Stock Trends

Momentum wrecked

Good morning,

Back in November, our Monday Morning Playbook highlighted the tendency for momentum crashes to occur in November. It took a bit longer than expected, but we finally got one this week.

Many of 2024’s best performers were taken to the woodshed on Monday but performance since has been more dispersed.

This week, we’ll take a look at some of Monday’s biggest losers and their current technical setup as well as:

Semiconductor weakness continuing

M&A activity heating up

4 stocks to put on your watch list

and more!

Momentum wrecked

Just a quick 2-day, 25% correction for AppLovin

APP was nearly a 10-bagger this year alone, so let’s not pretend the technicals matter much when a stock is this volatile and extended. It is pure speculation but the “risk” if you are long would be a gap-fill down to $178.

Bearish engulfing reversal confirmed for Palantir

Monday’s high of $80.91 is now tactical resistance. Still above the 21-DMA.

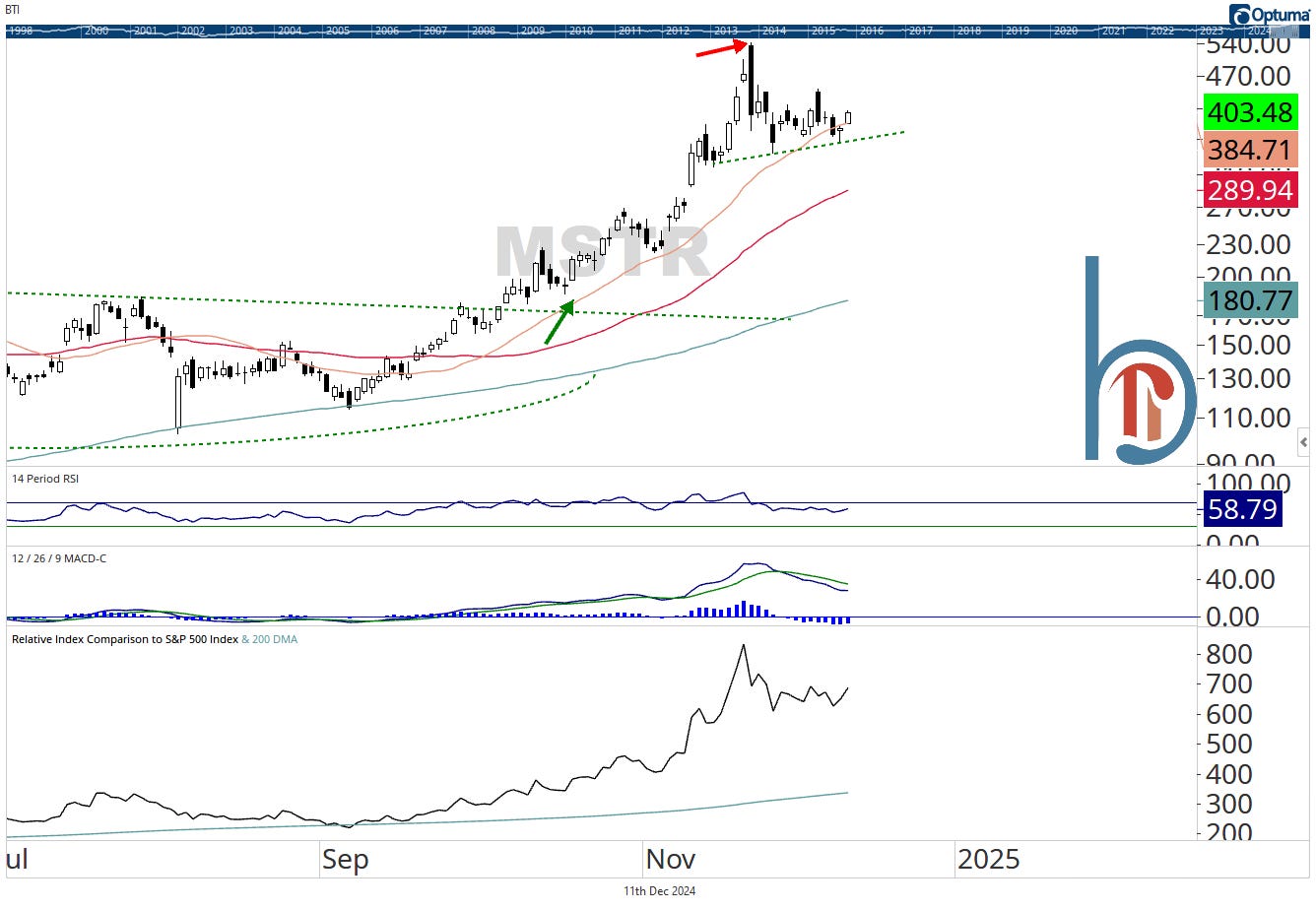

Microstrategy drops 7.5% Monday, now 29% off ATHs

MSTR’s bearish engulfing top was all the way back on November 21 and the pattern is in play as long as the stock remains below $543. However, candlestick reversals don’t have targets and a wedge is starting to play out here. Tuesday’s low of $356 is first support.

It took Reddit until Tuesday to break

Of the 4 stocks we featured in the “bubble-like action” section of Tuesday’s Overtime report, RDDT was the only one positive on Monday. They got to it on Tuesday but it remains the most tactically constructive, still above a rising 21-DMA.

But it wasn’t just growth stocks, they got Wal-Mart too

I’ve talked about how extreme of a run Wal-Mart has had, so much so that after the November rebalance, it is now the #1 holding in MTUM, the iShares USA Momentum Factor ETF. But even it fell 2% in Monday’s momentum crash, highlighting that this wasn’t just about crypto or software stocks.

Cintas had to break eventually

Few trends have been more straight up than Cintas but the stock finally broke below its 50-DMA with a 6.9% drop on Monday. I called out the risk to this one on November 14 and it will likely need some time to settle and base before it can resume higher. $228 key resistance.

They even got to our Hot List stock T-Mobile

One last example but a relative strength list like the Blue Chip Hot List is going to have a stock caught up in a momentum crash and our worst performer Monday was TMUS (-6.1%), which hadn’t been below its 21-DMA since September. We’re bouncing back off the 50-day but the straight-up ride is over.