Stock Trends (UNLOCKED)

Watch $141

Happy Thanksgiving,

Brown Technical Insights recently crossed 1000 subscribers here on Substack and to celebrate (and because ya know Thanksgiving is next week), this week’s Stock Trends report is being made available in full to free subscribers.

In addition, I’m offering a 30% discount to monthly and annual subscriptions (our deepest discount ever) for the next week. Just click the link below to upgrade.

Good morning,

I put out 48 Stock Trends reports a year but nothing feels like it has become more routine than the once-a-quarter “Nvidia just reported” report.

Since this post comes out Thursday morning before the real trading begins, it’s always a bit of a guessing game based on the after-hours and pre-market trading. But as of now, it looks like we’re dealing with a relatively benign reaction for the second quarter in a row.

The rest of the industry remains weak but, as highlighted on Monday, the level to watch today and Friday is $141. Above, and we keep the recent breakout intact. Below, and the chart becomes more tactically messy.

This week’s Stock Trends report will review:

Nvidia and other notable semiconductor charts

Earnings movers from this week

Biotech weakness

Big base breakouts

52-week highs

and more!

Nvidia + other semis

Watch $141

It was this week’s level to watch and it remains the key level based on the after-hours reaction to their report. If Nvidia can end this week above $141, we want to be bullish, if we’re below, more cautious. Monday’s low of $137.15 is a secondary support level to watch.

*As of 7:30 am ET, the stock was down less than 1%, trading at $144.66.

Not sure the Nvidia report will fix the other semis

A big theme here in recent months is just how bad semis ex-Nvidia and Broadcom have been. Applied Materials is one of the worst, and the $167 breakout level will be an important tell on investor sentiment toward the rest of the space.

Marvell still a good chart

One semi chart that has bucked industry weakness and I continue to like is Marvell Technologies. The recent pullback into support makes this a timely long idea.

