Stock Trends

Well... today should be a good day

Good morning,

The original title of today’s report was supposed to be: “The strength in these (non-tech) stocks stands out”.

But that was before 4:00 pm yesterday.

It’s nice to look where others aren’t, but it would be ridiculous to lead with anything other than the explosive moves that Microsoft and Meta are poised to open with in 30 minutes.

But the moves weren’t just significant for those two companies. The sheer amount of capex sent the entire AI complex higher in the after-hours, and likely provides a renewed spark for speculative areas that have been quietly correcting over the past two weeks.

For today’s report, we’ll quickly review the Meta and Microsoft charts (spoiler alert: huge moves to new highs aren’t bearish) as well as:

Other earnings reactions from this week

Quantum plays

Hot List updates

And finally, we’ll end with a long list of strong charts that may not be on investors' radar but are worthy of attention.

Earnings reactions from this week

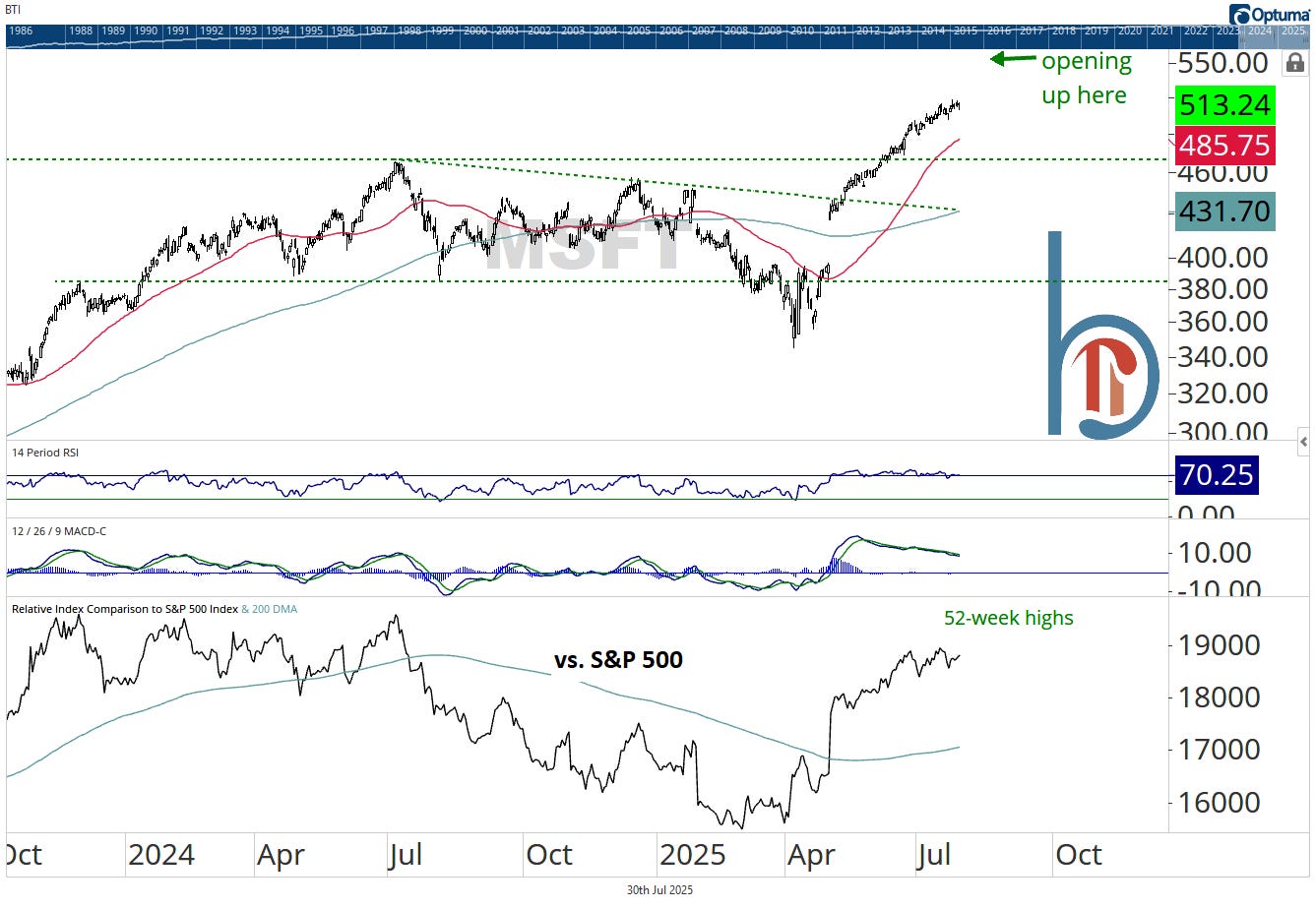

Microsoft blows it out

At the conclusion of its earnings call, Microsoft shares were higher by more than 8%, trading around $555. The company was already on a huge run, there’s little else to add technically except for: Hold on.

Handle… complete

Monday’s Playbook highlighted the potential cup and handle pattern in META and safe to say… it was a handle. The stock is up more than 11%, near $776 premarket, obviously completing a major base breakout. The measured target? $978…

Little change for RobinHood following its call

RobinHood shares were virtually unchanged following its earnings call last night. The stock had a huge run into the report, so not breaking down bodes well for future gains; however, the July 18 highs at $113 remain a potential near-term top and tactical resistance level.

