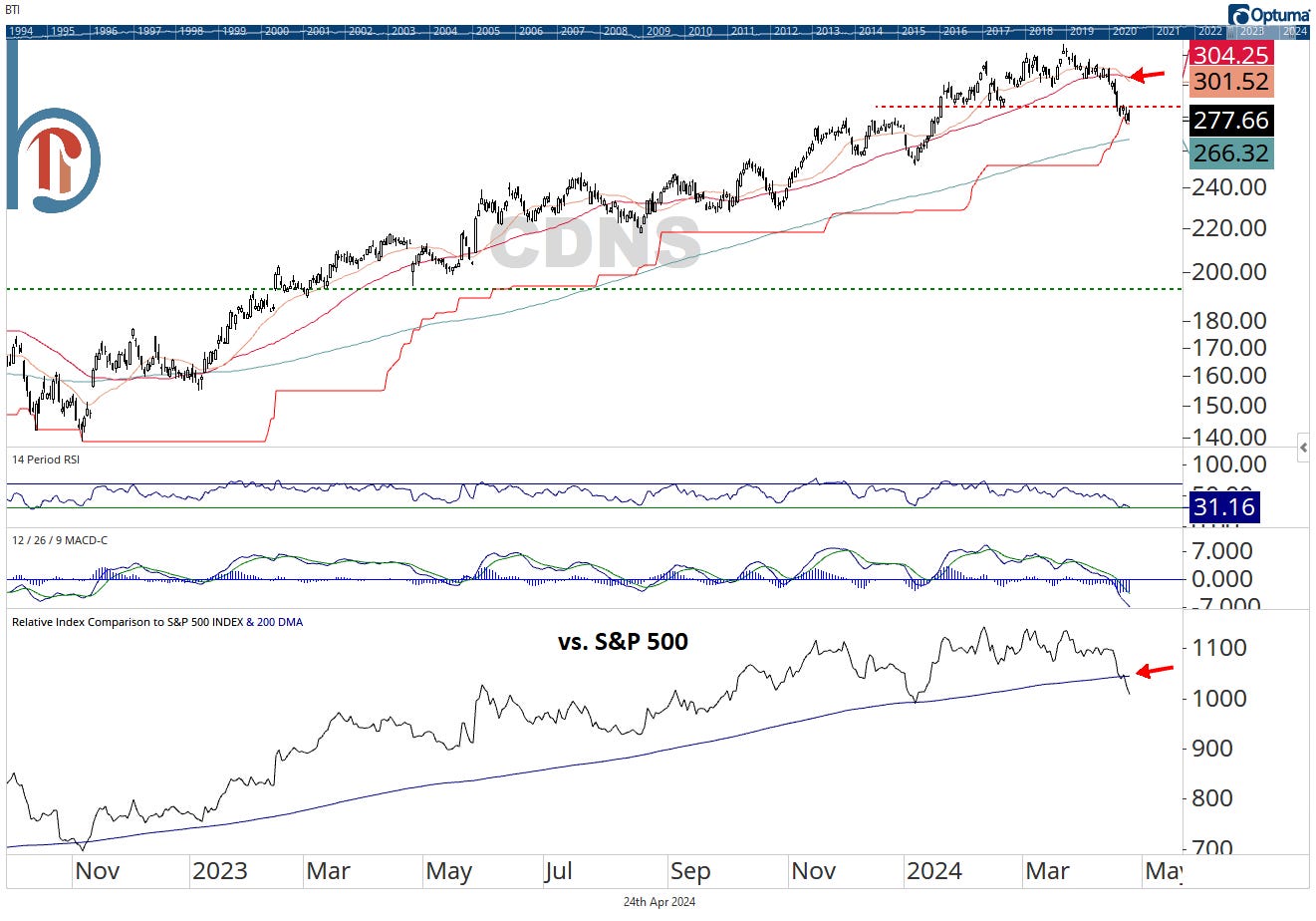

CDNS has finally rolled over, making a 3-month low

We sold former Blue Chip Hot List stock Cadence Design Systems too early but the stock has now broken down. CDNS just made its first 3-month low since the 2022 bottom and is below declining 21 and 50-day moving averages. Relative strength has also broken trend.

Netflix loses the $580 level

NFLX fell 9% last Friday, pulling the stock back below the $580 pivot point. The stock tried to rally early this week but failed at the underside yesterday. Risk to $500 as long as we remain below that gap.