Other earnings movers this week

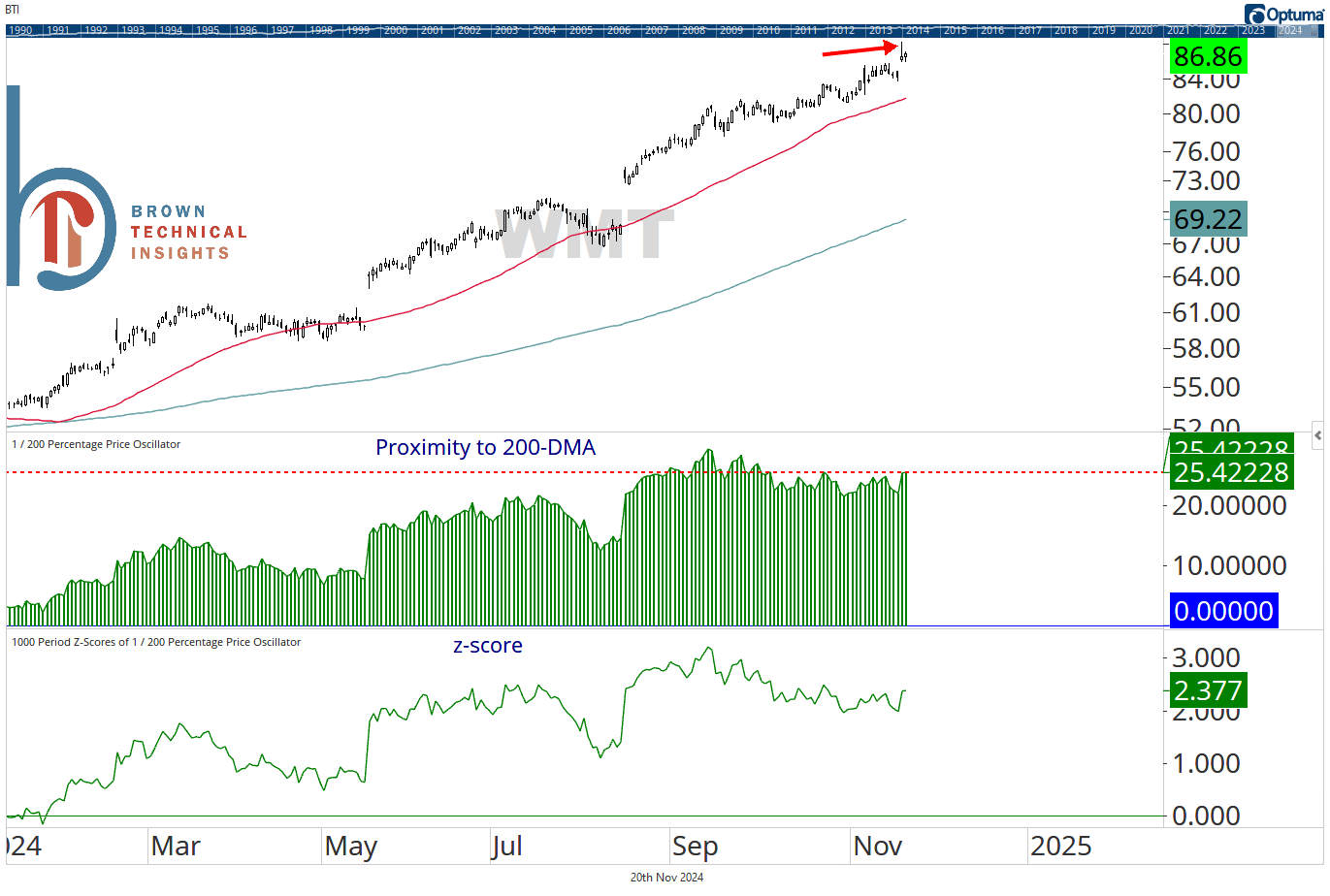

WMT blows it out but still not chasing this one

Wal-Mart continues to kill it, gaining 3% on Tuesday after its earnings report. Obviously, the trend is great, but the stock closed well off its highs of the day and is incredibly stretched above the 200-DMA. Wouldn’t chase and current longs should consider a trailing stop.

Target is terrible

Target fell more than 20% yesterday, good for its second-worst day ever. This kills a potential inverse head and shoulders formation and combined with the Wal-Mart beat, reiterates that something is deeply fundamentally wrong with this company.

Lowes is still a good chart

Lowes slipped below the $263 breakout point following its report but investors should stay the course. This is an uptrend and a stock at the top end of a big base. As long as we’re above the 200-DMA, I believe this is an opportunity.

Palo Alto misses, watch $375 support today

PANW was initially down about 5% after reporting last night but the stock is trading lower by only 2% pre-market. The miss doesn’t help but the breakout is intact and I still like this as an end-of-the-year opportunity.

*The company also announced a 2:1 stock split.

SNOW set to add to software strength

SNOW reported after the bell yesterday and is set for a 20% move higher today. It will be overbought in a downtrend which isn’t a great setup but move back above the 2022 lows indicates the worst is likely over here.

Can Intuit deliver a breakout?

For all the good software stocks, Intuit’s relative chart remains weak. The company reports earnings after the close and bulls will want to see support at $670 hold, and ideally, a move above $717 to signal a long-term breakout.

Biotech weakness is contagious

Bear trap in Eli Lilly?

LLY briefly hit its lowest level since February this week but snapped back with a 3.4% gain yesterday. There’s a slight bullish momentum divergence but the trend is turning against it (21-DMA below the 200-day for the first time in 18 months). $800 will be key resistance to watch, as a failure would indicate investors should fade the rally.

Long-term uptrend line broken in Regeneron

Regeneron is historically oversold with an RSI-14 of just 13 but the uptrend here is broken and investors should use rallies to reduce exposure.

Base Finder

Big base breakout for VERX

Vertex Inc. (not to be confused with Vertex Pharmaceuticals, ticker: VRTX) has broken out of a sweet post-IPO base. If we’re above $40, don’t underestimate the potential.

Datadog is a timely long

Looking for a high-growth stock just now breaking out? Check out Datadog which is up 7% the past 2 days and breaking out of a 9-month base. Measured target of $166.

An exception to materials weakness, APD pushing to top of big base

Amid the selloff in materials, relative strength in the sector’s 3rd largest weight stands out. APD is pushing to the top of a 4-year base that suggests $100 of upside.

Regions Financial is still an opportunity

Back to the well here, but I showed Regions Financial last week, and unlike some other stocks in that section that have had big moves, years of doing nothing implies there is more to go in this one.

