Stock Trends

Bullish changes in trend

Good morning,

Equities are off to a rough start in 2024 and this week has been no different. The S&P 500 has been down every day so far, small caps have now fully given up the December breakout, and the dollar has completed a short-term bottoming pattern.

These aren’t bullish developments, but the market is still in a far better place than it was in October. This week, I’m highlighting 12 stocks that have undergone a bullish change in trend. They may not be immediate buys, but all have seen enough of a shift to suggest the worst is over, and at the very least, should be on our radar for continued upward movement in 2024.

We’ll also look at:

The battle of the top stocks

Energy stocks breaking down

and more!

Battle of the top stocks

Apple bounce was short-lived

Apple has made 3 intraday stands at the 200-DMA this year, but a break of this support zone is seeming inevitable. At a 7% weight, that’s not going to help the market, but Apple lagging isn’t new.

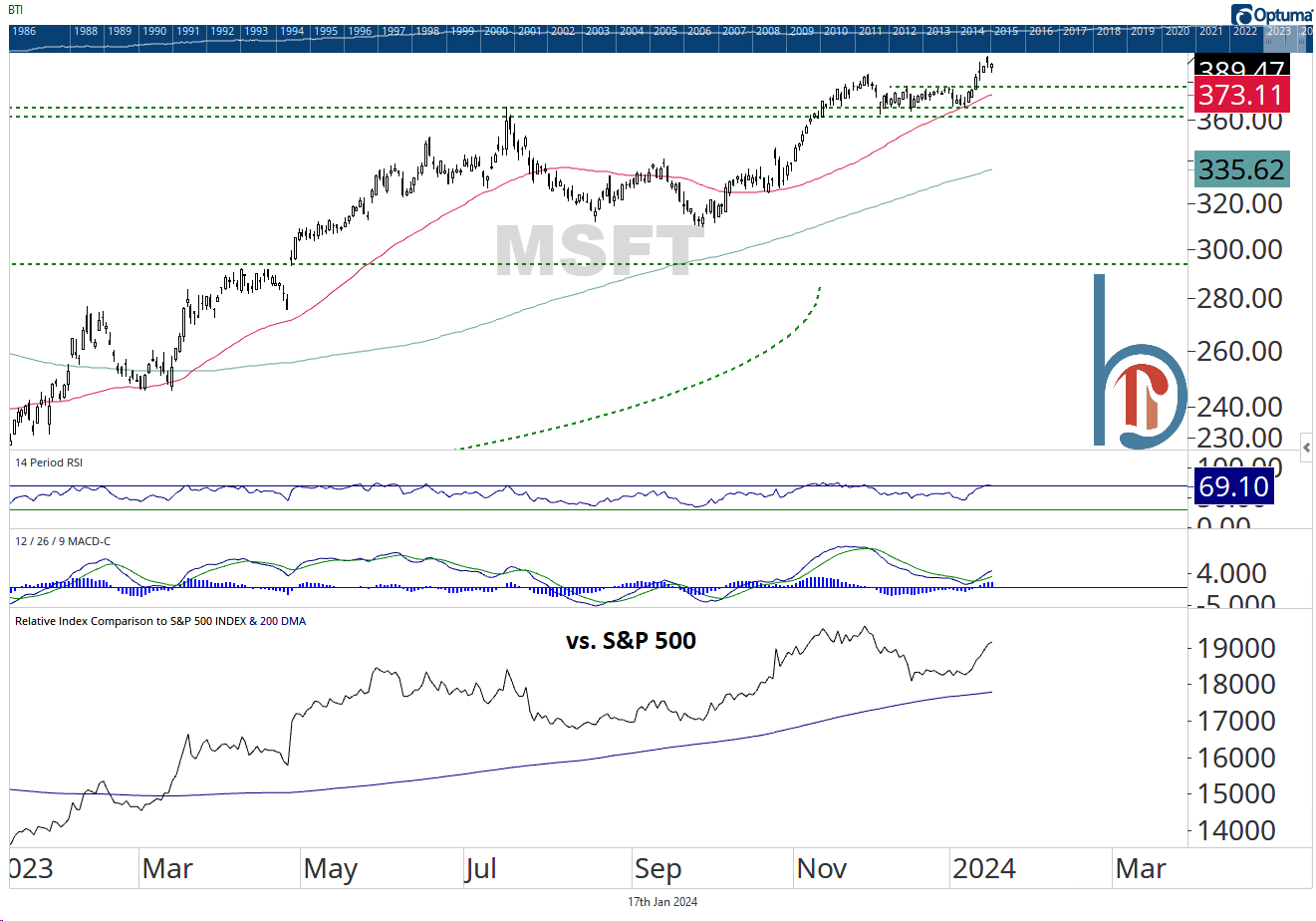

New all-time highs for the world’s largest company

Microsoft has now overtaken Apple as the world’s largest company and the charts suggest it isn’t about to give up that spot. The stock broke out last week and hit a new all-time high on Tuesday. Relative leader as well.

Bullish changes in trend

AbbVie breaks a 20-month downtrend line

Abbvie has broken a long-term downtrend line and got within a hair of the 52-week high list last week. If we’re above $154, I like it to continue up and test those all-time highs near $175.

CVS completes the bottom

CVS has completed a 10-month bottoming pattern and is now retesting the breakout point. $76 would be the appropriate tactical stop for new money.