Stock Trends

Predictably unpredictable

Good morning,

The Fed delivered a 50 basis point cut yesterday and following the news the market did exactly what everybody expected: Nothing.

Now, of course, there were only two hours of trading post the release and even less time once Powell’s remarks began so if you’re looking for some grand takeaway, I would at least wait and see where price is at the end of the week.

But at the very least, the non-reaction was a good reminder to focus on the charts, not what the Fed does or says. In that spirit, I’m highlighting 8 “just plain good charts” with no particular connection or theme other than they have a setup that suggests upside from now through year-end.

We’ll also review:

2 industrial leaders with short-term risk

Low vol and defensive stocks pulling back as expected

Key levels from the Top Tech 8 basket of the S&B 20

and more!

8 just plain good charts

ANET: Arista Networks

Former Blue Chip Hot List stock Arista Networks has corrected with the market the past two months but deserves another look. The stock is breaking out of its base and remains in an absolute and relative uptrend.

CCL: Carnival Corp

We looked at Carnival two months ago, just before the correction began. But the stock has bounced back and is knocking on the door of $19.60 again. Once it gets through, I don’t suspect it will look back. Target is still $25.

CI: Cigna Group

CI is pushing to the top of a 5-month base that measures to $413, or 16% above yesterday’s close.

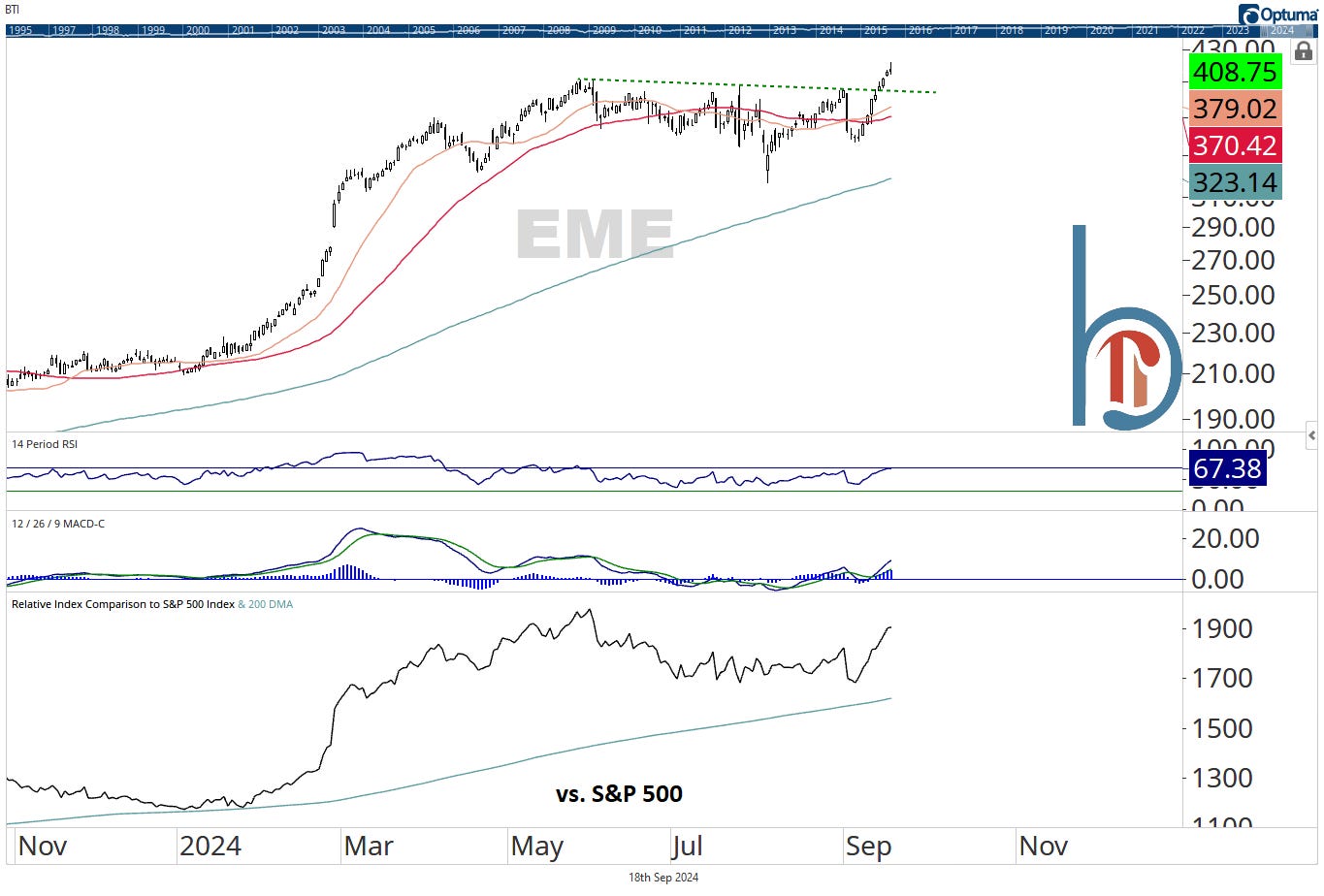

EME: Emcor Group

Air-conditioner maker Emcor Group is benefitting from the AI/data center trade like Carrier (featured below) and others but this stock has the better chart right now. EME just broke out from a 4-month consolidation and is hitting multi-month relative highs.