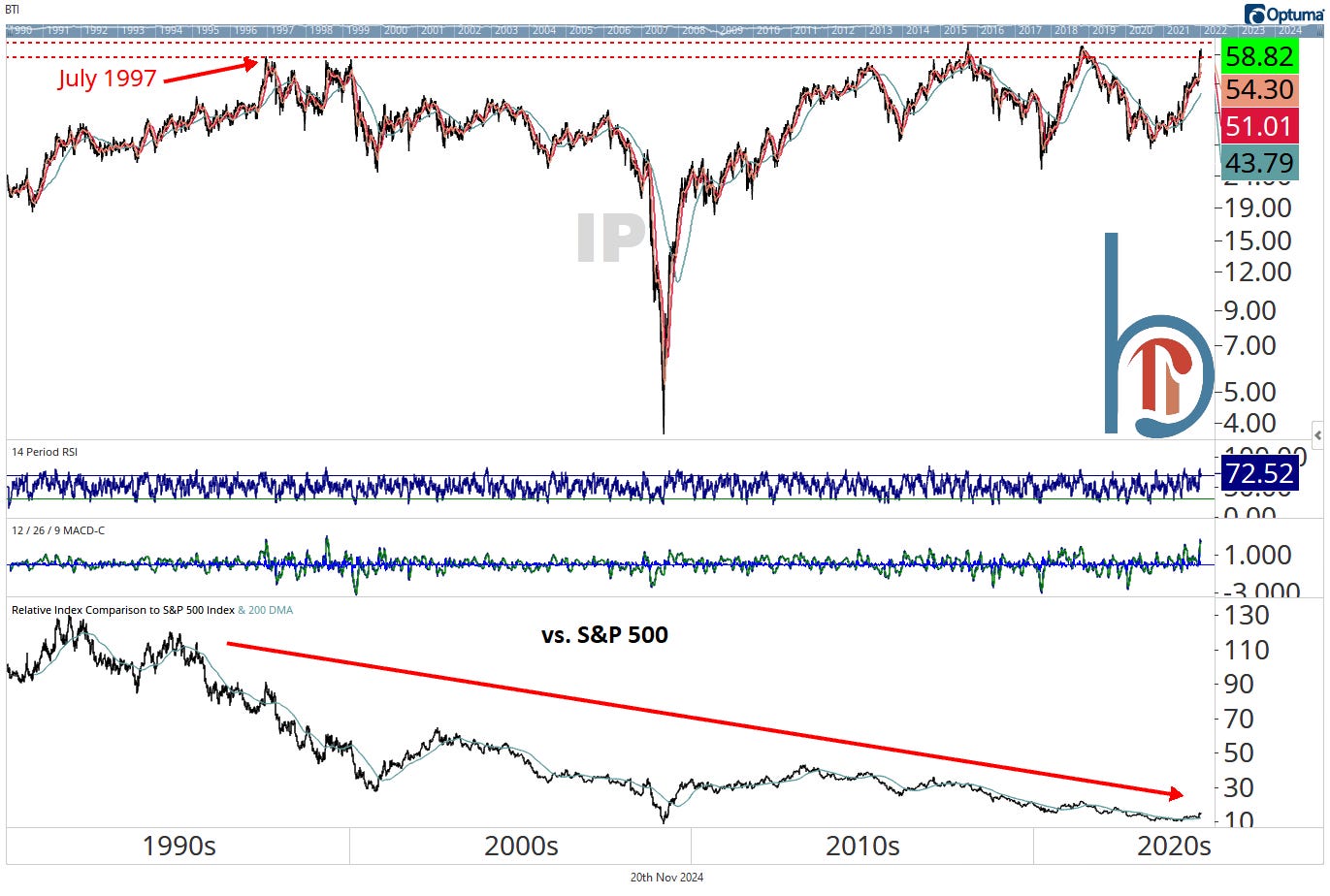

Is International Paper the largest base ever?

I love big bases but when one becomes nearly 30 years long, you can’t help but wonder if the stock just sucks. Only time will tell and I don’t believe a measured target is realistic, but there could be significant upside in IP if the stocks breaks above $63.

Stocks hitting 52-week highs

Blackstone making new absolute and relative highs

BX has traded like a technician’s dream over the past 3 years, respecting all major trend lines and support levels. Right now, the trends are bullish with the stock making absolute and relative 52-week highs on Wednesday.

Live Nation with a big base breakout and 52-week highs

This could have gone in the big base section but the stock has soared in this week’s tough tape so 52-week highs seem more relevant. The entertainment giant owns concerts and the consumer continues to spend on them.

Consumers love gaming too

Another thing the consumer continues to spend on? Video games. Makers Electronic Arts and Take-Two Interactive have both broken out of large bases and are hitting 52-week highs.

Other noteworthy charts

Pepsi and Mondelez on the 52-week low list

But strong reversals on Wednesday. Extremely oversold like biotech and you can put me in the “RFK can’t kill every business he hates” camp.

