Stock Trends

Headlines cause headaches

Good morning,

If you’re feeling headline fatigue, you’re not alone. This week’s up-down-all-around price action is prime time for taking money from investors and causing them perform worse than a benchmark that is already in a bear market.

If you’ve bought every good headline, you’re down.

If you’ve sold every bad headline, you’re down even more.

Some people say trendlines OVER headlines, but this week is a reminder that maybe it should be trendlines NO headlines.

In today’s report, we’re starting off with a review of some of the market’s most important and largest stocks. The message from their trendlines?

They (and thus the market) are not fixed.

However, one group continues to show relative strength and the potential for absolute gains: aerospace and defense.

We’ll look at ten names in that industry, including earnings reactions from Tuesday and buyable charts from lesser-known names.

Finally, we’ll review two Hot List stocks that have broken out this week.

Let’s get into it!

Stocks soar! Into resistance…

Tesla pops but can’t break the downtrend line

Tesla reported earnings after the close Tuesday and despite widely expected poor numbers, the stock gained 5.4% yesterday. That keeps support at $214 intact but the stock still needs to break the downtrend line and take out $292 before we have a completed bottoming pattern.

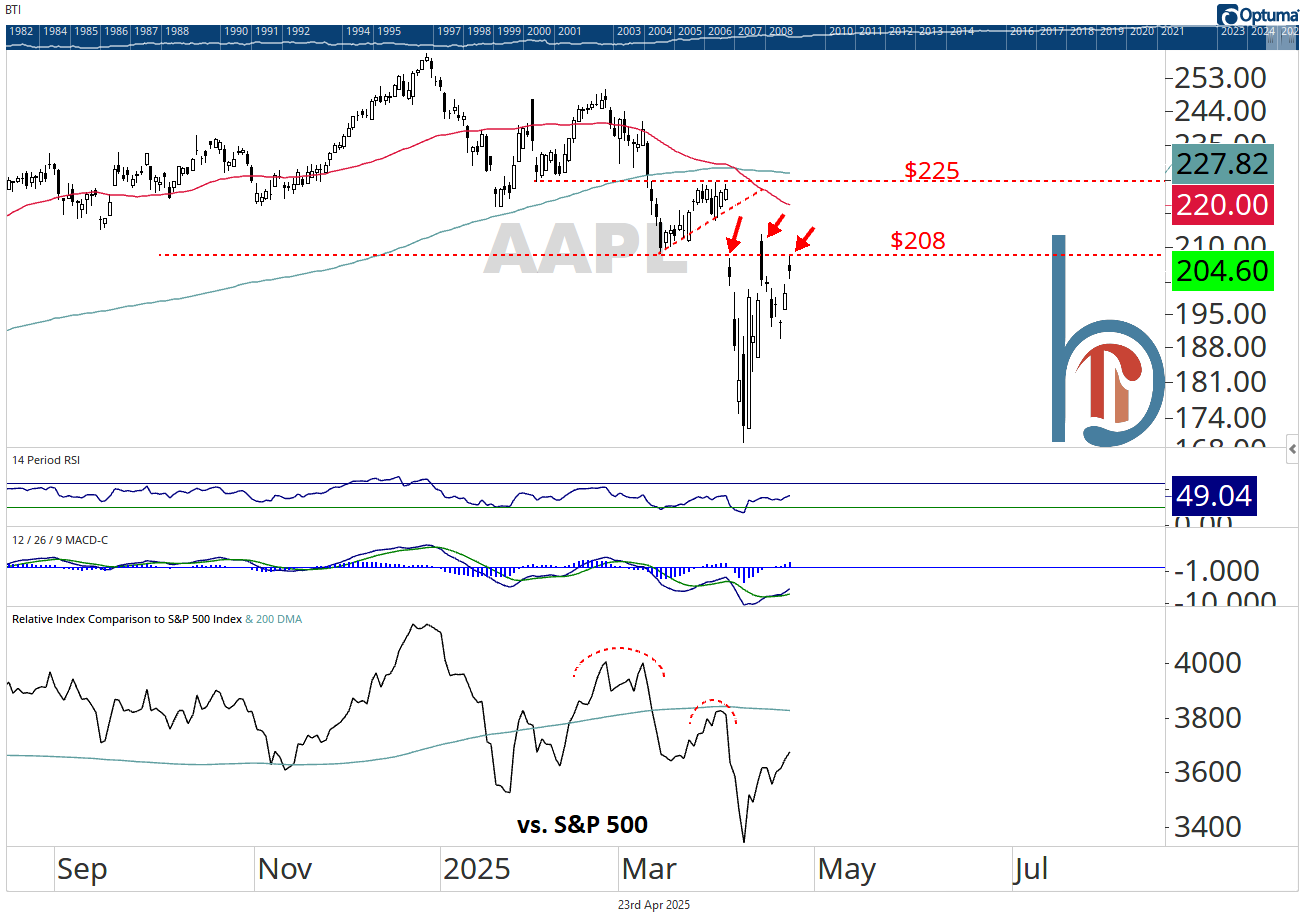

S&P 500 meets 5500 = Apple meets $208

Despite a euphoric open yesterday, the S&P 500 found sellers at 5500 again. There’s been a nearly identical pattern with Apple, and $208 being its equivalent resistance level. Guilty until proven innocent.

Bullish reversal for META stalls out at resistance

META is the only Mag 7 stock to have undercut its April 7 low this week but momentum didn’t confirm and the stock bounced back with a 7.3% gain the past two days. However, until the broken support range is reclaimed, we should be skeptical of any rallies.

Alphabet earnings look very important

Alphabet reports earnings after the bell today and which direction it breaks could have long-term implications. The stock is coiling into the apex of a short-term triangle. But when we zoom out we see this is happening right at major support. A move higher and all is well. A break lower and we could be back in the old range and with the trend firmly lower. 👇