Stock Trends

Bottoming

Good morning,

We’re seeing the market finally begin to pause and correct so far this week, and there are a plethora of big-picture breakouts that will likely to turn into buying opportunities.

We’ll review some of those today, but while the leaders begin to pause, I want to take the time to highlight some stocks that are just now joining the market rally.

Today, we’ll look at six stocks that are bottoming, as well as:

Big breakouts

Two stocks knocking on the door

Strength in China

Hot List updates

and more!

Bottoming

Gilead has bottomed

We sold Gilead Sciences right at the top, before a two-month, 20% pullback. But the stock has spent the past month bottoming and, on Tuesday, broke out. This is a stock I want to own today, with the idea being not that we get back to the March highs, but through them.

Moderna is trying

No name anywhere has been worse than Moderna but even that stock is showing early, nascent signs of a bottom. Momentum is bullishly diverging, and a breakout above $29.30 targets $34.80.

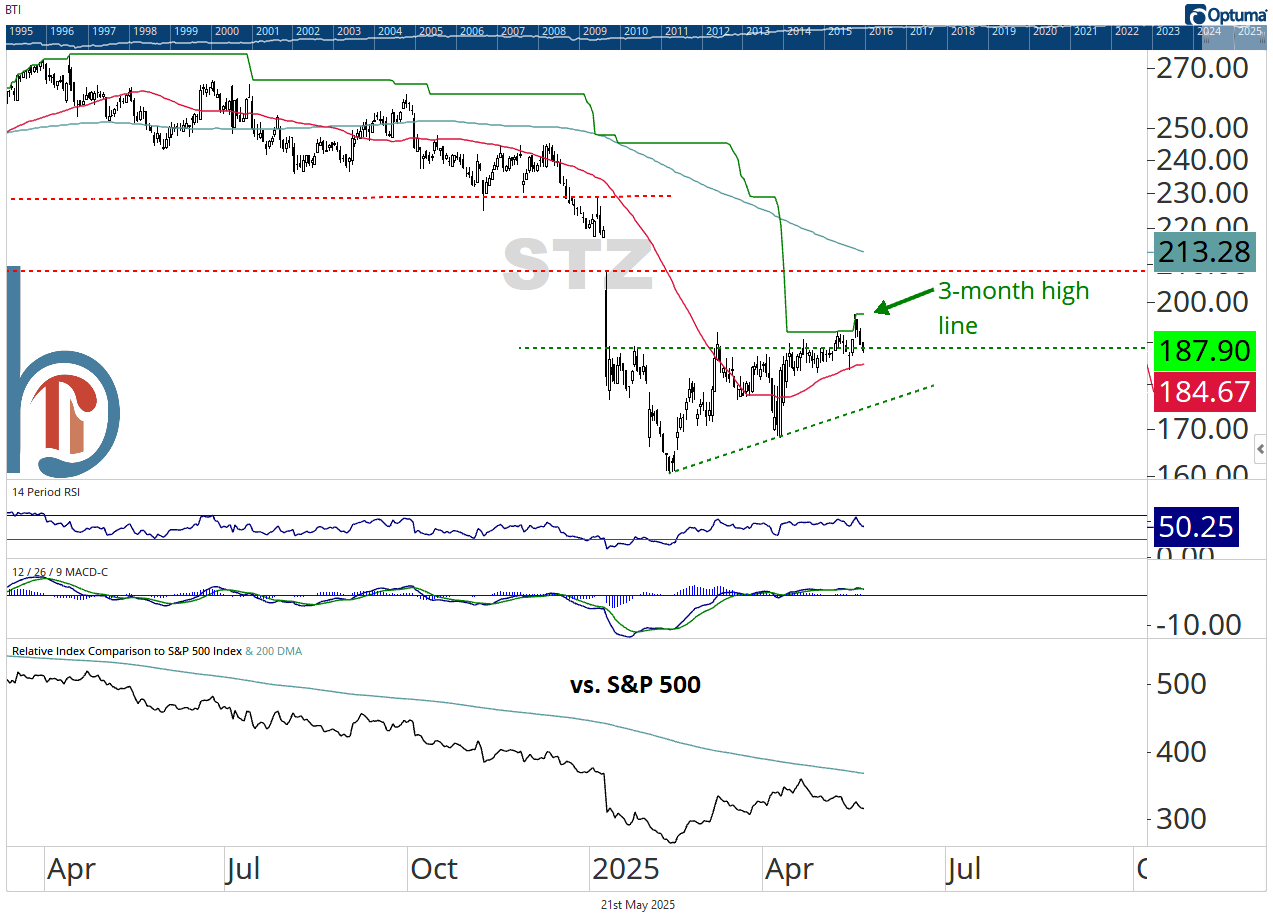

Uncle Warren has been scooping up Constellation Brands

The latest 13F filings showed that Berkshire Hathaway doubled its stake in the alcohol beverage giant in the first quarter, and the technicals support a change in trend. Last week, STZ hit its first 3-month high since the stock’s 40% drawdown began. It’s trying to turn its 50-DMA into support, and the pullback over the past four days could be an opportunity for value investors.