Stock Trends

The aerospace & defense correction is here

Good morning,

Regular readers know that we’ve been bullish on aerospace and defense stocks since April, but the last two Monday Morning Playbooks have highlighted some growing reasons for caution (see here and here).

I don’t think we’re dealing with a major top in the group, but tactically things were getting overheated and the past week has seen some of the biggest winners finally crack.

Today’s report will highlight key levels to watch on some of the stocks we’ve featured the most, as well as one laggard that has broken down further.

We’ll also review:

Hot List updates

Key levels to watch following Alphabet and Tesla’s earnings reports

Breakouts in gold miners and homebuilders

Stocks on my watch list

and more!

The aerospace & defense correction is here

Looking like we nailed at least “a” top in Kratos

KTOS closed well off its highs from the day we sold it (final 55% gain) and proceeded to drop more than 6% the next two days. It bounced back yesterday, but I’m skeptical the stock can quickly reclaim recent highs above $61.

Quick double-digit correction for Rocket Lab after its target is hit

Last week, I said this would be a logical place for RKLB to start to see some digestion, and the stock quickly fell 16% from highs hit later that day. The trend here is firmly intact and based on this stock’s (extremely volatile) history, it could very well continue higher. If I’m wrong about a tactical top in this group or one stock bucks that trend, this would be my pick to stay long.

Watch the 50-day on Archer Aviation

This is another high-flyer that could be a good tell on the group. Archer Aviation failed to break out and fell 17% over two days. It’s back to a key support zone, headline by the 50-DMA at $10.80. A break, and the stock has 20% more downside to its 200-day.

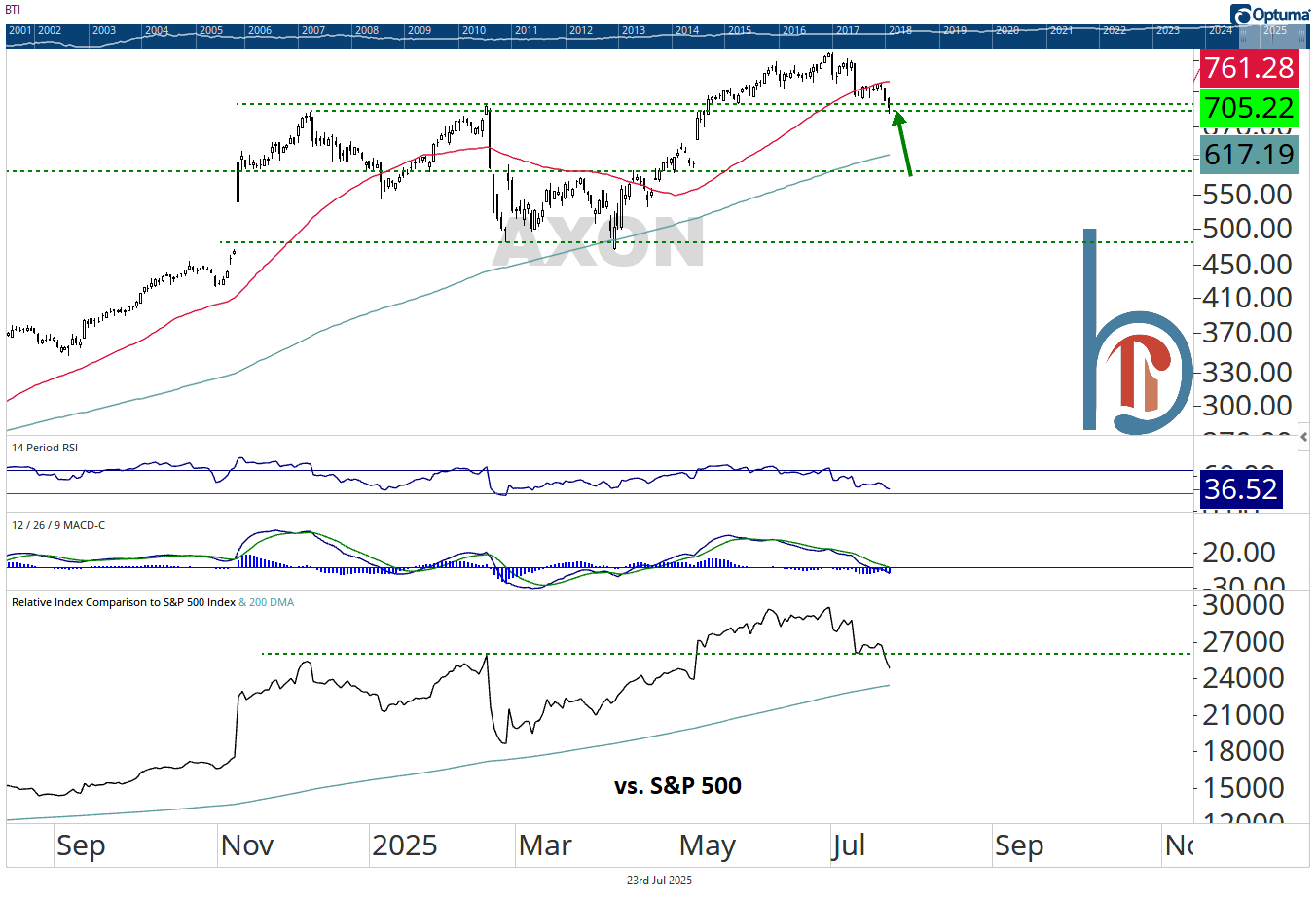

AXON topped back on June 30

Drones have been all the rage lately, so maybe money rotating into them is all this is. But Axon was one of the first big winners from our April feature, and the stock has been steadily weakening for weeks. It couldn’t get back over the 50-DMA; now we’ll see if the top of this big base can stop the bleeding.

Lockheed was never good, but an ugly technical break on Tuesday

Finally, Lockheed is a reminder to focus on the good charts when a group is working and not bet on laggards playing catch-up. Not only did Lockheed not participate in the huge run over the past few months, but it broke multi-year support Tuesday with a 10.8% drop, its worst day since 2021.