Stock Trends

All about that base

Good morning,

The S&P 500 hit another all-time high yesterday but under the surface, things are far different. Whether the breadth deterioration results in a correction at the index level remains to be seen, but this is an individual stock report and the fact is that most stocks are correcting.

In fact, since the beginning of the year, the percentage of S&P 500 stocks above their 50-DMA has fallen from more than 90% to under 60% on Monday.

So, how do we play this? Well, I believe that big bases are one of the most attractive set-ups to focus on when the market is correcting.

Why? Because the long-term technicals are unchanged. While other stocks are breaking uptrend lines, our long-term bases just continue to build, ready for a breakout when the market stabilizes. That’s a big reason why the 10 big bases in the tech sector were so successful.

Today we’re checking back on some of the most attractive set-ups from the 2024 Base Finder report as well as:

Long ideas within software

Consumer earnings reactions

2 stocks in the Mag 7

Bullish travel stocks

and more!

Long ideas within software

52-week high for Autodesk

I featured Autodesk 3 weeks ago and the stock is now 8% higher and hit a new 52-week high yesterday. I still like the stock and the trend here.

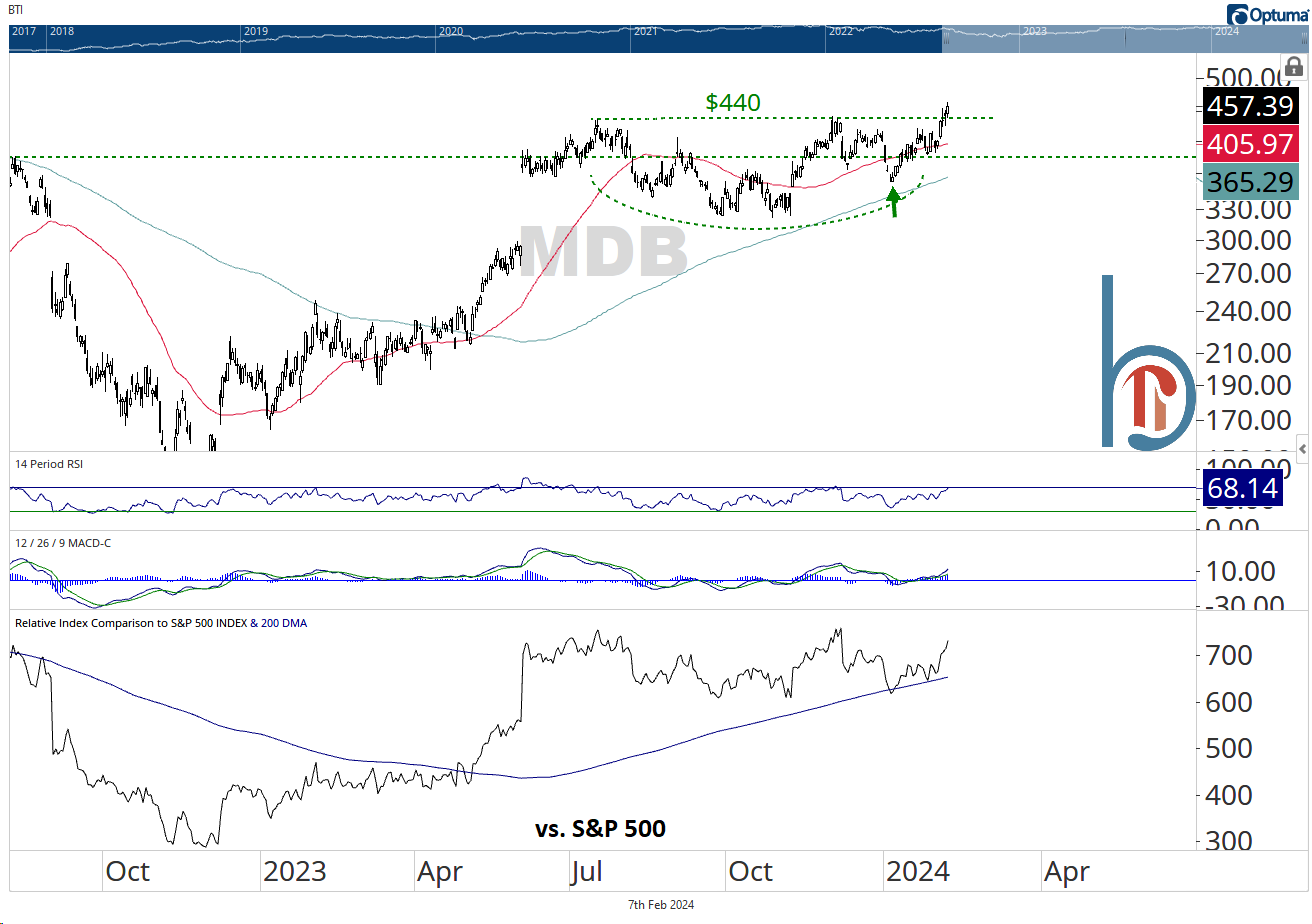

MongoDB finally breaks out

I’ve been eyeing MongoDB for a while and the stock is up 21% since my January 11 trade idea. However, the breakout means there is still plenty of time to get involved, the measured target is $556.