Stock Trends

Bullish industrials, financial breakouts and utilities bouncing back

Good morning,

In last week’s “The good, the bad, and the ugly”, nothing was more bad than some of the old school transport names we looked at. And to be clear, those freight names remain awful.

But there are plenty of industrials (including some of the largest and most important) that act great.

So today, we’ll review some “good” industrials charts.

We’ll also take a look at:

Top stocks in the financials sector

Utilities bouncing back

Some bullish healthcare calls revisited

Hot List updates

and more!

Bullish industrial bellwethers

All-time highs this week for Caterpillar

I’m old school and still think of CAT as the quintessential industrial. And it’s a great chart, hitting all-time highs this week and recently breaking out of a relative base. Tuesday did see a bit of a reversal with the market, so $485 is your tactical resistance level.

Dual 52-week highs for Cummins

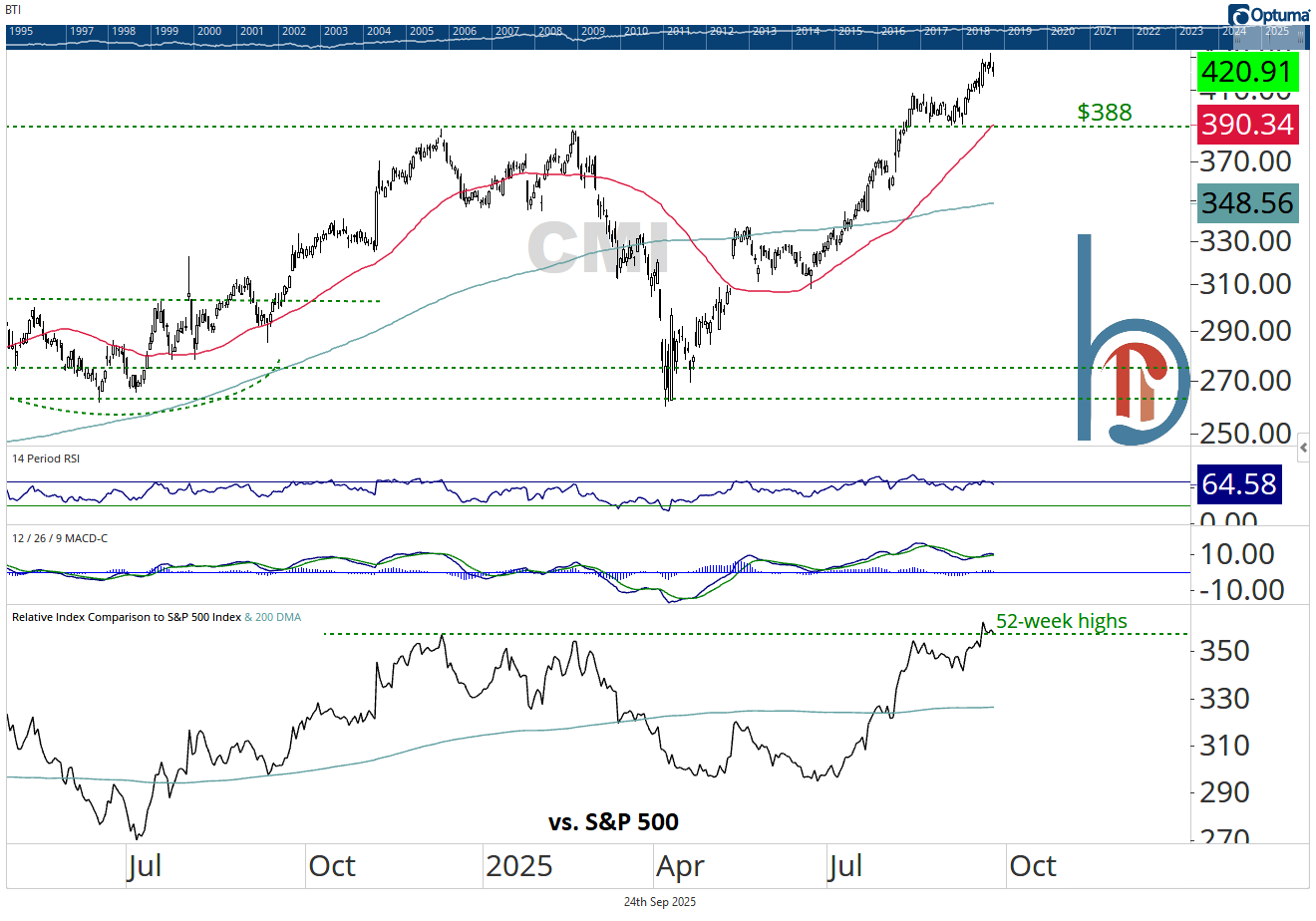

CMI also hit an all-time high on Tuesday and recently broke out to 52-week relative highs. The base measures to $512, and the breakout is intact as long as we’re above $388.

Bullish long and short-term setup for Xylem

Maybe bellwether is a stretch for this “water technology provider,” but it’s definitely a great chart. XYL is setting up just below its 2024 highs, and riding a relative uptrend.