Stock Trends

Nvidia, semis, high-flyers, and so much more

Good morning,

For a few years there, Nvidia’s earnings were the only market event that mattered.

Alas, that time has passed and we’ve matured as an investor class.

Just kidding.

Now the only thing that matters is tariff headlines and we’ve got another one this morning.

Wednesday evening, a federal trade court ruled President Trump doesn’t have the authority to impose the sweeping tariffs proposed on Liberation Day.

Futures initially spiked on the news, but combined with Nvidia being up 5% pre-market, the fact that futures are only up 1% shows you just how overbought this market is becoming.

Today, we’ll look at why the Nvidia chart has more to prove, as well as:

Other attractive semi charts

AI plays outside the tech sector

Big moves from high-flyers

2 bullish energy charts

and more!

What to watch on Nvidia and other semis today

Up is good but now comes the hard part

Nvidia is up about 5% to $142 premarket, and that’s certainly a bullish reaction that keeps the bull flag breakout going. However, gapping into a resistance level isn’t where you want to buy a stock and Nvidia will need to prove its momentum can finally carry it through the range from $144-$152.

Broadcom didn’t wait

AVGO didn’t wait for Nvidia earnings and broke out to its highest level since January yesterday. The stock is adding to gains this morning but is short of the $250 resistance level.

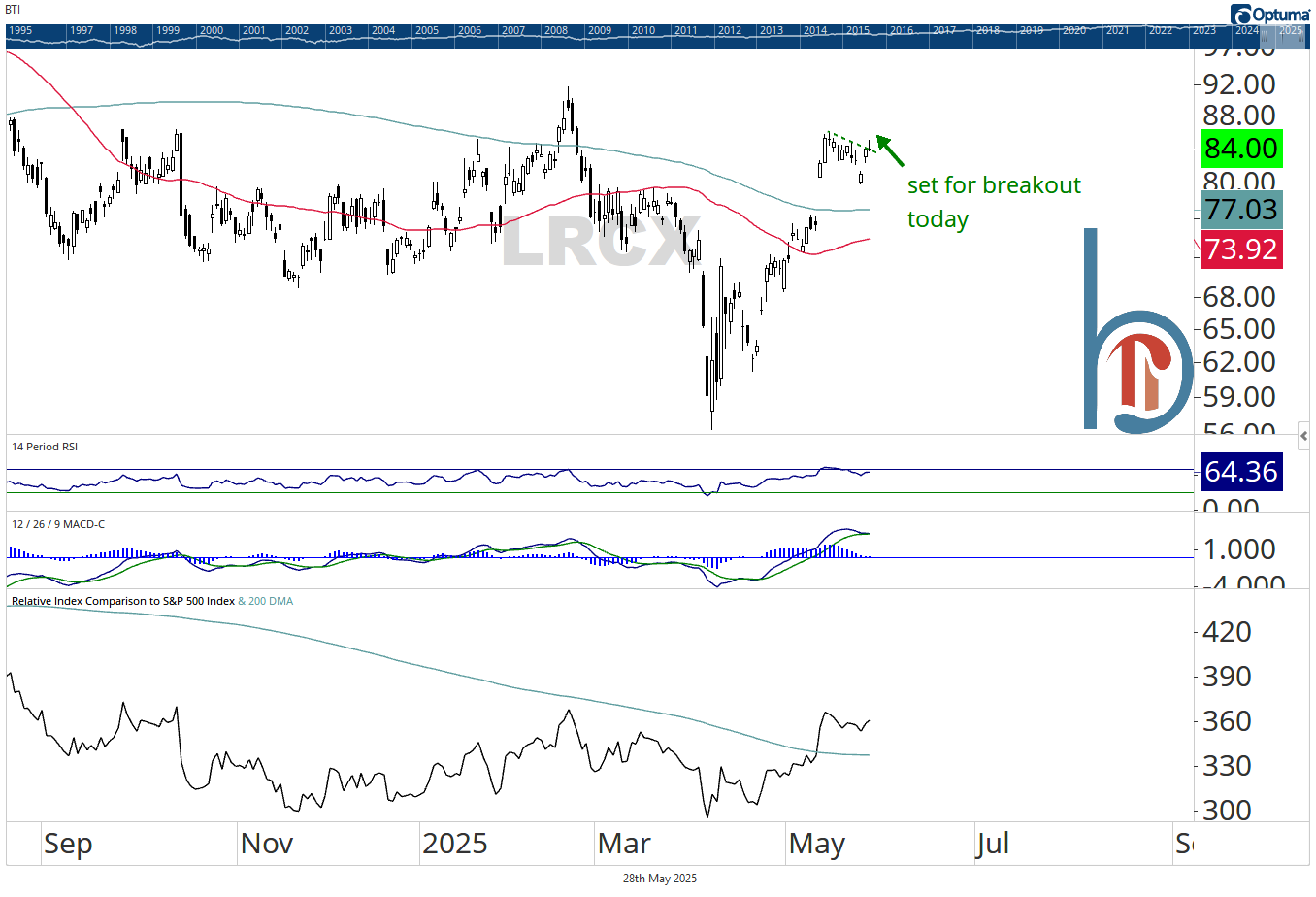

Lam Research set for another leg of upside

LRCX is another bull flag breakout and while it hasn’t been as strong as TSM, AVGO, or even NVDA, it is at least above its 200-DMA. The February highs at $92 are my initial target.