Spotify breaks support but finds buyers on Wednesday

Spotify broke support and hit its lowest level since May on Tuesday following earnings, but bounced back with a 4.9% gain yesterday. Tactically, the stock needs to reclaim $666, but the long-term trend here deserves the benefit of the doubt.

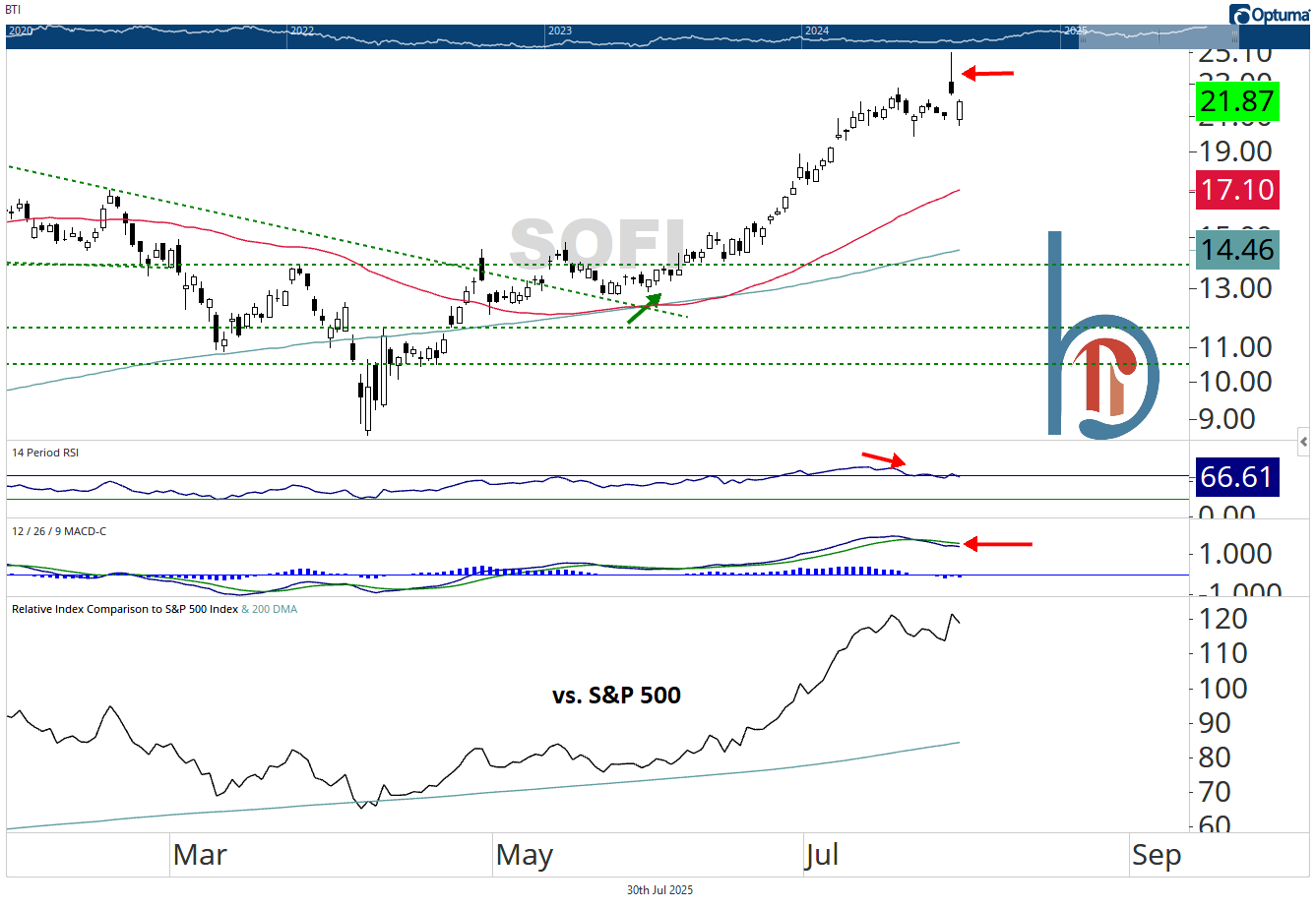

SOFI soars to new highs… And it’s gone

SOFI was up nearly 20% at one point on Tuesday but ended up with an ugly reversal and closed higher by just 6%. Sounds like somebody got some news early because after the close, the company announced a $1.5 billion stock offering, causing the stock to lose even more ground yesterday.

Huuuge breakout for Cadence Design Systems on Tuesday

Finally, in what was an incredibly obvious tell on the Meta and Microsoft reports in hindsight, CDNS blew out earnings on Tuesday with shares up more than 11% the past two days. This completes an 18-month base and targets $422.

Quantum plays poised to benefit

Speaking on Microsoft’s earnings call, CEO Satya Nadella said, “The next big accelerator in cloud will be quantum." That sent shares for the following companies higher, but we aren’t just following the commentary. These are bullish charts.