Stock Trends

Bullish follow-through

Good morning,

Tuesday’s Overtime report highlighted bullish intraday action for a wide variety of equity ETFs on Monday but stressed the need to see follow-through.

Yesterday’s breadth was disappointing relative to the headline gains (less than 3:1 advancers vs. decliners in the S&P 500 and just over 4:1 on the NYSE) but there was more good than bad.

Front and center in the good column were the banks (KBWB +4%), which posted their best daily gain since November and completed the double-bottom called out in Tuesday’s report.

This week, we’ll look at which financials could have more upside following earnings as well as:

Mid-month Mailtime requests

Way-to-early updates for the 2025 Base Finder

Energy breakouts

Red-hot utilities

and more!

Yesterday’s financials earnings reactions

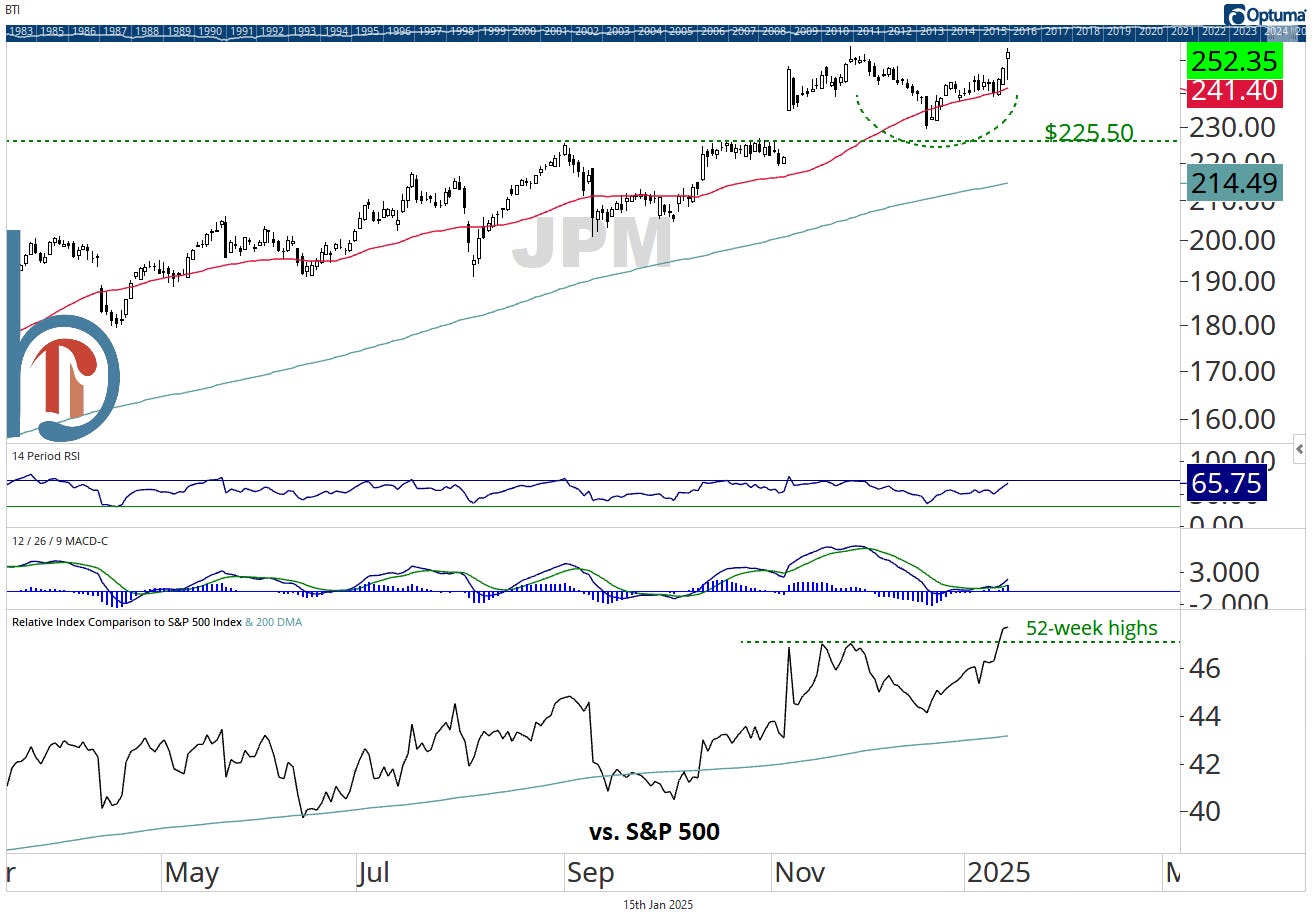

JPMorgan gains 2%

2% is the weakest gain of the four financials we’re looking at but the chart is still great. Breakout to 52-week relative highs and just a hair from new all-time highs.