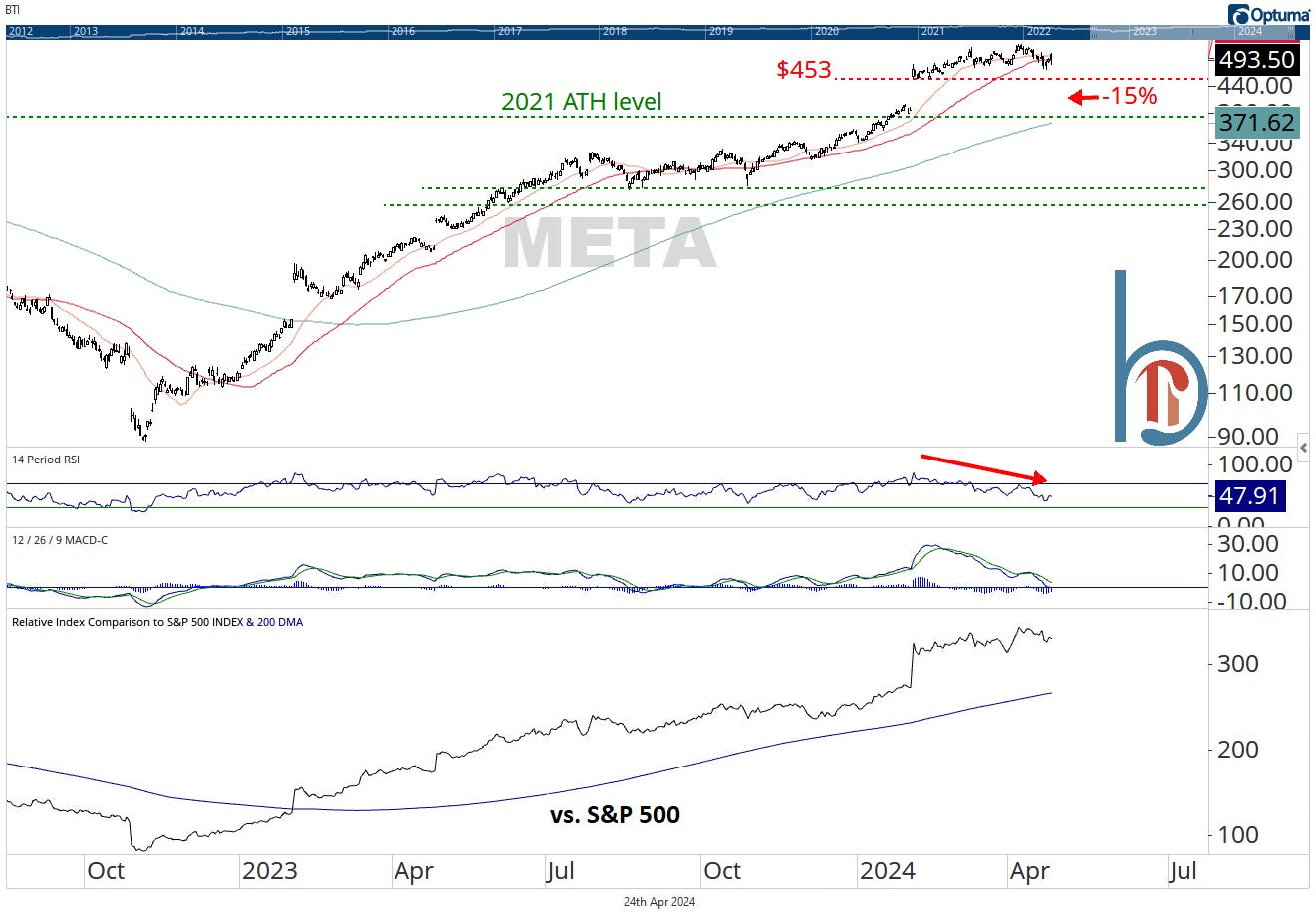

Meta set to create one hell of an island

At the conclusion of last night’s earnings call, META was trading at $418 or 15% lower from Wednesday’s closing price. Today’s action and close are what matters, but anything in that range will keep META above the 2021 all-time highs and 200-DMA, but leave the last quarter as a giant island. I don’t suspect we’ll reclaim $453 anytime soon.