Stock Trends

Top Tech 8 + Complete Blue Chip Hot List review

Good morning,

The market is continuing its bounce back this week and helping to affirm the base case that last Monday will be the low, or at the very least the low for most stocks.

That won’t happen without the top technology stocks bottoming, so today I’ll provide an update on several of the stocks in the Top Tech 8 basket of the new S&B 20 Index.

I’ll also provide a complete review of all Blue Chip Hot List holdings, while all stops remain on hold there.

Let’s get into it!

Top Tech 8

Alphabet rolls over, watch momentum on a potential retest

Alphabet was one of yesterday’s most notable underperformers amid news that the DOJ is considering trying to break up the company following its antitrust lawsuit victory. News aside, there is a ton of support at $151 and if momentum can get less oversold on a retest, I think the odds of a snapback rally are high. Watching, but not yet buying.

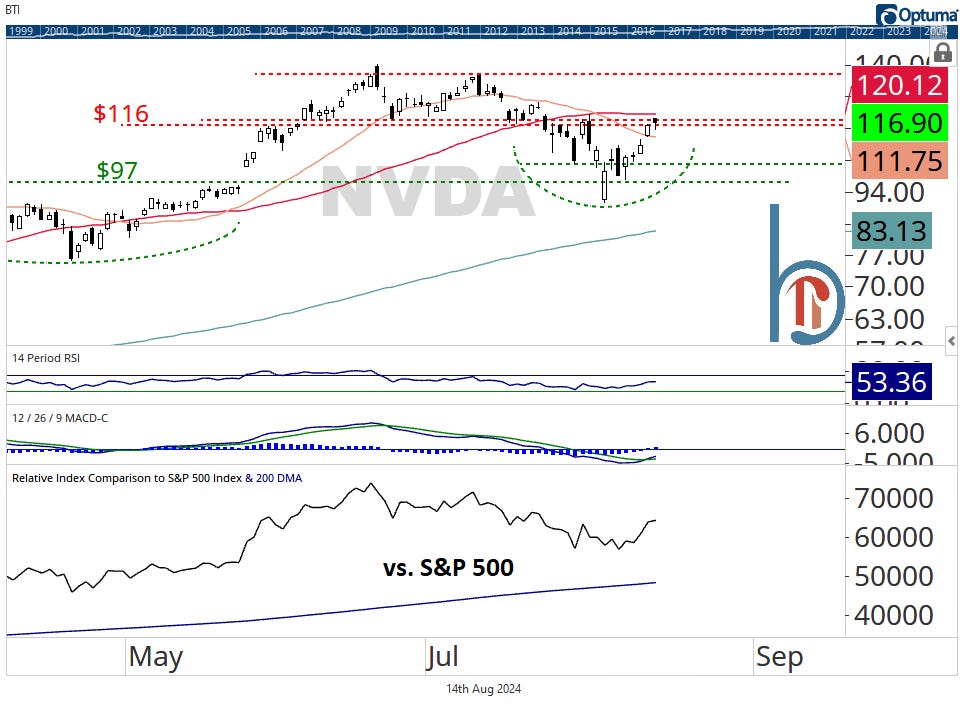

Nvidia back to the scene of the crime

Nvidia continues to respect key horizontal levels and after finding support at the top of its spring base, the stock is back at its breakdown point. Following a 35% drawdown, a move through $120 would likely confirm the lows are in and set up more upside for one of the market’s most important stocks. Earnings on August 28.

META back at the highs

META is within 3% of all-time highs and if the stock can break through, don’t underestimate the upside. This 6-month base conservatively measures to $634.

Blue Chip Hot List review

Keep reading with a 7-day free trial

Subscribe to Brown Technical Insights to keep reading this post and get 7 days of free access to the full post archives.