Base Finder breakout alert for Citi

I want keep this chart short-term but click here if you want to see how long this downtrend line stretches back. This is a buyable breakout for short and long-term investors.

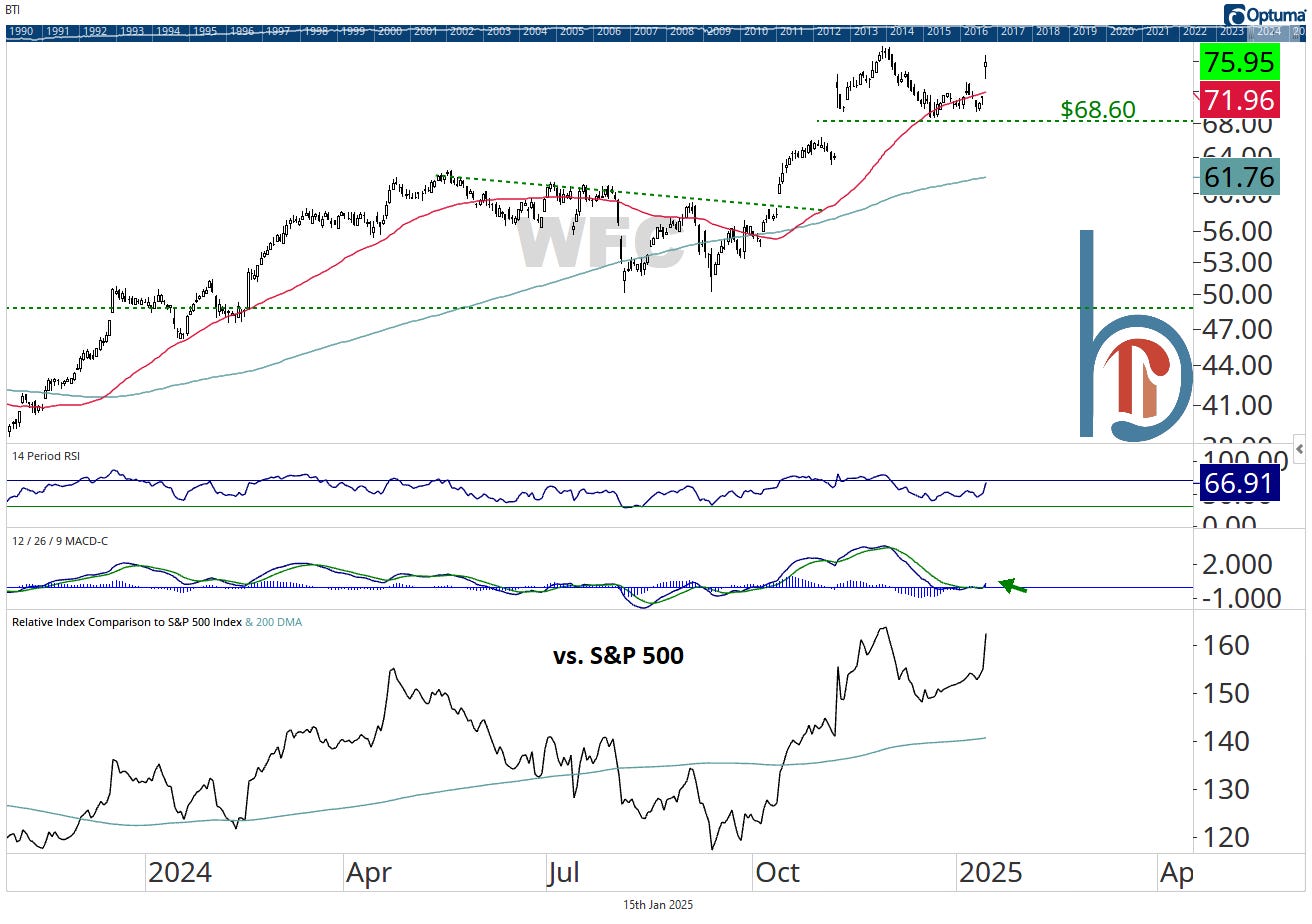

Wells Fargo tops with a 6.7% gain

It’s safe to say support held for WFC. Breakout to the highest level since November and the MACD is back in positive territory.

BlackRock back above $973

BLK gained 5.2% and put itself back above the key $973 level. The stock has big base potential but this is the weakest of the 4 charts tactically. Wednesday’s rally stalled at the underside of its 50-DMA, a stark contrast to the first three charts.