Stocks: The Good, The Bad and The Ugly

Who is leading the rally?

Good morning advisors, and welcome to another edition of Stocks: The Good, The Bad and the Ugly.

This week we are going to explore some of the top stocks leading the market’s rally over the past two weeks, some stocks that are definitely not participating and the technical set-up for a number of other important names. But first, some pre-market movers!

Pre-Market Movers

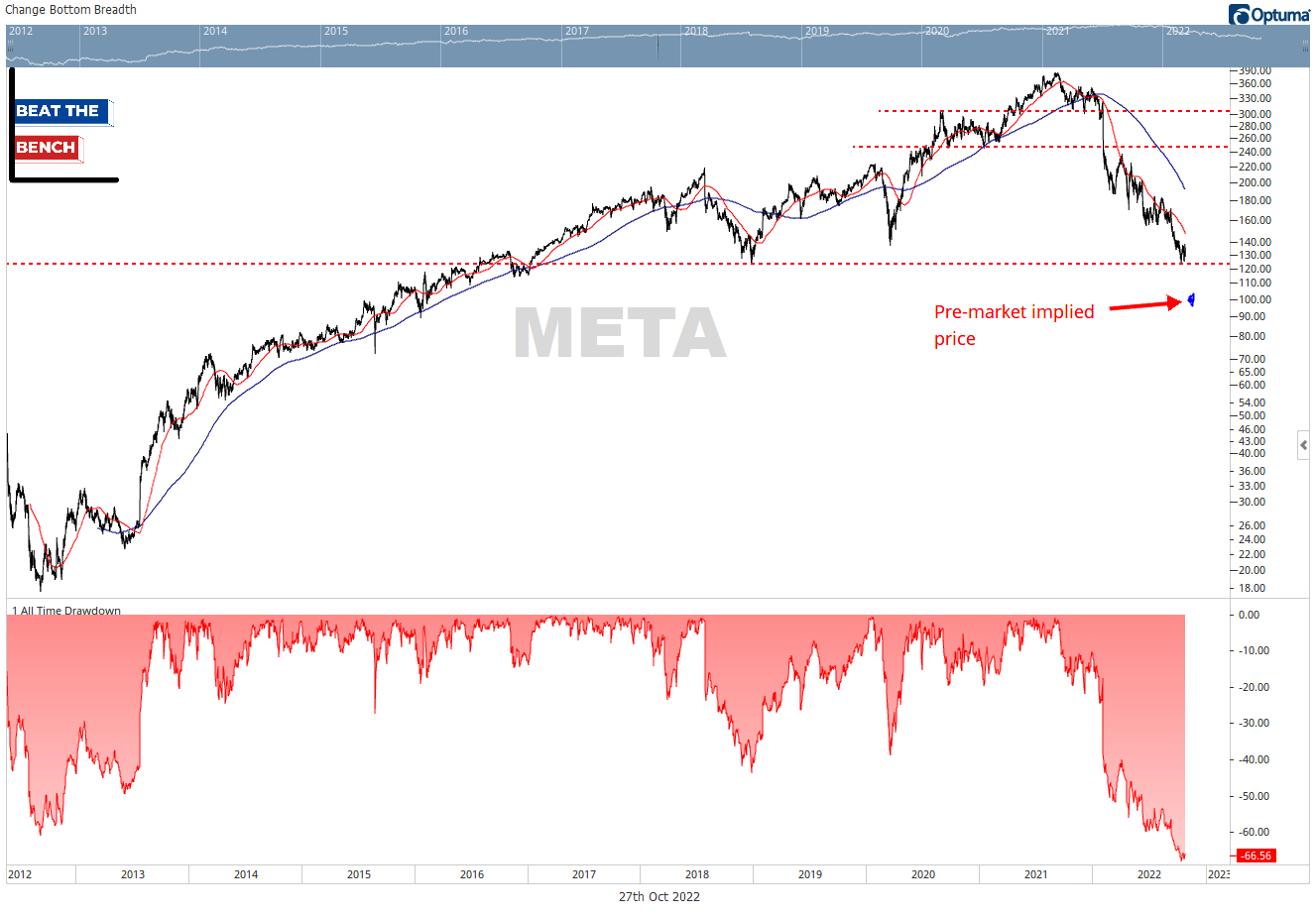

META: Meta Platforms

Meta is trading at exactly $100 in the pre-market (as of 7:52 ET), roughly where the blue dot is showing. That implies an astonishing 22% drop at the open and will extend its current drawdown from the highs to about 74%. There are no identifiable levels of support below current levels and all I can say is there hasn’t been a technical reason to own this stock since January, and there isn’t one today.

NOW: ServiceNow

ServiceNow is one of the few stocks to go into its earnings report near absolute and relative lows and see a surprise to the upside. Unfortunately, today’s pop alone won’t fix the chart. Pre-market the stock is up 13.8% (trading at $416), which is good enough to put it above the 50-dma. However, it will need follow through up above $433 to make a higher high.