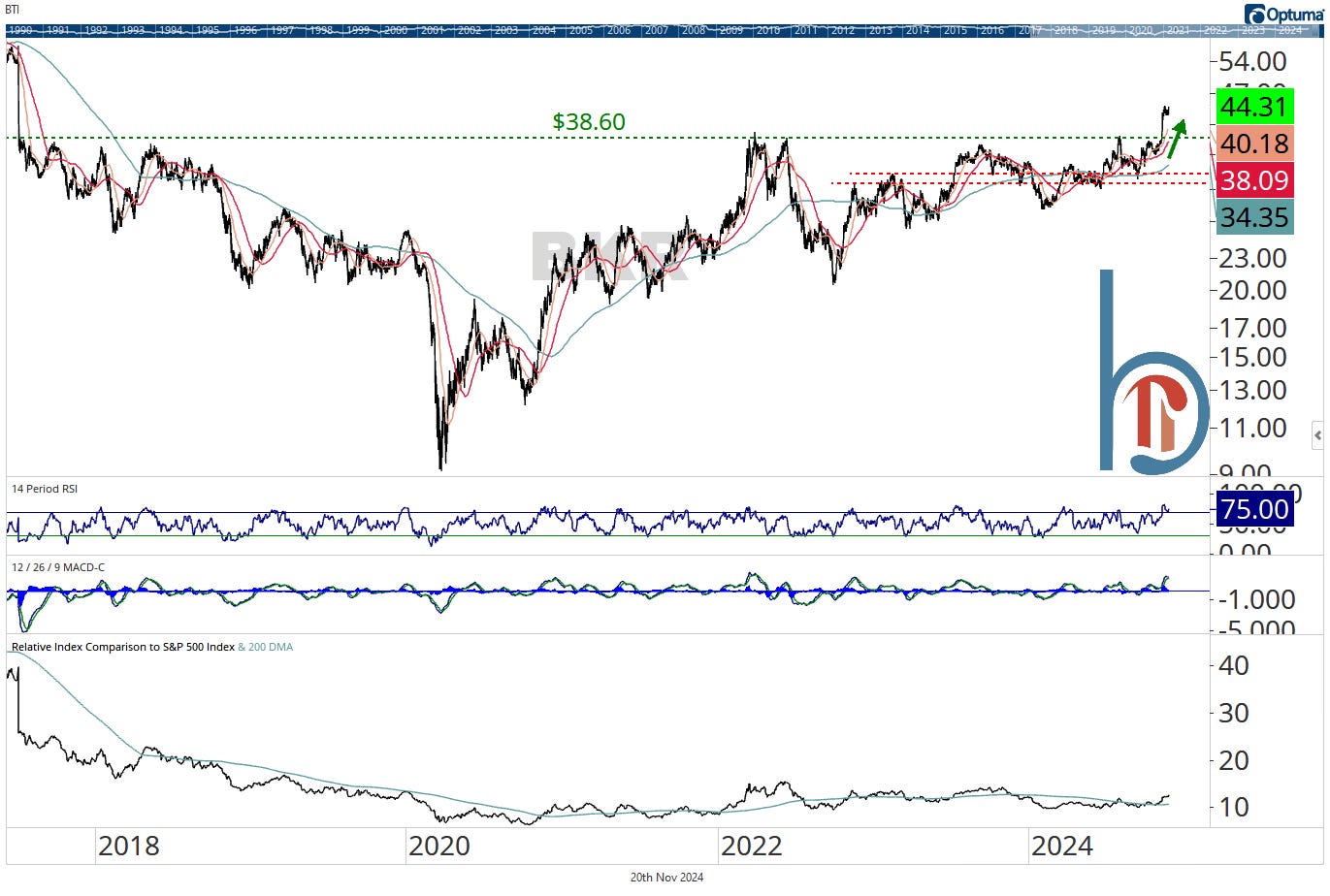

Most energy charts do not look like Baker Hughes

If you’re looking to dip your toe into energy stocks, might as well start with the leaders that have bucked weakness in the rest of the sector.

Investors are waking up to just how much the Brown family dropped at Disney World

Messy and volatile but this is an absolutely huge bottoming formation. Measured target on a breakout is $160.

Quick reminder that we are off next week. I wish everyone a Happy Thanksgiving and a great week with family and friends. We’ll see you in December!

Scott

Scott Brown, CMT

Founder, Brown Technical Insights

Essential insights into market trends, technicals, and opportunities