ORLY: O’Reilly Automotive

ORLY and competitor Autozone (AZO) had both already broken out to all-time highs, but ORLY is looking to add to those gains today. The stock is up an additional 2.5% and pushing towards $800 in the pre-market. The recent breakout point ($748) should be viewed as support and can be used as a stop loss for new money.

TDOC: Teladoc Health

So let me first say that TDOC is a horrible trend and not the type of chart I would normally feature. However, the stock is up 10% pre-market and was already showing some near-term momentum. This is a trade not an investment but: Buy and use the summer-time lows of $27.65 as your stop. This stock is eventually a sell, but a rally up to the red line would be a gain of nearly 50%.

The Good: Biggest Winners Since October 14

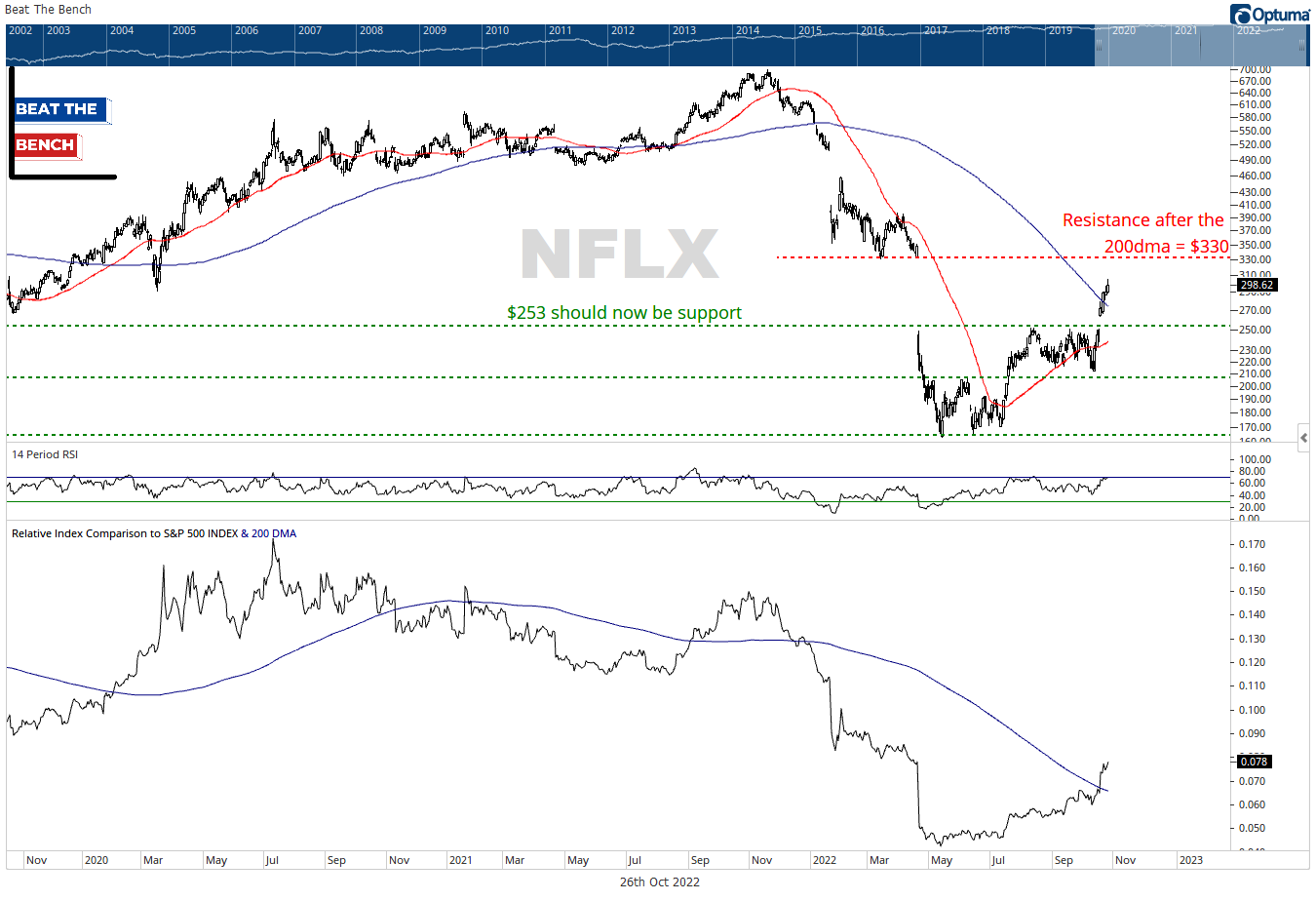

NFLX: Netflix

Netflix is the best performing S&P 500 stock since the market bottomed, up 30% since October 14. It looks to have a date with $330, and while the stock has a lot of near-term momentum behind it, the closer it gets to there the worse the risk/reward is.

SLB: Schlumberger

Schlumberger has been one of the best stocks in the energy sector since August and just broke out to 52-week absolute and relative highs. If SLB can stay above $49, long and strong.

ISRG: Intuitive Surgical